Hibiscus – coming BOOM

ESG behaviour changing?

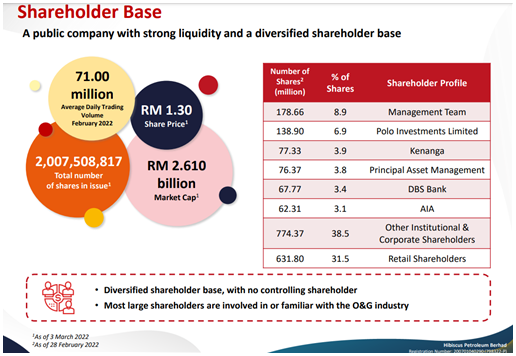

Hibiscus recently released the March 2022 investors presentation. Below is page 9:

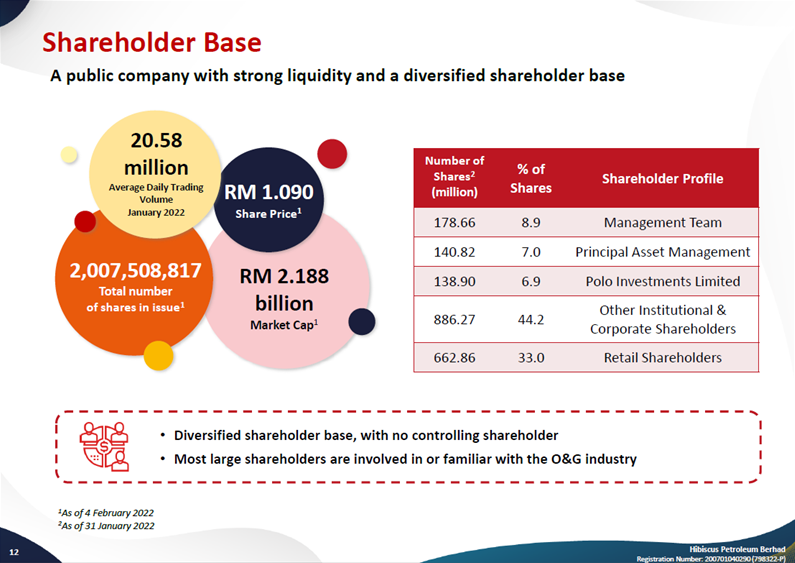

And here is page 12 of the February 2022 investor presentation:

Please note the tables to the right of both pages.

Now, there are more institutional shareholders that exceed 3% holding - AIA, DBS Bank and Kenanga.

So what?

Well, this might be the beginning of institutional investors coming round to the view that they must be invested in the fossil fuel domain despite the ESG mandate. This would cause a re-rating.

Insider movement

Major shareholder – Datuk MICHAEL TANG VEE MUN has acquired 10,792,400 shares since 21 February 2022. And Dato Sri Roushan Arumugam sold 4,774,300 shares.

Datuk Michael interest is via Polo Investment Ltd and Mettiz Capital Sdn Bhd.

Polo invested in Hibiscus at end 2015 (23.5 sen/share) and has not changed its shareholding since. It is estimated the capital appreciation for Polo is 30.3% CAGR. A major shareholder show of confident.

Supply and Demand Balance

At the end of 2021, most analysts were predicting that supply will exceed demand and there will be “BUILD” in inventory.

Now, middle of March, OPEC and EIA data indicated that Q1 2022, supply had not cope with demand and instead of build, there is further “DRAW” of inventory.

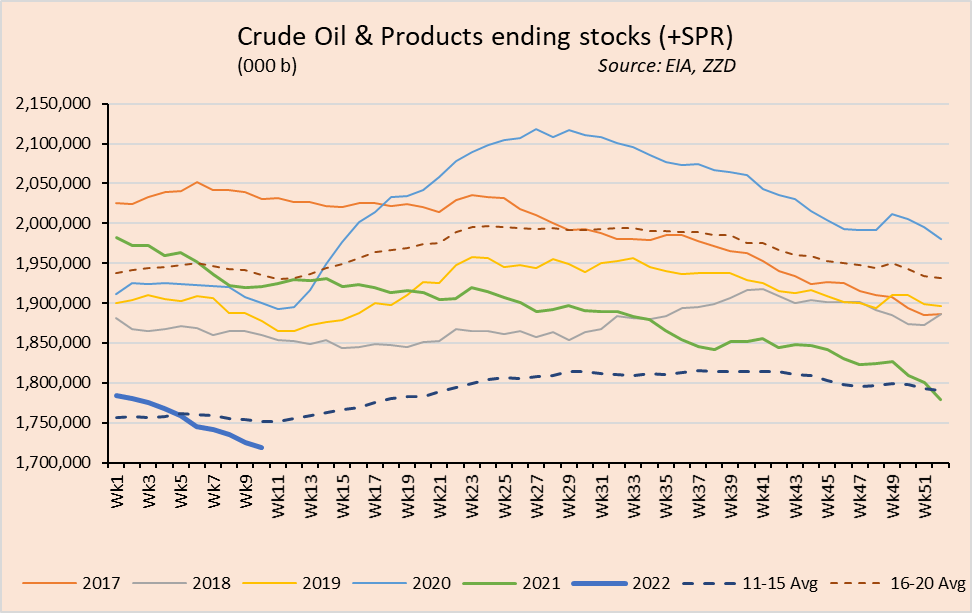

Here is EIA for week ending 11 March 2022:

