HIBISCS (5199) HIBISCUS PETROLEUM BHD buy Hibiscus III - How much is Hibiscus Worth (Part a)

So much has changed since I wrote my articles in June 2021.

Oil price went from US 74 to now US 84.86, a 14.7% increase.

There is now a gas & coal supply crunch in Europe, China and India. Much has been written about this and I will not go into this except to conclude that the greenies are MAD, insane, e.g.

- The UK oil and gas regulator did not approve Shell’s gas project recently in the UK side of the North Sea.

- IEA said, the gas shortage is not the fault of the green deal and asking double effort to put up more renewable projects

- Germany wants to bring forward the closing of their coal mines by six years

And many more…

Some of these greenies think that you just flip a switch on the wall and wala, electricity just come out, yeah right! And there is no need to know how the electricity got there.

Imagine should a government say that they will give a million bucks for any third child born, the greenie will think tomorrow they can come up with that third child!

The most optimist case, one that already have two children, there still is the persuasion whether the “factory” agrees or not? Then, not in the mood, tired, foreplay like wine and dine before the action and there could be some mis-firing due to lack of practise. These could take anything from weeks to months. Assuming agreement is obtained and action was done properly, there is still 9 months, no miscarriage etc etc…. At the quickest, with paper work after birth and bureaucracies, one may only see the money maybe after 10 to 12 months. More likely, 12 or more months.

Similarly, should shale players ramp up rigs etc, production would only be seen like at least 2 months down the road. Today looking at the rigs number, 543 for the just announced numbers, it is just enough to increase production to cover the depletion. YES DEPLETION! There must be at least 850+ rigs drilling today for production to increase in two months (December/January) later. There are currently manpower issues (apparently, they do not want to work), old rigs needing refurbishment, broken equipment to be replaced – supply chain issues to overcome and on and on …. Do not forget, there is also the ESG issues in America too – no more finance for dirty fossil fuels.

The fear that shale will flood the market once more is totally misplaced.

Supply & Demand

Demand is going up – most countries are talking about endemic now, travel between countries is being promoted, jet fuel, the last product that has not recovered could be returning with a vengeance.

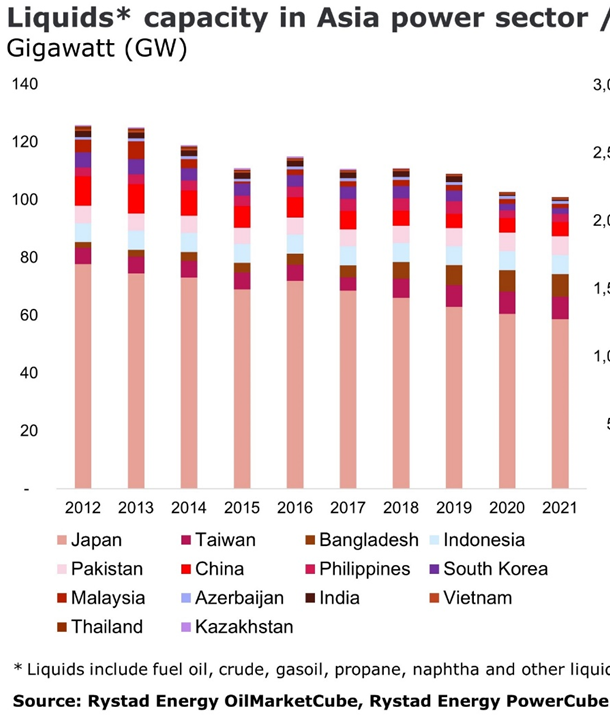

The high gas prices now are forcing some electricity generators to convert to oil. Below is some information on Asia power sector.

It is estimated that 500,000 bpd could be added to current demand. This will totally negate OPEC+ 400,000 bpd increases.

UPDATE on Repsol purchase

The conditional sale and purchase agreement has 6 conditions:

(i) the approval from each of PETRONAS and PetroVietnam of the sale of the FIPC Shares to Peninsula Hibiscus for the relevant PSCs, to be obtained by Repsol;

(ii) the approval or waiver from each of PCSB and PVEP of the sale of the FIPC Shares to Peninsula Hibiscus according to relevant JOAs, to be obtained by Repsol;

(iii) the approval from the Barbados Exchange Control Authority of the sale of FIPC Shares to Peninsula Hibiscus, to be obtained by Repsol;

(iv) the clearance by Bursa Malaysia Securities Berhad (“Bursa Securities”) of the circular to shareholders of Hibiscus Petroleum in relation to the Proposed Acquisition;

(v) the approval of the shareholders of Hibiscus Petroleum at an extraordinary general meeting (“EGM”) to be convened; and

(vi) Bank Negara.

Conditions ii), iii) & vi) have been obtained. Conditions iv) & v) rightly should be one condition and I believe no shareholder will vote against the purchase of Repsol asset.

PCSB and PVEP are 100% owned by Petronas and PetroVietnam respectively. Both PCSB and PVEP had given waiver. Do you not think that Petronas and PetroVietnam approval were required before PCSB & PVEP gave the waiver?

Management had on 30 Jul 2021, in an interview with Stockbit Malaysia (https://www.youtube.com/watch?v=CbNLG6HtjOY) said that no more CRPS will be issued for the Repsol purchase. Cash flow appears to be sufficient to fund the purchase.

There might be some loan though.

And Hibiscus is confident enough to declare 1 sen dividend.

Repsol assets were valued at usd 415 in Jan 2020 (https://connect.ihsmarkit.com/upstream-insight/article/heroldReports/136390/seam-alert-repsol-weighing-sale-of-malaysian-assets) Thank you to twynstar for this gem.

There remains the following:

- EGM to get shareholders approval of the purchase. A circular would be despatched soon after BURSA gives its approval (mere formality). The EGM would most likely be held after the upcoming AGM to be held normally in the first week of December 2021.

- Approval from PETRONAS and PetroVietnam (refer comment above on PCSB/PVEP)

https://klse.i3investor.com/blogs/ZZD/2021-10-17-story-h1592739879-Hibiscus_buy_Hibiscus_III_How_much_is_Hibiscus_Worth_Part_a.jsp