SUBUR 6904 SUBUR TIASA HOLDINGS BERHAD and JTIASA 4383 JAYA TIASA HOLDINGS BHD comparison - Koon Yew Yin

The Auditors qualified Subur Tiasa’s 2021 annual accounts. In their opinion Subur Tiasa’s current liability exceeded current assets which had created doubts if the company could function properly. For my long business experience, I have been borrowing as much money as I could to do more business to make more money. I still can remember, in 1967 when I founded Mudajaya Construction I could not borrow money from the Bank because the Bank did not accept moving assets, such as Bull Dozers, Trucks and Cranes as collaterals.

As a result, many investors with limited accounting knowledge have been dumping their Subur Tiasa holdings to buy Jaya Tiasa.

To make the situation worse, Subur Tiasa wanted to change its financial year to end in December instead of July. As a result, its latest 16.15 sen EPS was for 2 months while Jaya Tiasa’s latest 5.28 sen EPS was for 3 months. Subur’s current market capitalisation is Rm 493 million and Jaya Tiasa’s market capitalisation is Rm 1,100.

For comparison of Subur Tiasa’s 16.15 EPS for 2 months with Jaya Tiasa’s 5.28 sen for 3 months divided by each of their market capitalisation.

16.15 sen ÷ 493 = 0.033

5.28 sen ÷ 1,100 = 0.005

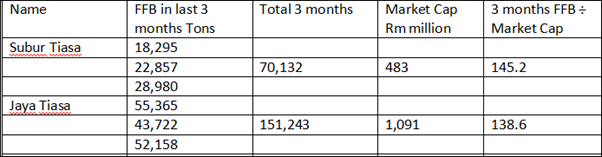

Another way to compare is to consider their actual FFB production in the last 3 months.

Based on the 2 ways of comparisons, it is much better to sell Jaya Tiasa to buy Subur Tiasa.

https://klse.i3investor.com/web/blog/detail/koonyewyinblog/2022-04-28-story-h1622325472-Subur_Tiasa_and_Jaya_Tiasa_comparison_Koon_Yew_Yin

Baltic dry index - 2125

1 hour ago