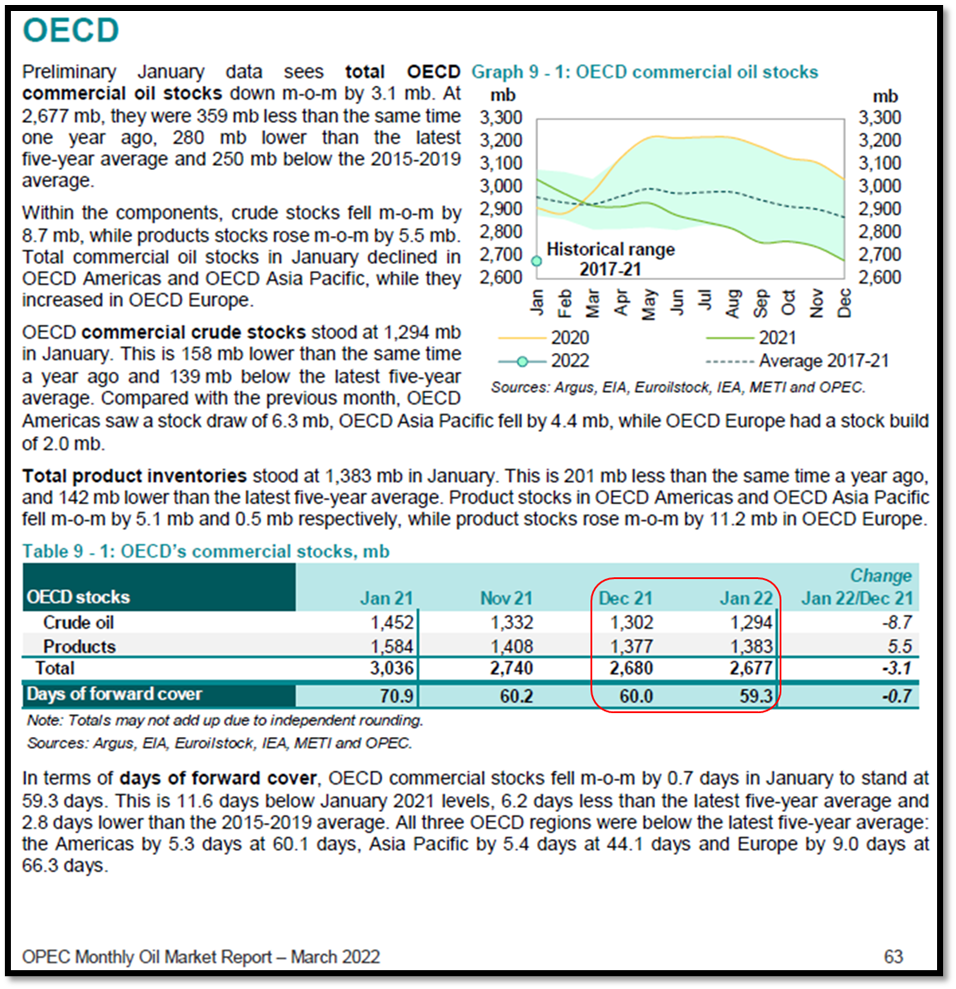

And here is OPEC March 2022 monthly report.

OECD commercial oil stocks continue to draw to 2,677 mb as of January 2022.

The JCPOA deal with Iran is being pursued vigorously as well as Venezuela. It is clear that there is indeed shortage of supply.

Oil price

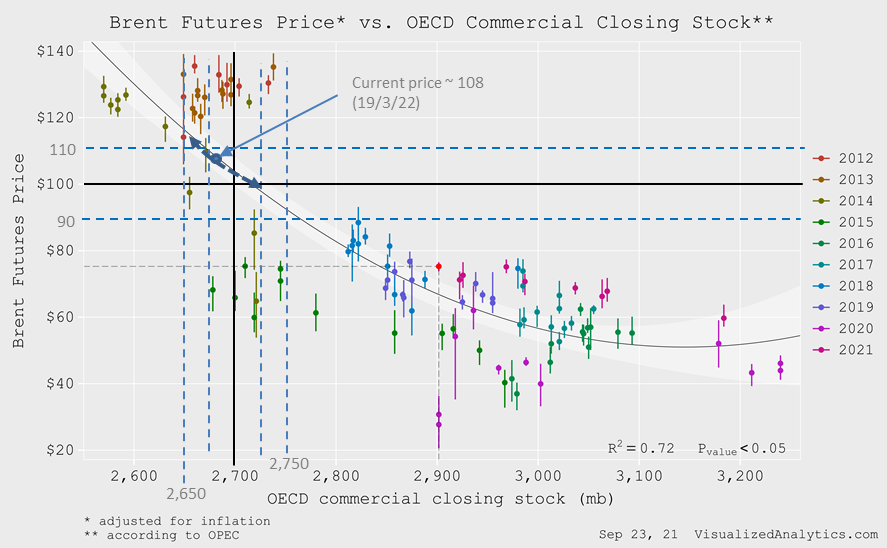

Thus, oil price, now usd 108, follows the graph provided by VisualizedAnalytics.com, that is, price is a function of the inventory level.

Obviously, the graph provides guidance ONLY.

