Radiant Globaltech Bhd (with MSC malaysia status company since 2014)is engaged in providing retail technology solutions including retail hardware, retail software, as well as maintenance and technical support services. It also offers full range of retail technology solutions to its customers.

WHAT is MSC Malaysia status?

MSC Malaysia status is a recognition by the Government of Malaysia through the Multimedia Development Corporation (MDeC), for ICT and ICT-facilitated businesses that develop or use multimedia technologies to produce and enhance their products and services.

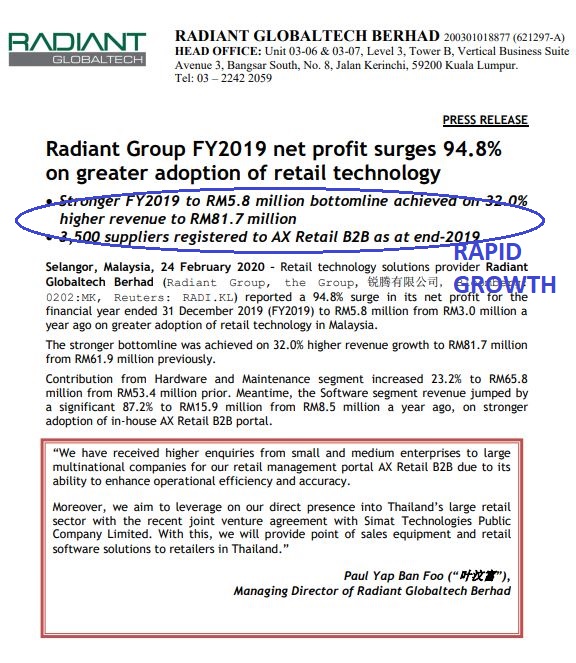

Radiant Globaltech aims to leverage direct presence into Thailand’s retail sector

KUALA LUMPUR (Feb 25):

Retail technology solutions provider Radiant Globaltech Bhd aims to

leverage its direct presence into Thailand’s large retail sector with

the recent joint venture agreement with Simat Technologies Public Co

Ltd.

In a statement Feb 24, Radiant

Globaltech’s managing director Paul Yap Ban Foo said with this, the firm

will provide point of sales equipment and retail software solutions to

retailers in Thailand.

“We have received higher enquiries from

small and medium enterprises to large multinational companies for our

retail management portal AX Retail B2B due to its ability to enhance

operational efficiency and accuracy,” he said.

SOURCES: https://www.theedgemarkets.com/article/radiant-globaltech-aims-leverage-direct-presence-thailands-retail-sector

RGTECH Has similar service products (as shown above) with REVENUE

(0020)!!! the difference is they service in different broad regions. RGTECH

focus in SEA market where Revenue focus in local market!!!

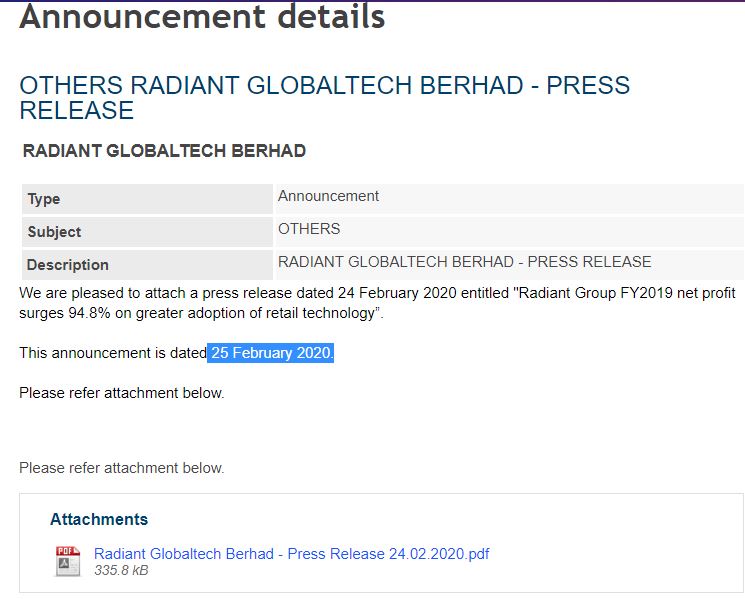

Recent Announcement :

