Why should AYS (5021) AYS VENTURES BHD rebound - Koon Yew Yin

An official blog in i3investor to publish sharing by Mr. Koon Yew Yin.

All materials published here are prepared by Mr. Koon Yew Yin

Author: | Publish date: Wed, 17 Nov 2021, 10:32 AM

The Budget 2022 announcement on 1st Nov, has been pulling down all the listed stocks, especially big companies. The biggest culprit is the additional prosperity tax increase from 24% to 33% for big companies whose annual profit exceeds Rm 100 million. Although smaller companies like AYS is not affected by the additional prosperity tax, it is being drag down. Its price chart is showing a down trend which encourages weak holders to sell.

No stock can drop continuously for whatever reason. After some time, it must rebound.

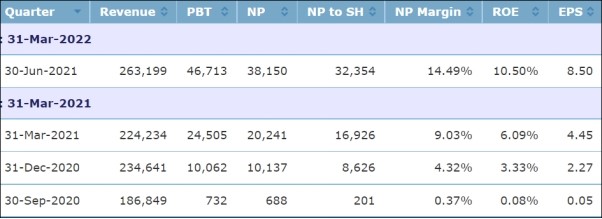

The last column of the above table shows EPS for AYS. Its latest EPS was 8.5 sen and its previous EPS was 4.45 sen, an increase of nearly 100%. Its EPS for next quarter ending September which will be announced before the end of this month, should be more than 10 sen EPS. AYS deserves a much higher rating.

Why Steel price does not affect AYS?

AYS does not produce steel. It buys steel from the cheapest steel producer to sell the construction contractors.

Back ground:

AYS Ventures Bhd is an investment holding principally involved in the trading and manufacturing of steel related products. The company is organized into three segments namely trading, manufacturing and others. The trading division trades and markets a diverse range of steel products and construction materials whilst the manufacturing division manufactures and trades pressed steel and fiberglass reinforced polyester sectional water tanks, steel purlin, and wire products. Other segment includes investment holding, warehousing and storage services and dormant. The products serve customers in the construction, engineering for heavy steel industries, fabrication, oil and gas, power plant and shipbuilding sectors. The group principally operates within Malaysia.

Market Buzz

https://klse.i3investor.com/blogs/koonyewyinblog/2021-11-17-story-h1593874845-Why_should_AYS_rebound_Koon_Yew_Yin.jsp

Month of January 2026

3 hours ago