Stock code: 5025 NWP

17 December, Thursday

VIRTUAL EGM 11:00am – 11:30am

Polling Results

[ PASSED ] Special Resolution : proposed reduction of issued share capital

[ PASSED ] Ordinary Resolution 1 : authority to allot and issue up to 20% new shares

[ PASSED ] Ordinary Resolution 2 : proposed ratification of the payments of directors’ fees

[ PASSED ] Ordinary Resolution 3 : proposed rectification of the payment of additional director’s fee

Observation:

-

Special Resolution

To reduce issued share capital is a very common accounting exercise to clean up the balance sheet of companies with accumulated losses, to clean the sheet and rid it of legacy losses.

NO EFFECT to market price or number of shares held by shareholders. -

Ordinary Resolution 2 & 3

The above resos pertain to the settlement of disputes with previous directors.

No more amount owing to anyone, time to move on. -

Ordinary Resolution 1

The board now has immediate authority to issue and place up to 20% new shares, for a period up to 31Dec 2021. This is interesting because the company has just completed a fund-raising round where it issued 10% new shares that were listed on 7Dec, less than 2 weeks ago. Why another round?

Let’s take a look at the most recent private placement exercise.

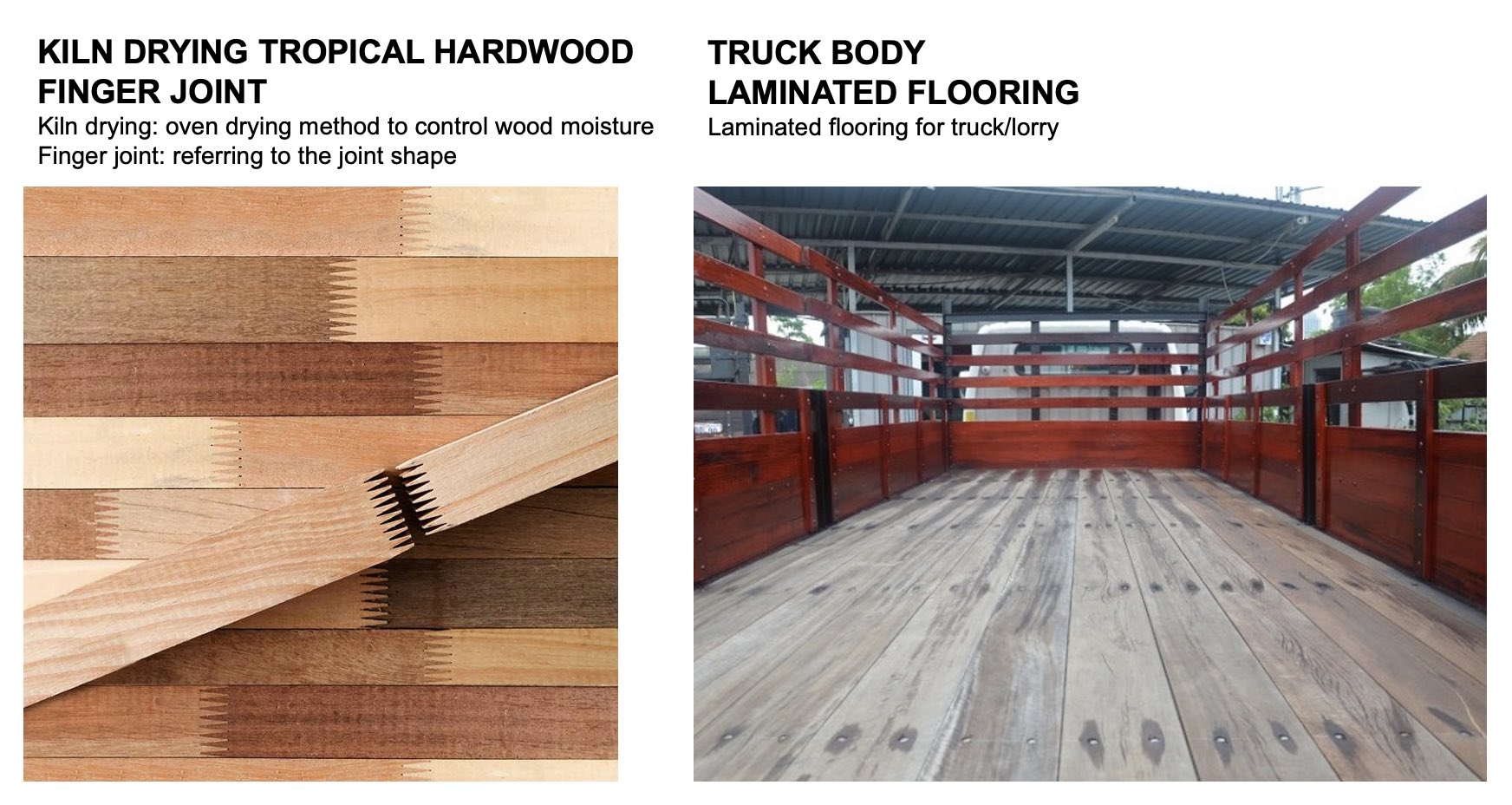

The proceeds would be utilized mainly for the purchase of machineries and equipment relating to their timber manufacturing. The company has to upgrade their production line to make new products that include ‘kiln drying tropical hardwood finger-joint and truck body laminated flooring’.

According to Companies Act and Bursa Malaysia rules, the board does not need to specify the purpose of the fund-raising when seeking shareholders’ approval and mandate. Approval from Bursa is only needed during the actual exercise itself.

