FOCUS LUMBER BHD (5197) - WHY THIS STOCK REMAINS ON OUR RADAR

What a crazy couple of days it has been for the global markets! Bursa Malaysia was not spared in the market selldown caused by the ongoing conflict between Ukraine and Russia. Any headlines hinting of an escalation in the war would bring another wave of selling in stocks and pushing commodity prices to new highs.

As we approach the 2 week mark into the conflict, the clear winners emerging from this uncertainty are commodity prices. In fact, the Malaysian economy actually stands to benefit from the high prices of crude oil since the country is a net exporters of crude oil.

Of course, the biggest boon for the Malaysian economy and stock market is the all time high prices of crude palm oil prices (CPO), which have touched a new high of RM7,268 per tonne on the most active traded contract today (9 Mar2022). The record breaking CPO prices have resulted in a huge rally in the whole plantation index, which is up by an impressive 28% YTD and outperforming every other sector on the Bursa Malaysia.

Since plantation stocks have been very well covered, we like to revisit a stock that was highlighted as there have been many positive developments since the last update.

KEY POINTS FOR FOCUS LUMBER BHD

1) BLOWOUT EARNINGS

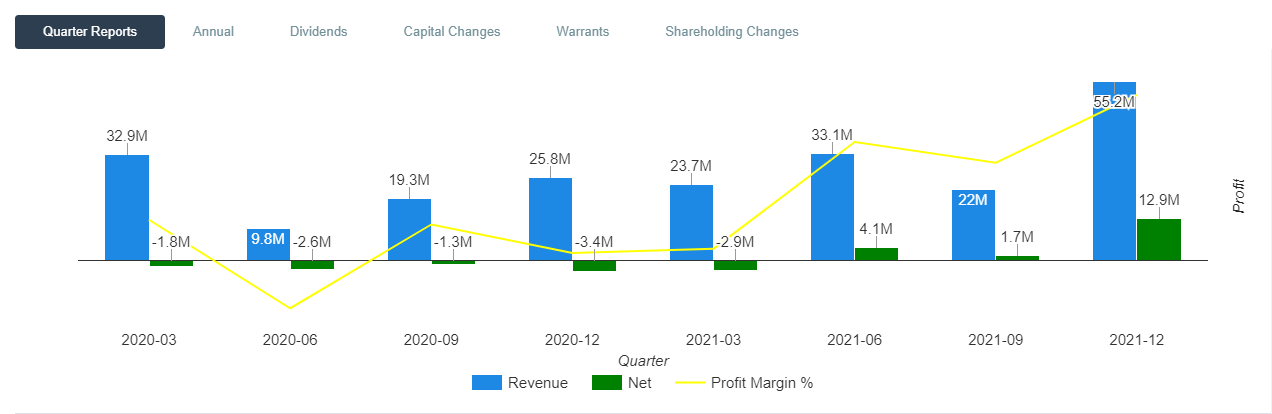

Focus Lumber reported a new record quarter profit of RM12.94 million or EPS of 13.08 sen per share, an increase of 661% QoQ! Management has guided that they are confident that FYE 2022 will be a fruitful year for the company. In a non-rated note by Hong Leong Investment Bank Research dated 8 Feb 2022, they have an assumption of 23 sen for FY22 and pegged the fair value at RM1.98 based on 8.6X FY22. The report was issued before the latest quarter results were released, hence we could be looking at higher revisions of EPS and fair value for the stock going forward.

2) LUMBER FUTURES HAVE CONTINUED RISING TO NEW HIGHS

At the time of the last posting on 7 Feb 2022, the price of Lumber was trading at USD1,070 per 1000 board feet and has since gone up to touch another new high of USD1,400 per 1000 board feet this week.This would translate to higher ASPs for plywood sold in the USA of which, 60% of Focus Lumber’s revenue is derived from the Recreational Vehicle segment.

3) UNFAIRLY SOLD DOWN THIS WEEK

Focus Lumber was not spared in the recent stock market malice. After hitting a high of RM1.66 after reporting the latest blowout quarterly results, the stock was heavily sold down in the last 2 days to touch a low of RM1.29. The selldown has found good buying support around the RM1.35 to RM1.40 level, We still believe that provided the RM1.22 is not violated, the uptrend that started since Dec 2021 is still intact.

CONCLUSION

The recent panic selling has presented a good opportunity to add or initiate new positions into Focus Lumber at the current price of RM1.36. Just based on the latest quarter EPS of RM0.13 per share, we could be looking at prospective PER of only 2.6X! Also, not forgetting that Focus Lumber has a net cash position of RM0.73 per share with no bank borrowings.

With the expectation of stagflation being the theme for the foreseeable future, the place to seek extraordinary returns would be to own a basket of commodities via ETFs or investing in the Futures Markets or simply to buy the stocks that would benefit directly from the elevated commodity prices.

Disclaimer: This blog is created for sharing of trading ideas only. It is not in any way or form meant to be an inducement or recommendation to buy or sell any stocks. Consult your financial consultant before making any financial investments.

KEY POINTS FOR FOCUS LUMBER BHD

https://klse.i3investor.com/web/blog/detail/thealphatrader/2022-03-10-story-h1600182849-FOCUS_LUMBER_BHD_5197_WHY_THIS_STOCK_REMAINS_ON_OUR_RADAR