Date 25FEB 2020

Sources: https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3026365

2019 Highlight:

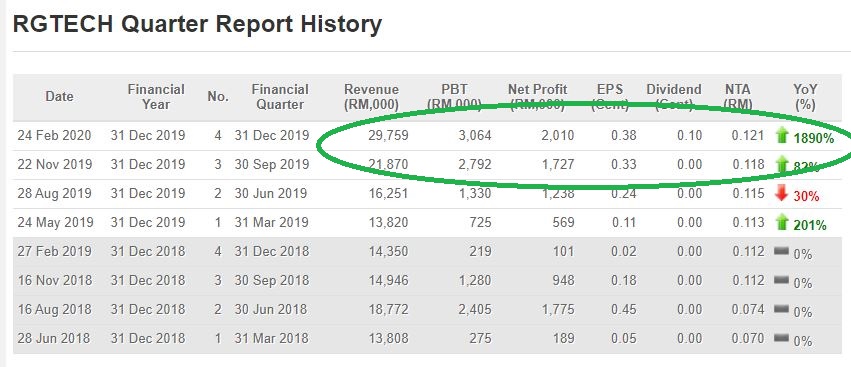

Results:

As you can see on the QR above, BOTH Revenue and Profit growing strong

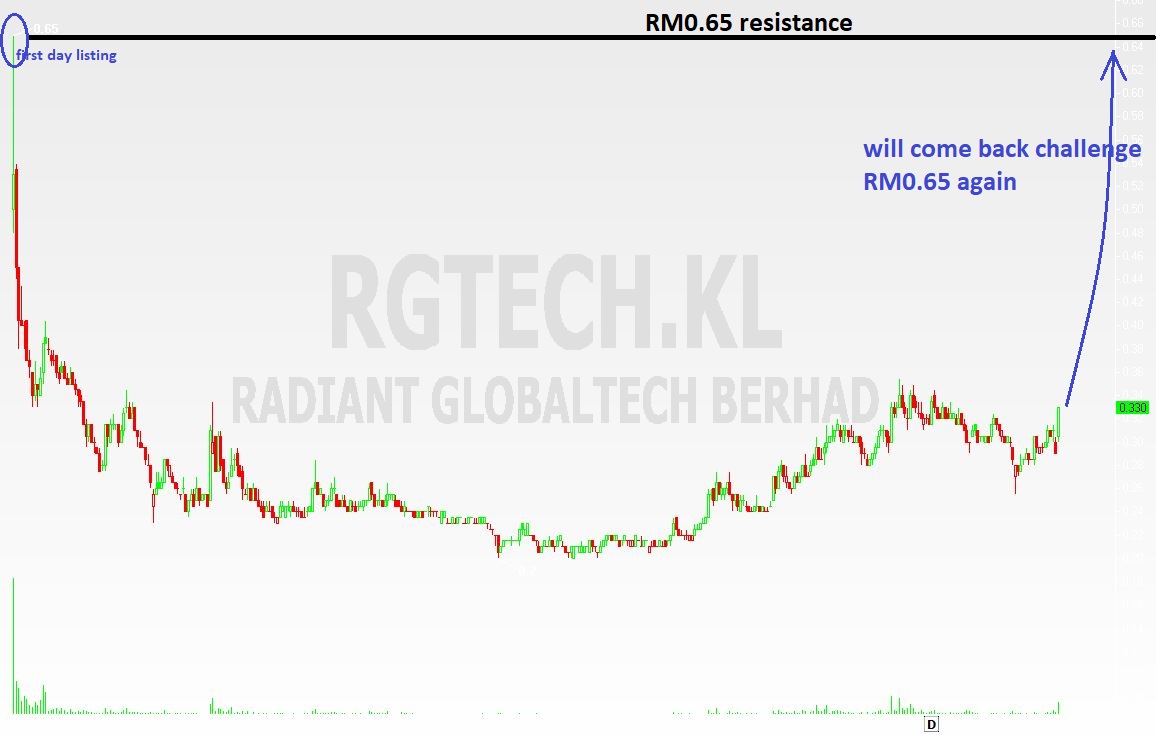

Technical analysis

Rgtech is about to breakout RM0.35 sens, we believe short term target is RM0.65 however we do not want for short term gain as we believe the rapid growth and improvement in fundamentals of rgtech will value at much higher price. Hence, our mid to long term target for RGTECH is not available yet