Let us explore the possibilities.

Possibility 1: to raise funds for TIMBER BIZ

Given that the most recent exercise has already covered the capital

requirements of the existing timber business of NWP, this possibility is

rather unlikely for now.

Possibility 2: to raise funds for NEW BIZ

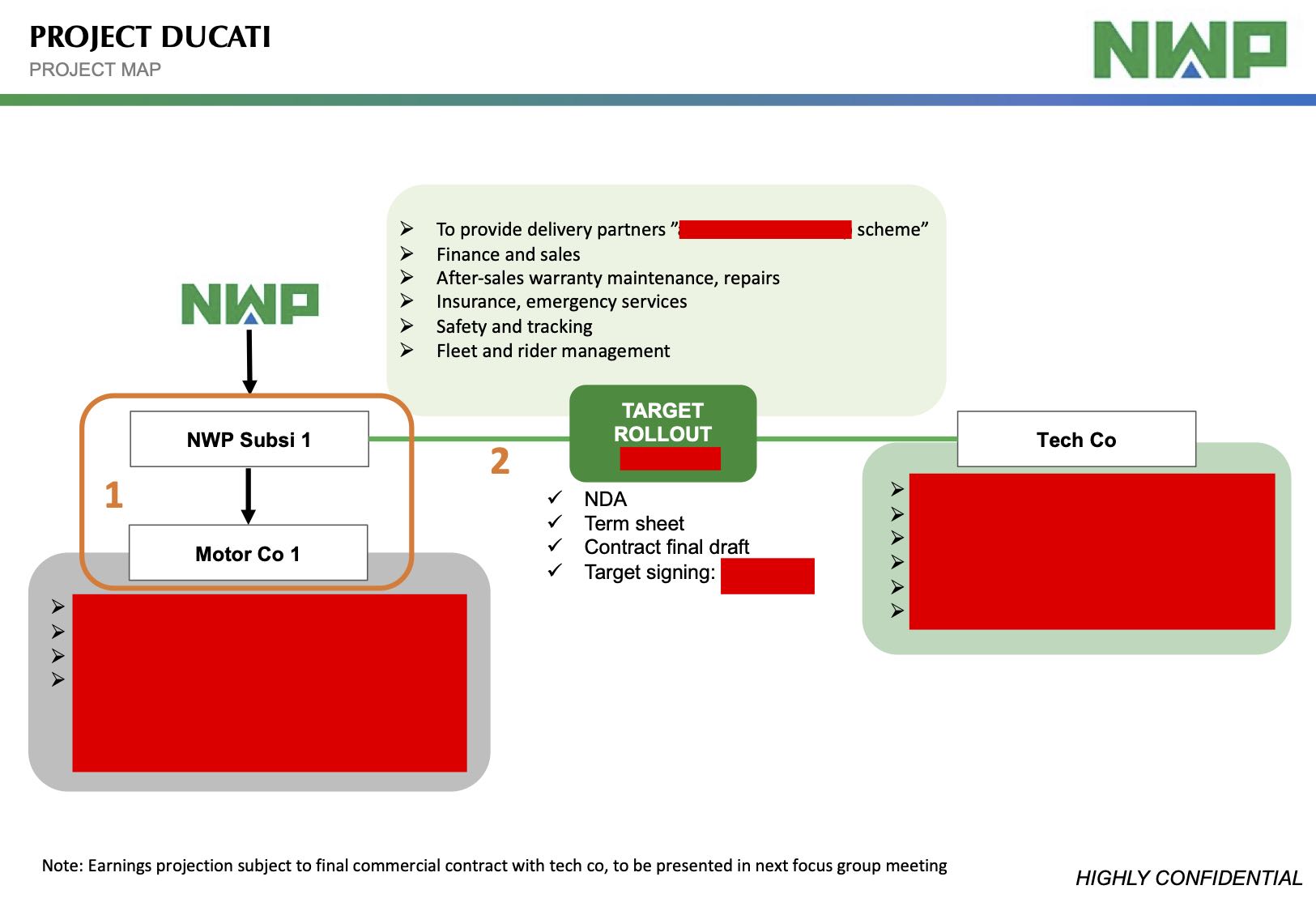

There was a question raised during the EGM, whether the company has the necessary capital to roll out the new automotive business said to be partnering a “well-known delivery service provider”.

It is only logical to assume that the capital requirements for

operations of running such a large scale venture would not be light.

The response from the board was that they have already planned for it and would make announcements in due course.

- Could this new round of fund-raising be earmarked for this specific project? Also, is the board able to secure enough takers for all 20% of the new shares?

- If indeed the fund-raising is for the mega project that is said to take off anytime, finding investors for the new 20% shares would be the least of worries. Or has the board already identified funders, hence the immediate new mandate right after the last exercise?

They certainly seem to be moving forward at a fast pace.

THE NEXT STEP

To roll out the mega project, the FIRST step would be to secure Motor Co 1 as shown in the project scheme. Without Motor Co 1, the company would not have the relevant platform to JV with the so-called Tech/Service Co. Once step 1 is concluded, the next step would be the actual JV already.

How soon are we to the actual progress update from the company? Could it be very soon just like how they announced the property MOU?

Things are surely getting busy for NWP. Let's observe how market anticipation is reflected on the trading board.

Thank you

Best regards,

Alpha7 Research

https://klse.i3investor.com/blogs/alpha7research/2020-12-17-story-h1538255050-17_December_NWP_EGM_What_s_Next.jsp