Koon Yew Yin 23rd Dec 2020

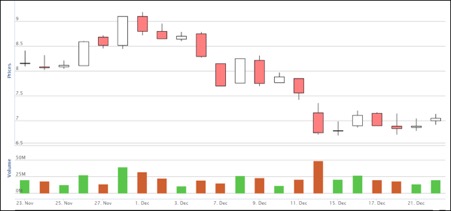

You can see from the Supermax share price chart that it dropped from Rm 9.18 on 1st December to close at Rm 6.79 on 14th December, a drop of 35% in 2 weeks. This is due to JP Morgan’s downgrade all the glove stocks. Unfortunately, many investors believe in JP Morgan and sold their holdings aggressively. It is so ridiculous to mislead investors.

The closing prices in the last 7 trading days were as follows:

14th Dec closed at Rm 6.79

15th Dec closed at Rm 6.79

16th Dec closed at Rm 7.11

!7th Dec closed at Rm 6.90

18th Dec closed at Rm 6.84

21st Dec closed at Rm 6.84

22nd Dec closed at Rm 7.05

The closing prices of the last 7 trading days indicate that there are many institutional investors supporting the share price despite JP Morgan’s downgrade all the glove stocks.

It looks like it has touched rock bottom and the worst is over. It should continue to go up higher and higher to reach the target prices set by all the Investment Banks as shown on the table below.

Although the price chart is still showing down trend, the fact that it did not continue to drop in the last 7 trading days, indicates that the price has touched rock bottom and it should go up higher and higher.

Chartists who follow charts strictly, who have no business sense and completely ignore the surge in demand for gloves due to the Covid 19 pandemic, would advise you to wait for Daily MACD buy signal to start buying. The 3 most important buy signal are:

1. Golden Cross Buy

2. Daily MACD Buy, both blue and red line crossed zero level.

3. Weekly MACD Buy

Chartists who have no business sense and follow the chart blindly cannot make much money.

But as a long-term serious investor, I am willing to take the risk to start buying in the last 2 days because I believe the price trend will soon reverse. I might have paid a few sen more but I know sooner or later it will rebound. You must not forget that it dropped 35% within 2 weeks.

The best time to buy at the cheapest price is at the pivoting point of a trend reversal.

Moreover, I believe all the target prices set by so many investment banks are easily achievable as shown on the table below.

Yesterday RHB Investment Bank predicted a target price of Rm 13.25.

I believe all the Investment Banks’ target price are easily achievable.

Supermax reported that it made EPS 30.59 sen in its 1st quarter ending September. It doubled its profit from its previous quarter. Even if you assumed the company cannot increase its selling price, its annual profit will be 4 X 30.58 = Rm 1.22. Based on PE 10, it should be Rm 12.2.

Supermax’s next quarter ending December should be another record high. It is most likely, the company will make the announcement in Mid-January, about 3 weeks’ time.

http://koonyewyin.com/2020/12/24/supermax-price-trend-reversal/