JAKS (4723): JAKS RESOURCES BHD & The Identical Power plant that generates RM 1.5 Billion annualized Profit presently

With reference to the above subject – JAKS at 40% ownership of its Hai Duong coal fired power plant would earn RM 590 Million per annum.

In this article I would try to explain why i find it highly plausible that JAKS can deliver similar performance if not better

………………………………………………….............................................................................................................................

1. We have JAKS – CPECC owned power plant in Hai Duong as per below specification under BOT contract:

1200 MW (2 units x 600 MW) Coal Power Plant.

Currently going through commissioning phase and expected to commercially operate first unit by May 2020.

2. We have AES 51% owned identical Coal fired power plant as per below specification under BOT contract successfully commissioned in 2015:

1240 MW (2 units x 620 MW) Coal Power Plant.

Further similarity between Mong Duong II and JAKS Hai Duong power plant:

- Both using domestic anthracite coal

- Both are 100% foreign owned

- Both under 25 years Build-Operate-Transfer (BOT) scheme

- Both are guaranteed by Vietnam Government

- Both Power purchase agreements signed with EVN

- Both coal supply agreements signed with Vinacomin

- Both under 75:25 debt to equity financing

- Both under max 18 years loan tenure allowed by Vietnam government

3. The below website shows financial reports of AES Corp.

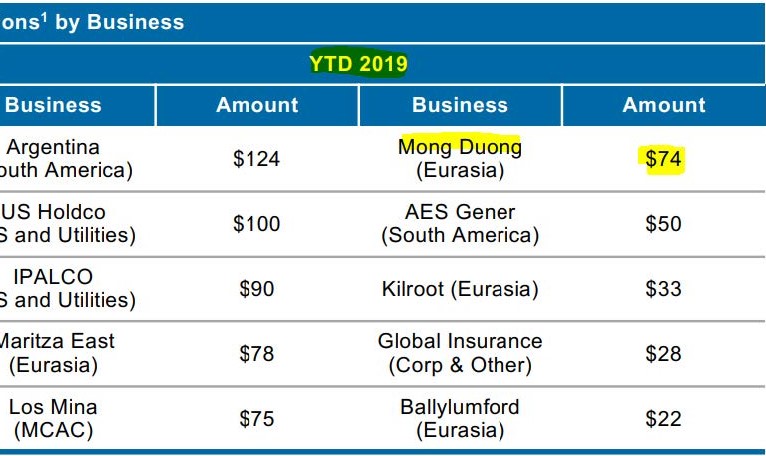

One can refer the historical presentation data and derive the following earnings for its Mong Duong II subsidiary as per below:

