HIBISCS (5199) HIBISCUS PETROLEUM BHD buy Hibiscus III - How much is Hibiscus Worth (Part b)

VALUATION - How much is Hibiscus Worth

SOON, the 3rd child will be delivered. And what a productive child too – it would increase current production from 9,000 bpd to about 27,000 boepd. The 27,000 is barrel oil equivalent (boe) as the gas production is converted to oil equivalent.

In the previous write-up, there was still the possibility of more CRPS (and dilution) being issued, giving an estimated valuation between RM 1.16 to 1.29, now CRPS route is not required, the revised value would be RM 1.42.

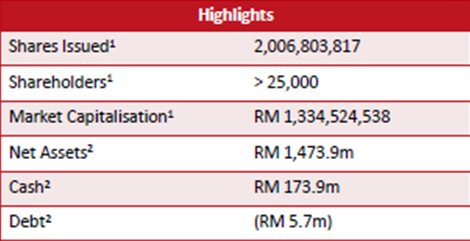

Latest data from Hibiscus September 2021 presentation:

As my proposition is Hibiscus buy Hibiscus, the Net Assets would be

1,474 x 2 = RM 2,948 m

Shares issued (all CRPS converted) = 2,012.4 m gives RM 1.46 per share.

SEEK TRUTH FROM FACTS

These are few facts to take note:

1) A company that to date, is debt free

2) It has managed production cost well

3) Healthy free cash flow, with higher average selling price (ASP) is more robust

4) ASP of its product has increased and potentially will increase more, if not, at least maintain at current level

5) Production will increase by 3 times within the next quarter or two. i.e., more product to sell in an increasing ASP!!!

Based on above FACTS, Hibiscus is a very valuable company. In Bursa, one cannot find another company with such huge (REAL) potential. If so, please share, thank you.

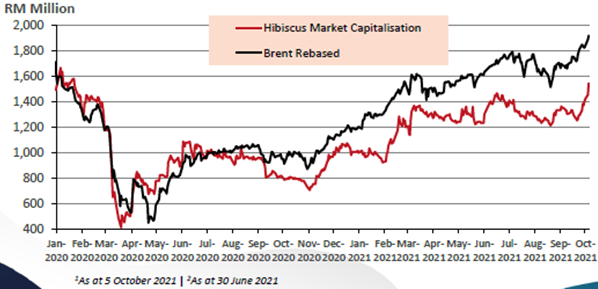

Presently, share price of Hibiscus has followed oil price movement. See figure below from presentation on Hibiscus’ website. It has NOT considered the impending increase of production at all.

Hibiscus, like oil and gas companies all over the world has been valued at a discount of about 20% despite the increased oil price (https://oilprice.com/Energy/Energy-General/US-Oil-Stocks-Are-Seriously-Undervalued-Right-Now.html).

It is really amazing that Greenies (all over the world) forsake such opportunity for supposedly green investments that will not make money in the next 5 years or more.

Lately, some, like Norway has decided that they will continue to invest in fossil fuel projects. But they are the minority. Should more come around to invest in REAL (instead of illusion), then current prices would gain further.

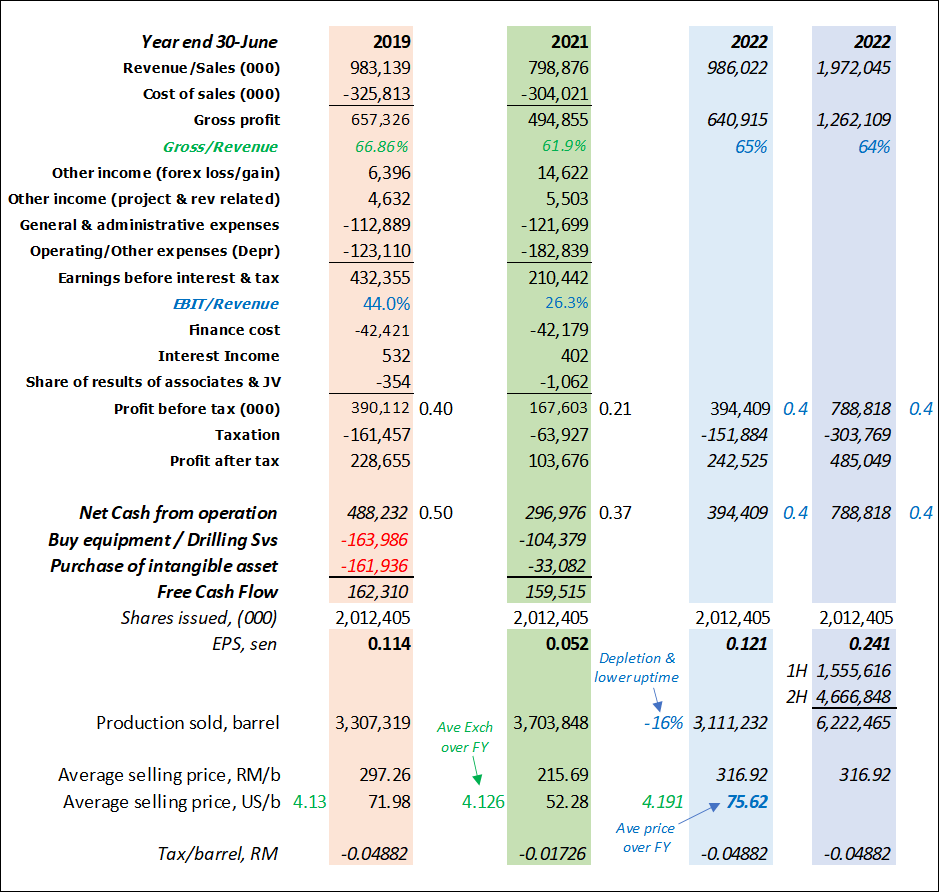

Finally, what exactly is Hibiscus worth? Below is typical profit & loss table. Year 2020 was omitted as it is abnormal. Impairment, negative goodwill and such items are also omitted. Figures in blue are best, conservative, guesses.

Beauty is in the eye of the beholder, so, play / change the blue values to one’s heart delight. Use whatever PER one desire to get the value one is comfortable with.

Summary

Oil price has appreciated since June 2021 by about 14%.

Greenies are MAD, currently under an energy crunch, they double down to stop and remove fossil fuels. Good news for oil price going forward as supply will be cringed further while demand goes through the roof.

Like making babies require 9 months, shale oil, with current 543 rigs will not be able to increase production to flood the market like before in the next 6 to 12 months. An estimated 850 rigs are required to materially increase shale oil to overcome depletion.

Repsol deal is nearing completion with only two out of six conditions to be fulfilled – shareholders approval during an EGM and Petronas & PetroVietnam approval that should be forthcoming. Completion is expected to be end of this year.

No more CRPS to be issued for Repsol asset purchases. This indicated that rising oil price has aided cash flow so much that a 1 sen dividend was also declared.

Repsol asset, estimated at USD 415m in Jan 2020, was bought for USD 215m, an excellent deal.

Hibiscus is revaluated to be RM 1.42 to 1.46.

EPS for FY2022 could be 12 to 24 sen. For the later, Repsol asset production is included for Q3 & Q4 FY22. As PER is personal, none is given.

Happy investing, PEACE.

Disclaimer:

I wrote this myself without pay. I and my families own Hibiscus

shares. This is not an advice to buy / sell Hibiscus or any other

equities / securities / assets.

https://klse.i3investor.com/blogs/ZZD/2021-10-17-story-h1592739877-Hibiscus_buy_Hibiscus_III_How_much_is_Hibiscus_Worth_b.jsp

1