My Portfolio Jan22

Summary for January 2022

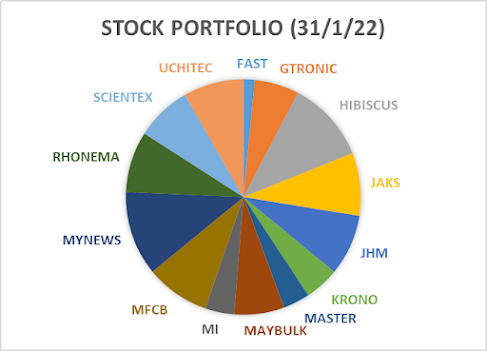

Portfolio @ End of Jan22

The first month of year 2022 was not a good month to the stock market as KLCI dropped 3.5%.

Tech-related stocks led the drop with approximately 20% slash in their share prices.

My portfolio could not escape from the bad sentiment and registered 1.2% loss in the month of January 2022.

The share price of the hopeless Fast Energy fell the most at 26% but it did not affect the overall portfolio much as the value is already very small.

JHM & Gtronic were the worst performers apart from Fast but overall loss was minimized by the 23.9% rise in Hibiscus's share price.

I sold part of my Hibiscus shares earlier at 88sen which was at the wrong timing again.

Besides Hibiscus, I sold all my LeonFB shares at 87.5sen, also shortly before its share price advanced to RM1 level.

I realized a bit of profit from myNews just to hold a bit more cash. All these selling acts were in anticipation of upcoming Omicron wave after Chinese New Year.

No one knows how will Malaysia stock market react to Omicron wave. In the western world, the damage of skyrocketing new Covid-19 cases to the stock market seems to be rather muted.

Today, new Coivd-19 cases in Malaysia has already surpassed 17,000 cases, which is five to six times more than 3,000 cases recorded in less than one month ago.

Nevertheless, KLCI rose 21 points or 1.4% today when there is 17,134 new Covid-19 cases. The index actually gains since the new Covid-19 cases grow.

So I guess Omicron wave will not have too much negative impact on our stock market, as there should be no further strict lockdown or MCO.

Now the government is even discussing about reopening the country's border as early as March without the need of quarantine.

Most tech stocks have dropped 20-30% from their peak. Is it a good time to grab some?

After a sharp fall in the first half of January, share prices of tech stocks seem to consolidate in the past 2 weeks.

However, the truth is that the PE valuation of most tech stocks are still on the high side.

Their share price might go up back to previous high or drop further to another lower level.

For investors who are fans of technology stocks, I think it's not wrong to collect a portion of shares at this stage.

I myself have some tech stocks in my watchlist since the end of last year.

After a brief study into some of those tech stocks, I like MPI the most but plan to buy Unisem first.

To my own surprise I ended up investing in MI first.

I've been watching MI for quite some time and I like its 10-year roadmap with "horizontal" diversification.

Initially I thought it only set up sales offices in Taiwan, South Korea & China but now it seems like there will be manufacturing sites there.

Because of high capex throughout the years, MI's free cash flow has been in the negative territory since it was listed in 2018.

This remains a concern to most investors and might have contributed to its sluggish share price compared to its peers.

Apart from this, dilution of earnings from new shares issued for acquisition of Accurus as well as from private placement to partly fund the acquisition of Talentek reduced its attractiveness in the eyes of investors.

To me, those are magnificent acquisitions and they should pave a broad way for its growth to another level in the future.

Generally I like what MI is doing but I have to monitor its cashflow closely.

There was one stock which I planned to buy in Jan22 but failed. One of the reasons I sold shares in January was to prepare for this investment. It was Coraza.

Its IPO price was 28sen and I already have a plan to act on its IPO day.

If its opening price is below 40sen, I will buy 100% with my allocated cash. If it's between 40-50sen I will buy 50% first. If it's between 50-60sen, I will buy 30%. If it's over 60sen, then I shall watch first as the sentiment for tech sector was bad.

Despite poor market sentiment at that time, I predicted that Coraza should probably open between 50-60sen.

It exceeded my expectation to open at 70sen but closed the day lower at 64.5sen.

I waited below 60sen but it never reached there. It went all the way up to 90sen in 4 days time.

This month there will be lots of companies in my portfolio releasing their quarter results again. Hopefully there will be no negative surprise this time.

http://bursadummy.blogspot.com/2022/02/my-portfolio-jan22.html

Singapore Investment

-

-

-

-

Can Singapore Stocks Keep Shining4 hours ago

-

-

-

-

Singtel share price in supersonic form!13 hours ago

-

-

-

Updated: Cut-off Dates For SRS Top-ups in 202518 hours ago

-

-

-

-

-

-

-

-

Basic Healthcare Sum 20261 day ago

-

-

-

-

-

-

Finance Investment Movement 642 days ago

-

-

-

-

-

AI takes the backseat, for a change4 days ago

-

-

2025 Review and Predictions4 days ago

-

-

-

-

-

-

Let It Go6 days ago

-

-

-

-

-

-

-

冷眼孙子股市兵法:真正的投资心法"1 week ago

-

Dec 20251 week ago

-

letter to myself1 week ago

-

-

-

-

Dear Universe2 weeks ago

-

-

-

-

Portfolio Summary for November 20252 weeks ago

-

-

-

Portfolio (Nov 30, 2025)2 weeks ago

-

Portfolio (Nov 30, 2025)2 weeks ago

-

-

-

-

-

-

Portfolio -- Nov 20252 weeks ago

-

-

-

-

-

-

-

I’m Elated.3 weeks ago

-

-

What Shall We Do About VERS?3 weeks ago

-

-

-

人生意义是什么?5 weeks ago

-

-

-

-

-

-

-

Singapore FinTech Festival 20251 month ago

-

-

iFAST 3Q25: Achieving record AUA1 month ago

-

-

-

Can we survive the next market crash?2 months ago

-

-

-

-

-

-

-

-

-

Key Collection2 months ago

-

-

-

-

-

Decoupling3 months ago

-

Been a while!4 months ago

-

-

-

-

-

-

-

-

FAQ on Quantitative Investing Part 28 months ago

-

-

-

-

-

-

-

-

Arigato Everyone! A Decade of Blogging!11 months ago

-

Top 10 Highlights of 202411 months ago

-

-

-

STI ETF1 year ago

-

-

-

Unibet Casino Bonus Codes 20241 year ago

-

-

-

-

Monthly IBKR Update – June 20241 year ago

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Monthly Summary of November 20232 years ago

-

Migration of website2 years ago

-

-

-

-

-

-

Hello SP Group, I'm Back!2 years ago

-

-

-

A New Light2 years ago

-

-

-

-

-

2022 Thoughts, Hello 2023!2 years ago

-

Series of Defaults for Maple Finance2 years ago

-

Takeaways from “Sea Change”3 years ago

-

Greed is Coming Back3 years ago

-

-

-

-

-

-

-

-

What is Overemployment3 years ago

-

Terra Hill Condo (former Flynn Park)3 years ago

-

Alibaba VS Tencent: The Battle Royale3 years ago

-

-

-

-

-

-

-

-

-

-

-

-

-