https://www.aes.com/investors/financial-reports-summary/default.aspx

AES at 51% stake: US$ 46M (FY2016) 100% stake annualized: RM 378M

AES at 51% stake: US$ 51M (FY2017) 100% stake annualized: RM 396M

AES at 51% stake: US$ 45M (FY2018) 100% stake annualized: RM 370M

AES at 51% stake: US$ 74M (YTD2019: Q1+Q2+Q3) at 100% stake annualized: RM 812M

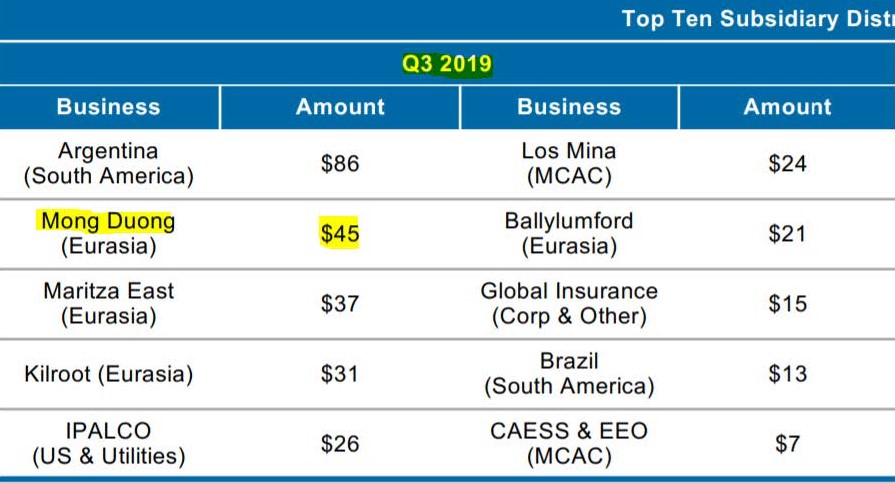

With reference to page 29 of Q3 2019 ‘Presentation’ one would see the PTC (Pre-Tax Income) of its Mong Duong plant subsidiary to be US$ 45 M in Q3 2019 alone. This is indeed a mind-blowing figure.

The above means, at 100% stake, if annualized the Pre-tax income will be:

US$ 45/QTR x (100%/51%) x (RM4.2/1.0 US$) x (4 QTR/YR)

= RM 1482 Million

JAKS at 30% stakes will be earning RM 444Million (being tax free for the first few years)

JAKS at 40% stakes will be earning RM 590 Million

Note that Mong Duong plant cost US$ 2.1 Billion and thus having much higher depreciation rate than the US$ 1.87 Billion of Hai Duong. That’s about RM 40 Million earnings difference per annum.

Now, the critical question to be answered is why the first few years the Mong Duong II earnings was not as impressive as it has shown lately?

………………………………………………………………..............................................................................................................

Answer: It has all to do with the "utilization rate" (how much effectively the electricity was sold)

If one looks at the utilization rate (power sold) effects under the BOT contract as per below formula, utilization rate will have significant impact on the bottom line. It has an exponential effect on Profit with fixed costs.

“All payment from EVN to the power plant is calculated based on the actual or contract output of the power plant, not the capacity of the power plant”

Information 1:

Refer article below related to Mong Duong dated 18th Jan 2019:

However, I am unable to ascertain the above is for Mong Duong II (AES owned) or Mong Duong I (ADB owned). Alternatively, for a more comprehensive explanation on its low utilization, please refer DK66 article below with appropriate references verified for Mong Duong II.

https://klse.i3investor.com/blogs/Jaks%20resources/204451.jsp

Summary from DK66 article above:

- Year 2016 was a full operational year after the plant achieved commercial operation. Its capacity was 59% utilized.

- Year 2017 was exceptional. Mong Duong II was on reserve shutdown for 5 months at the request of Electricity of Vietnam, given that the hydropower plants were running at high capacity due to unusually heavier rainfall. The plant has only 35% utilization rate in the year.

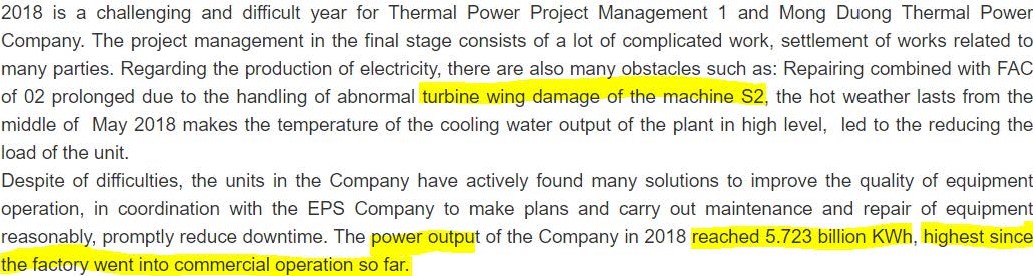

- Year 2018 was the 3rd year of operation and was scheduled for major maintenance (alternative source)

Note: there is a quite a difference between utilization calculated based on power sold and operating hours

Information 2:

Note below article refers to Vinh Tan 1 Coal fired power plant having exactly same capacity of 1200 MW.

http://hlcenc.com/product/vinh-tan-1-thermal-power-plant/

Article related to China Vinh Tan 1 Power Plant in relation to

first year anniversary of commercial operation for Unit 1 & Unit 2.

http://www.cnr.cn/gd/gdkx/20191206/t20191206_524886717.shtml

The following are some highlights from the above article :-

"In the first contract year, the two units of the project continued to

maintain safe, stable, and high-load operation. The unit load rate

reached 95.80%, the cumulative power generation was 8.686 billion kWh,

the cumulative power sales were 8.194 billion kWh, and the annual

utilization hours were 7,238 hours."