WHY RGTECH

- Revenue (0200) Rival, their figures and service products are very similar

- Stronger FY2019 32% higher revenue than FY2018

- Net profit surge 94.8% on greater adoption of retail technology

- 3,500 suppliers registered to AX Retail B2B as at end-2019

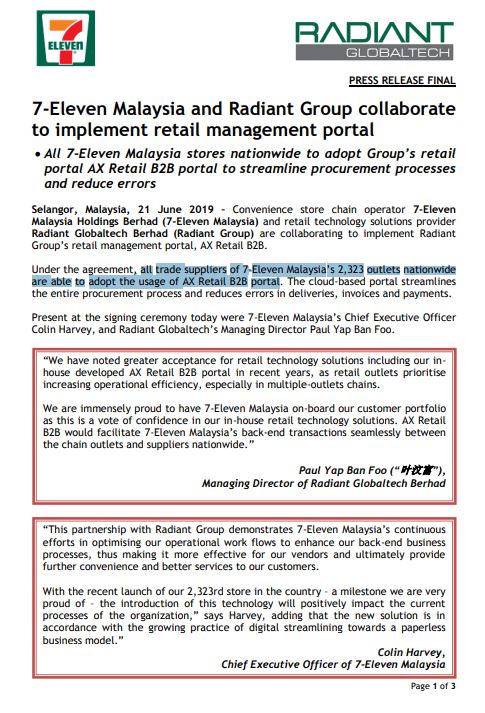

- All 7-eleven Malaysia stores total 2,323 outlets are adopting usage of AX Retail B2B portal