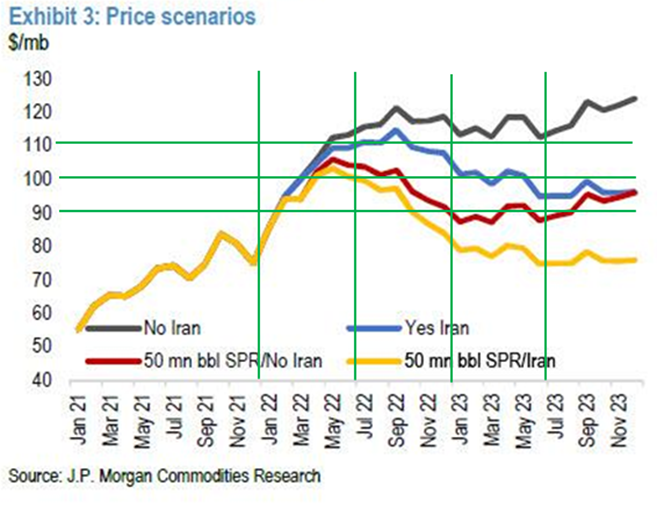

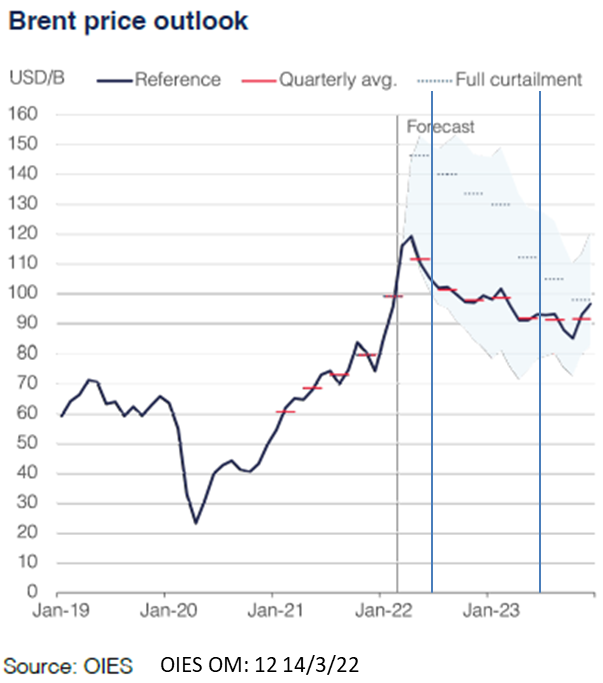

JP Morgan provided probable Brent oil price for several scenarios as well as The Oxford Institute of Energy Studies (OIES).

Here is JP Morgan (4/3/22) take on the dynamic of the various scenarios:

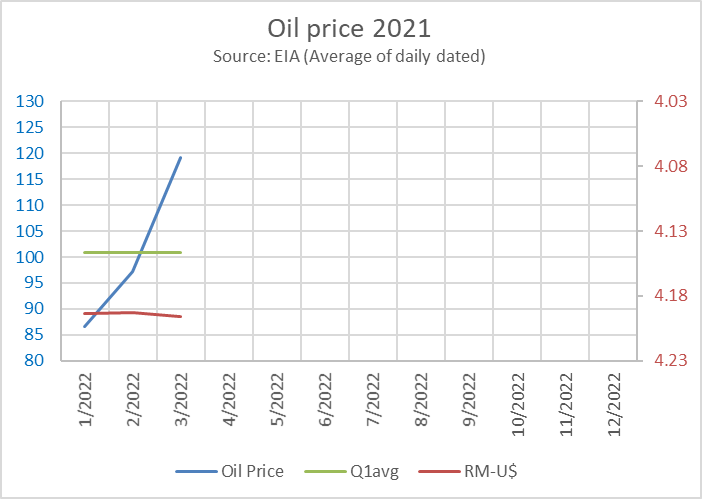

Actual dated Brent oil price provided by EIA has been averaged monthly as shown in chart prepared by author together with the average Ringgit-USD exchange.

Based on the above charts, it can be seen that Q1 2022 Brent oil price will average usd 100. For Q2, 2022, the average price is forecasted to be 107, while for July 2022 to end June 2023 (FY 2023), the average price is forecasted at 90.

