https://klse.i3investor.com/web/blog/detail/koonyewyinblog/2022-11-30-story-h-304692304-Hengyuan_will_continue_to_report_more_losses_Koon_Yew_Yin

My purpose for writing this article is to prevent investors from losing more money.

What Is a Crack Spread?

A crack spread refers to the overall pricing difference between a barrel of crude oil and the petroleum products refined from it. It is an industry-specific type of gross processing margin. The “crack” being referred to is an industry term for breaking apart crude oil into the component products, including gases like propane, heating fuel, gasoline, light distillates, like jet fuel, intermediate distillates, like diesel fuel, and heavy distillates, like grease.

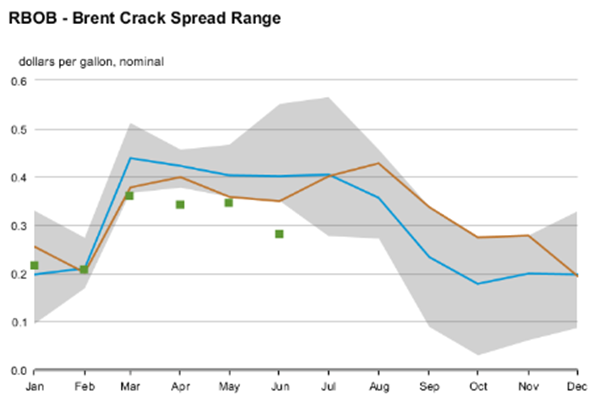

During the quarter ending June, the Brent Crack Spread margin was rising above 0.4 and Hengyuan reported EPS Rm 2.22. Since then, the margin has been dropping. As a result, it reported an EPS loss of Rm 2.14 for the quarter ending September.

The Brent Crack Spread margin continues to drop as you can see the chart above. As a result, Hengyuan will continue to report more losses for the quarter ending December.

Hengyuan price chart is down trend as shown below: