These are the 2 most important questions; all investors want to know.

There are 2 basic fundamental principles for investing:

1) Among all the stock selection criteria such as NTA, cash flow, debt or healthy balance sheet etc profit growth prospect is the most powerful catalyst to push up share price.

Due to the CPO record high price, all plantation companies have reported increasing profit in the last few quarters. All plantation stocks are growth stocks. Do not sell good growth stocks.

The most important question is “When will CPO price drop?”

Ukraine-Russia conflict:

Russia invaded Ukraine on 24 February. Ukraine has a population of 44 million people. Over 5.5 million refugees have since left Ukraine, while an estimated 7.7 million people had been displaced within the country by 21 April. 90% of Ukrainian refugees are women and children. In fact, most of the farmers have joined the army to fight Russia.

As a result, Sunflower oil production will be affected for a long time. In fact, they have missed the planting season for the year.

Ukraine and Russia are the major producers of the world’s sunflower oil, accounting for 7.3 and 5.8 million MT respectively in 2020. Together these two countries account for nearly 73% of the export trade in sunflower oil. In terms of overall oils and fats consumption, sunflower oil typically accounts for about 9% of global consumption and almost the entire quantum is used as a food commodity.

As a result, Sunflower Oil price has been shooting up due to supply shortage which will support CPO price for at least one more year.

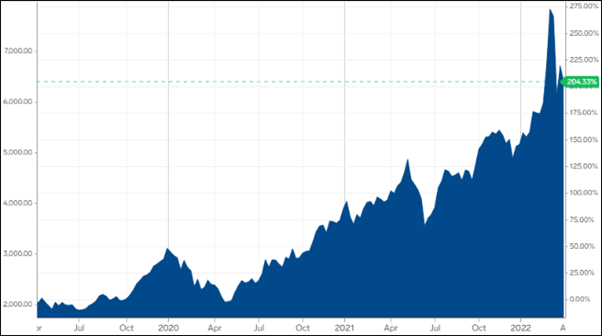

CPO price chart:

As I have said, the Ukrainians have missed the planting season for the year which will push up CPO price for another year at least. CPO price has peaked recently. Due to the Ukraine war CPO price will soon break the old record high and establish a new historical record high.

In fact, CPO price has been below Rm 3,000 for decades. Currently, CPO price is above Rm 6,000. All plantation companies should be able to report higher profit for the quarter ending March which should be announced before the end of May, another 2 or 3 weeks.

2nd Fundamental Principle for investing is based on price charts:

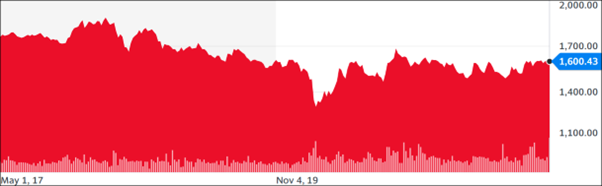

Price charts cannot lie. Do not sell up-trending stocks. The price charts for all plantation stocks are up trending; for examples, Subur Tiasa and SOP as shown below.

The above is the 5 years KLCI chart which is almost at its trough as many investors have sold their holdings and waiting at the side line. Clever investors should take advantage of this situation to buy plantation stocks. In my opinion, the best plantation stock to buy is Subur Tiasa.

For your information, you can see from Subur Tiasa’s 2021

annual report that famous Dr Neoh Soon Kean of Dynaquest Sdn Bhd is one

of the 30 largest shareholders.

https://klse.i3investor.com/web/blog/detail/koonyewyinblog/2022-05-05-story-h1622437905-Shall_I_sell_Plantation_Stock_When_will_CPO_price_drop_Koon_Yew_Yin