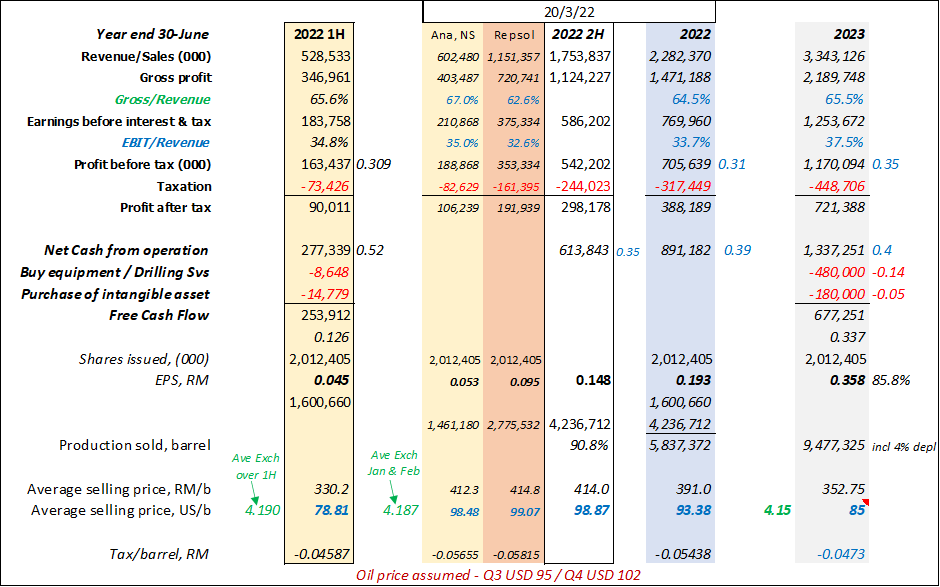

Revising the oil price, the previous forecast is re-calculated as shown below with FY2023 as well.

Staying conservative, Q3 FY22 and Q4 FY22 oil price used are usd 95 and 102 respectively, and the negative goodwill, RM 36 million, has also been removed (non-cash item). Repsol production upgraded to 17,600 boepd, taking into account recent Maybank Investment Bank report data.

For FY2022, earning per share is about RM 0.193.

FY2023

Preliminary FY2023 earnings was calculated using oil price at usd 85 with Ringgit-usd exchange of 4.15 and matrix slightly better considering improvement made to Repsol fields.

FY2023 earning per share is estimated to be RM 0.358, an 86% increase over FY 2022 with following assumption:

· a 4% depletion to the production of all fields

· repaired sub-sea valve

· field development like side-track / infill wells, water flood

· Repsol fields brought to Hibiscus productivity standard

From the FY2023 estimate, free cash flow (FCF) will be tremendous. As indicated, with huge amount allocated to purchasing equipment as well as intangible asset, estimated FCF might amount to RM680 million or RM 0.33 per share. Generous dividend could be declared.

Do note that no consideration from Sunflower / Marigold was considered as this, even with fast-track, will not deliver first oil until FY2024.

The Australian asset is better sold as it is a distraction. In addition, management has said many times about the high operation cost of Australian oil and gas fields.

Summary

There has been an increase in institutional shareholders – AIA, DBS and Kenanga. Each of them hold more than 3%. It appears, despite ESG, institutional investors view oil & gas equities favourably now. This would cause a re-rating.

Major shareholder, Datuk MICHAEL TANG VEE MUN through Mettiz Capital Sdn Bhd bought 10,792,400 shares this year (so far) while Dato Sri Roushan Arumugam sold 4,774,300 shares. Another major investor in Hibiscus, Polo Investment Ltd (Datuk Michael has interest too) enjoyed a CAGR of 30.3% since buying in at end 2015. This is a vote of confident for Hibiscus by a major shareholder.

Oil supply remains challenged while demand has not plateaued but is robust and growing. This caused inventories in usa and OECD to “draw” to lower level. With the “price to inventory level” chart of VisualizedAnalytics, current price, usd 108 is undemanding.

Going forward, inventory level is estimated to go lower still.

Current geo-political event in Ukraine caused disruption to global oil market. JP Morgan and The Oxford Institute of Energy Studies estimated oil price to remain elevated for 2022 and 2023.

With the latest elevated oil price, Hibiscus earnings (per share) for FY 2022 is estimated to be RM 0.19 while FY2023 might reach RM 0.36 – COMING BOOM indeed.

PEACE.

Disclaimer:

I wrote this myself without pay. I and my families own Hibiscus

shares. This is not an advice to buy / sell Hibiscus or any other

equities / securities / assets.

https://klse.i3investor.com/web/blog/detail/ZZD/2022-03-20-story-h1600338629-Hibiscus_coming_BOOM