For better reading experience, please visit the orininal site at the following link:

CARLSBG (2836) – Latest Quarter Result [4QFY20]

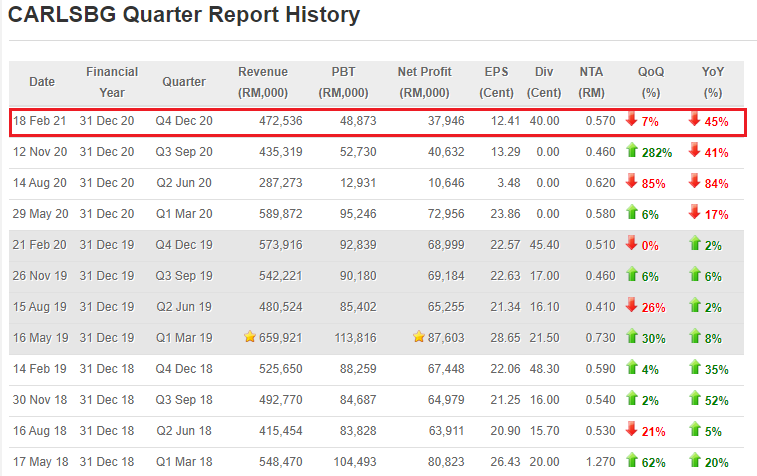

Carlsberg Brewery Malaysia Berhad (Carlsbg) has just released their latest 4th quarter result of financial year 2020. No surprises this time as the result is well within expectation.

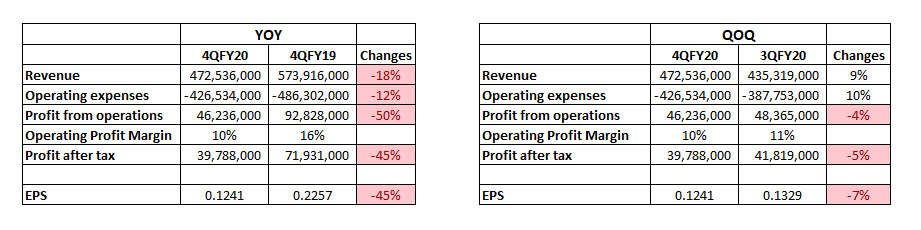

Comparing the same quarter last year (YOY), we could see that Carlsbg revenue has actually dropped by 18%, whereas its profit from operations has dropped by 50%. Due to the Covid19 pandemic, Carlsbg’s operation and sales in Malaysia and Singapore are impacted severely by the implementation of MCO/CMCO/RMCO and Circuit Breaker measures since March 2020. This explains why the result is so bad as compared to the same result last year.

Comparing with the previous quarter (QOQ), we could see that its revenue has actually improved by 9%. Profit from operations has dropped slightly, but this is due to the one-off restructuring cost of RM9.9 million in this quarter. By excluding the one-off restructuring cost of RM9.9 million, profit from operations will then be RM56,136,000 which is greater than previous quarter by 16%. Operating profit margin will then be improved as well, and this improvement is due to the cost control measures implemented by the Management amid the pandemic.

Even though the business has been bad due to the unfavorable environment caused by the pandemic, Carlsbg’s cash flow is still healthy. The Group has managed to generate a positive operating cashflow of RM211,739,000, which is commendable given the tough situation faced by the business now. Carlsbg also has a strong balance sheet and sufficient access to borrowing facilities whenever they deem necessary. In other words, Carlsbg will not face any cashflow or debt issue in the near term.

Conclusion

Overall, there is no issue with Carlsbg’s latest quarter results. No doubt the business is currently undergoing setbacks due to the Covid19 pandemic. But we all know that sooner or later, the world will get passed with the pandemic and everyone will get back into their normal lifestyle.

I strongly believe the upcoming quarter results will definitely be better than this quarter result due to Chinese New Year festive season, the relaxation of Movement Control order which allows dining in the restaurant again, and the improved consumer spending sentiment moving forward. Carlsbg performance will only be better from now onwards, this is well witnessed in the quarterly improvement in its quarter results since the 2nd quarter of financial year 2020.

At the point of writing this article, the share of Carlsbg is trading at around RM23, which is 40% lower than its previous high of RM38. Therefore, the upside gain potential is huge as we are looking at a potential gain of 65% when things are back to normal. This is without the inclusion of dividend yield YET.

During this quarter, the Management has proposed an Interim and Final dividend of 40 cents, which is 75.4% of its net profit. It is well known that the Management is always committed in paying high dividend payout to its shareholders. Moving forwards, when their profitability improves, shareholders will then receivable a greater amount of dividend yield income.

If you still have doubts, please refer to my previous analysis on Carlsbg to understand better. Personally, I think at the current price level the share is still very attractive. The downside risk is minimal, and the potential upside gain is good enough to give us a healthy Risk and Reward ratio. This is a mid to long term stock play, and hence you should not expect for a quick gain in stocks like Carlsbg.

Cheers for a better year!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

DISCLAIMER

This post is completely for education and discussion purpose only. The author of this post does not have the required licenses to provide any investment advice or induce any trade for the readers here. Therefore, it should not to be taken as investment advice or inducement to trade and the Author take no responsibility for any gains or losses as a result of reading the contents herein. Please invest at your own risk.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

https://klse.i3investor.com/blogs/buycall/2021-02-19-story-h1541169049-CARLSBG_2836_Latest_Quarter_Result_4QFY20.jsp