马印原棕油价差扩大 7棕油股成赢家

大马与印尼原棕油现货价

(吉隆坡12日讯)印尼祭出出口限制规定后,与大马原棕油价差进一步扩大,故分析员指种植业务集中在本地的棕油股,显然是受惠者,并点名7位赢家。

马银行投行研究发布报告写道,印尼在上月27日落实新规定后,本地原棕油价进一步跑赢印尼价格。

大马一个月远期原棕油期货价格按周上涨了1.8%,至每吨5714令吉;反之,印尼当地原棕油价格则下跌2.8%,报每公斤1万4930印尼盾(约4.35令吉)。

分析员点出,这意味着当地种植商,需要一同分担印尼食用油市场补贴的压力。

“正面来看,整体影响远低过我们的预测,因为我们上周预计当地原棕油价格,理论上会下跌至每公斤1万4000印尼盾(约4.07令吉)。”

“我们还预测印尼提炼商正牺牲部分提炼赚幅。”

落实新规定后,马印两国国内原棕油价差,已然从原先的每吨246令吉,扩大至每吨1378令吉。

“这项新政策在短期内,会不可避免地让我国种植商受惠,因为原棕油价会走高。”

大马与印尼棕油价差

同时,该投行列出本地7家种植股赢家,包括IOI集团(IOICORP,1961,主板种植股)、砂拉越油棕(SOP,5126,主板种植股)、莫实得种植(BPLANT,5254,主板种植股)、大安(TAANN,5012,主板种植股)、TH种植(THPLANT,5112,主板种植股)、合成种植(HSPLANT,5138,主板种植股)和FGV控股(FGV,5222,主板种植股)。

另外,分析员维持种植股“正面”评级,首选吉隆甲洞、砂拉越油棕和莫实得种植。

印尼当局上月底规定,强制出口商为当地市场留下出口量20%棕油产品,以确保有充足存货,让食用油处于可负担价位。

同时,当局还对当地原棕油价设下每公斤9300印尼盾(约2.71令吉),及油脂每公斤1万300印尼盾(约3令吉)的顶价。

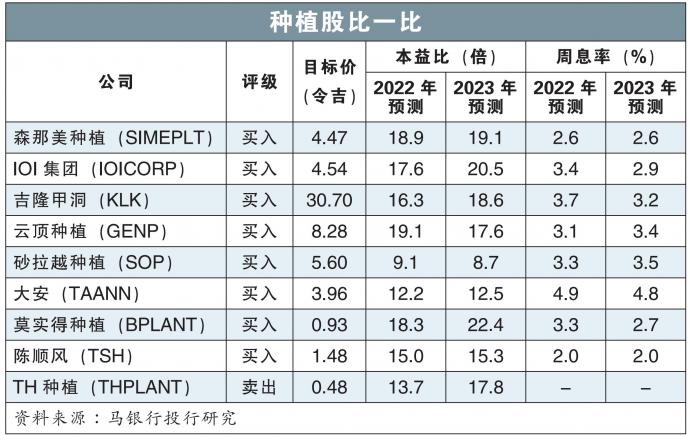

种植股比一比

印尼贸易部估计,当地今年食用油需求约为560万公吨,但也停止将本月起征收的出口税,用于补贴食用油。

“往好的来看,这意味着从出口税中收集到的原棕油基金,将主要用于确保未来强制B30生物柴油的持续性,甚至可能提高比例。”

据报道,印尼原棕油生产商协会(GAPKI)相信,新出口限令或扰乱本月出口,但整体出口应该不会下滑太多。

“至于3月,出口商需要调整出口量来遵守条规。”

http://www.enanyang.my/%E8%B4%A2%E7%BB%8F%E6%96%B0%E9%97%BB/%E9%A9%AC%E5%8D%B0%E5%8E%9F%E6%A3%95%E6%B2%B9%E4%BB%B7%E5%B7%AE%E6%89%A9%E5%A4%A7-7%E6%A3%95%E6%B2%B9%E8%82%A1%E6%88%90%E8%B5%A2%E5%AE%B6

Singapore Investment

-

-

-

-

-

Updated: Cards To Use for Insurance Premiums13 hours ago

-

-

Best Fixed Deposit in December 202516 hours ago

-

-

-

-

-

-

-

The future of cash in a cashless society22 hours ago

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Portfolio Returns for Dec 20255 days ago

-

-

-

-

-

-

-

-

Finance Investment Movement 641 week ago

-

-

AI takes the backseat, for a change1 week ago

-

-

2025 Review and Predictions1 week ago

-

-

Portfolio Nov 20252 weeks ago

-

-

Dec 20252 weeks ago

-

letter to myself2 weeks ago

-

-

-

Dear Universe3 weeks ago

-

-

-

Portfolio Summary for November 20253 weeks ago

-

-

-

Portfolio (Nov 30, 2025)3 weeks ago

-

Portfolio (Nov 30, 2025)3 weeks ago

-

-

-

-

-

-

Portfolio -- Nov 20253 weeks ago

-

-

-

-

-

-

-

I’m Elated.4 weeks ago

-

-

What Shall We Do About VERS?4 weeks ago

-

-

人生意义是什么?5 weeks ago

-

-

-

-

-

-

-

-

iFAST 3Q25: Achieving record AUA1 month ago

-

-

-

Can we survive the next market crash?2 months ago

-

-

-

-

-

-

-

-

-

Key Collection3 months ago

-

-

-

-

-

Decoupling4 months ago

-

Been a while!4 months ago

-

-

-

-

-

-

-

-

FAQ on Quantitative Investing Part 28 months ago

-

-

-

-

-

-

-

-

Arigato Everyone! A Decade of Blogging!11 months ago

-

Top 10 Highlights of 202411 months ago

-

-

-

STI ETF1 year ago

-

-

-

Unibet Casino Bonus Codes 20241 year ago

-

-

-

-

Monthly IBKR Update – June 20241 year ago

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Monthly Summary of November 20232 years ago

-

Migration of website2 years ago

-

-

-

-

-

Hello SP Group, I'm Back!2 years ago

-

-

-

A New Light2 years ago

-

-

-

-

-

2022 Thoughts, Hello 2023!2 years ago

-

Series of Defaults for Maple Finance2 years ago

-

Takeaways from “Sea Change”3 years ago

-

Greed is Coming Back3 years ago

-

-

-

-

-

-

-

-

What is Overemployment3 years ago

-

Terra Hill Condo (former Flynn Park)3 years ago

-

Alibaba VS Tencent: The Battle Royale3 years ago

-

-

-

-

-

-

-

-

-

-

-

-

-