This means the utilization rate (using output for comparison) of the newly operated Vinh Tan 1 as per below:

= 8.686 (output) / 12.0 (capacity) = 72% (normal)

Mong Duong utilization rate max ever since production till end 2018:

= 5.723 (output) / 12.04 (capacity) = 47% (abnormal)

The above shows Mong Duong II had been severely under-utilized till end of year 2018.

Despite such low utilization rate, Mong Duong II managed to deliver an average US$ 48M per annum till 2018. (equivalent to RM 120M for JAKS in worst scenario at such low utilization rate)

The Fixed O&M costs under BOT contract also explains the difficulty faced by Mong Duong on the first 3 years. As EVN would not have paid for any surplus costs.

So then what happened in 2019 for Mong Duong II's gradual rise to spectacular performance ?

.....................................................................................................................................................................

2019 provided the perfect condition for Mong Duong II to operate and sell power at its rated capacity.

2019 became the breakthrough year where the EVN would have been forced to operate the Coal fired power plant at full swing due to water shortage with the rapidly rising demand for electricity in vietnam: This would likely be the scenario in the future from now on.

The declining coal price from US$75/ton to US$45/ton wiould have made coal fired power plant no longer economically inferior to hydropower plant:

https://markets.businessinsider.com/commodities/coal-price

Future prospects:

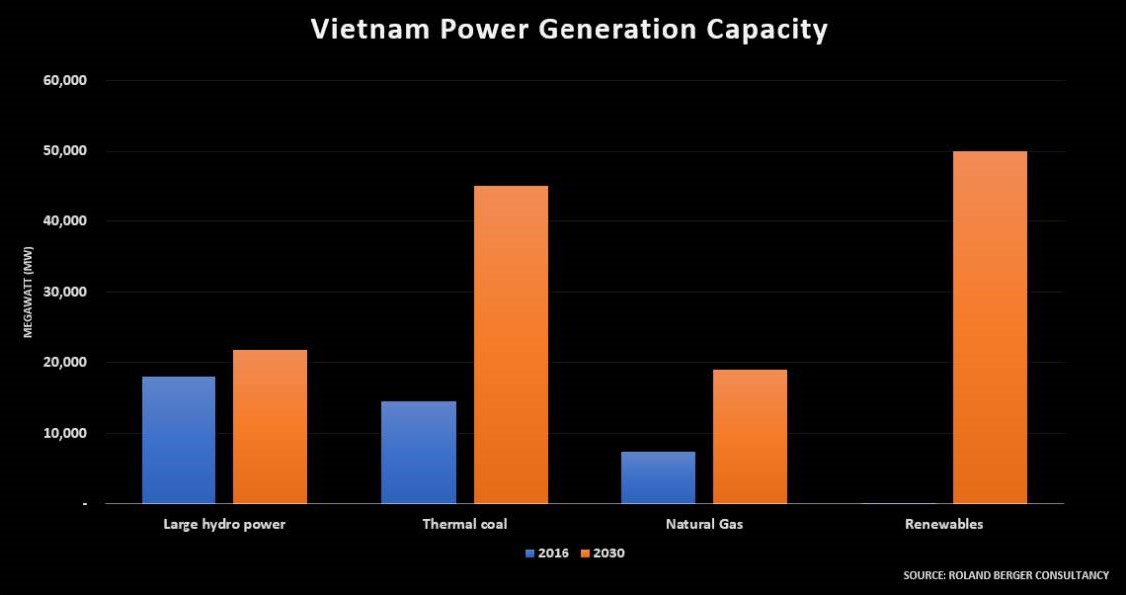

Considering the rapidly rising electricity demand in Vietnam and the investment on Hydroelectric plants which had reached a plateau, the gap in supply and demand has to be either filled by raising the utilization rate of Coal power plant or bringing new Coal fired plants into operations (the latter takes much longer time).