- MSC Malaysia Status

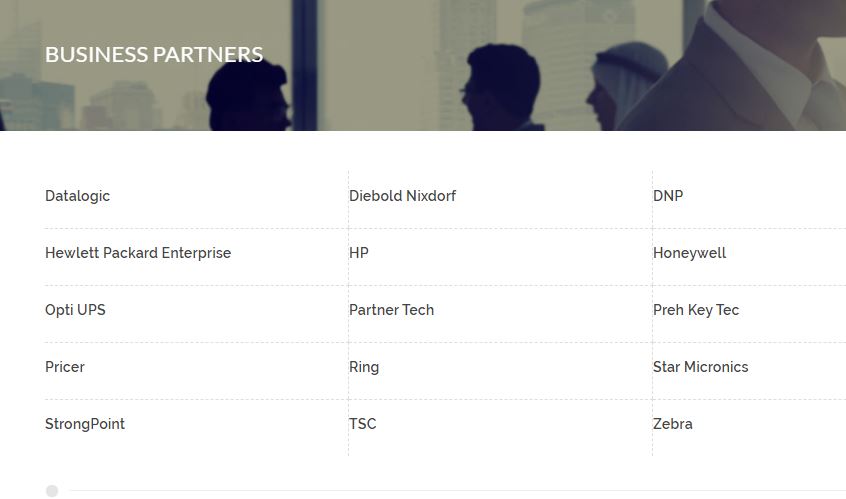

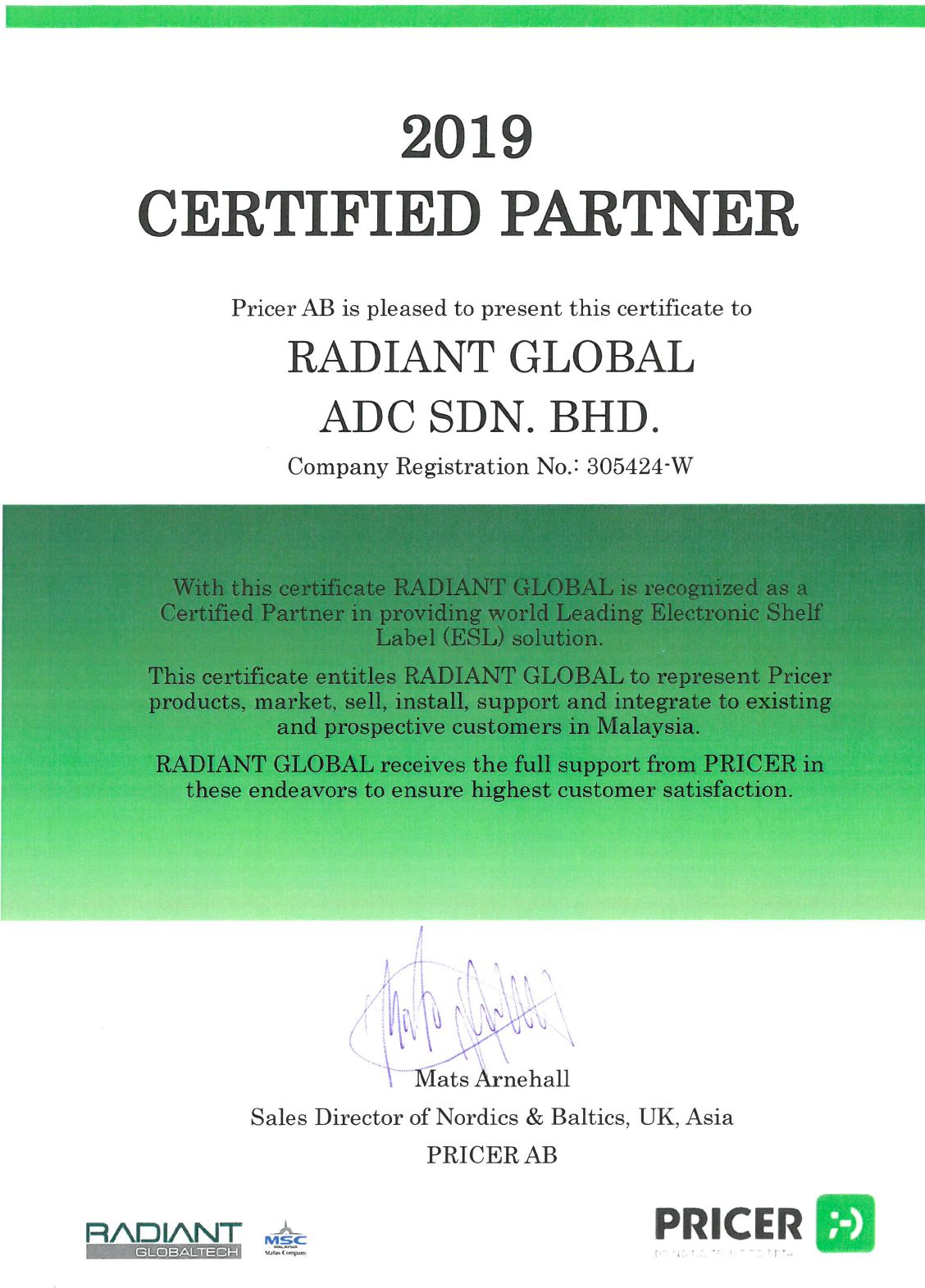

-International Business Partners: Honeywell, Pricer, HP, Datalogic and etc.

TP1 : RM 0.65

TP2 :N/A, Not going to sell as long as QR continue to improve

Our analysed target price is based on several factors : company growth, business partner, technology valuation,service product and rival valuation Revenue(0200)

Join our telegram at :

DISCLAIMER : Investments involve risks, including possible loss of

principle and other losses. This article and charts are provided for

information only and should not be construed as a solicitation to buy or

sell

https://klse.i3investor.com/blogs/share4u_2020/2020-02-26-story-h1483946308-Rgtech_Superb_Growth_Tech_stock_incoming.jsp