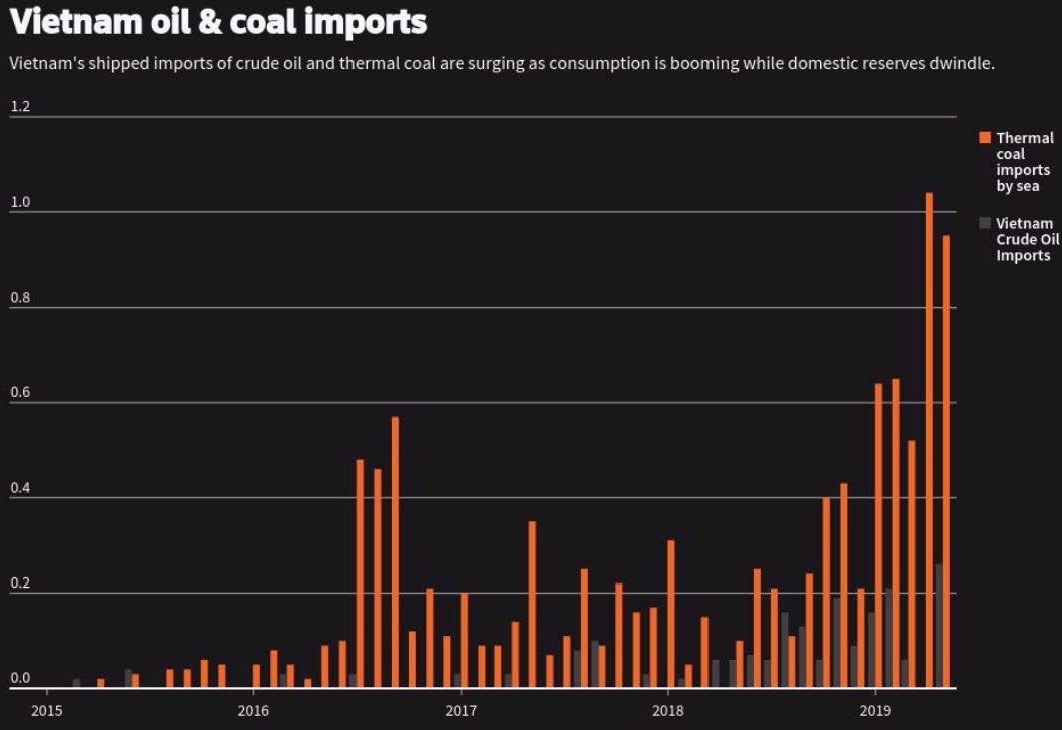

This is evident looking at the below graphs obtained from the above link:

Look at the above rise in Thermal Coal consumption from 2015 to 2019. This is clearly due to increased Coal fired power plant utilization rate.

The prospect for lesser interest rate with warmer lender is there as per below:

Considering all the above I am positive that there is no reason for Hai Duong power plant to deliver any inferior return than Mong Duong II present performance. Hai Duong power plant is with efficient Chinese technology and should be having relatively lower capital cost (lower depreciation) & maintenance cost compared to AES ‘Mong Duong II.

For investors who are still unfamiliar with Jaks, you are kindly requested to go through the below essential articles from DK66 – a true gentlemen whom I am greatly indebted for his sharings.

https://klse.i3investor.com/blogs/Jaks%20resources/226512.jsp

https://klse.i3investor.com/blogs/Jaks%20resources/226058.jsp

Quote From :

https://klse.i3investor.com/blogs/Insight1/2019-12-14-story247782-JAKS_The_Identical_Power_plant_that_generates_RM_1_5_Billion_annualized_Profit_presently.jsp

https://klse.i3investor.com/blogs/jennylohsharing/2020-12-17-story-h1538255239-JAKS_The_Identical_Power_plant_that_generates_RM_1_5_Billion_annualized.jsp