I am updating my previous article, trying to answer one new question raised in AGES i3 forum.

Two questions being asked in AGES i3 forum, i.e. 1) how many AGES-PA (ICPS) preference shares being converted to mother shares and 2) how much value invested due to two methods of conversion?

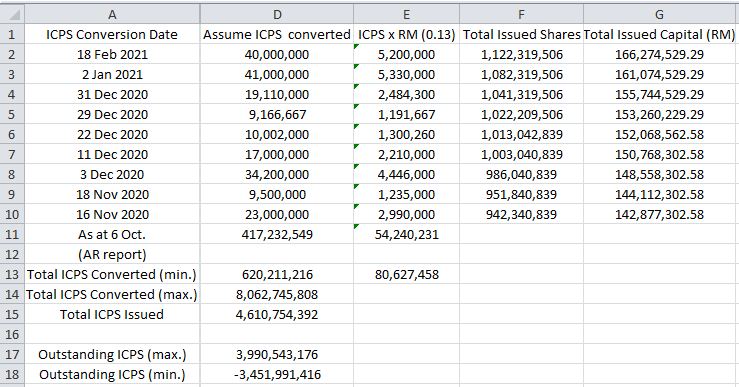

Actual amount is reported in AR2020 issued on 6 Oct., 2020. Thereafter,

will be an estimate until the next Annual Report due to 2 methods of

conversion.

Below is tabulation of converted AGES-PA to AGES mother shares based on

1 ICPS+12sen, the total cash as addition to issued capital and total

AGES mother shares issued. Due to the

question on the second method of conversion, i.e. all using ICPS (which

is unlikely due to AGES-PA present price of 3sen x 13=39sen instead of

just 3sen + 12sen=15sen), I am showing both the minimum and maximum of

ICPS conversion required.

ON 11 Dec., 2020, AGES reached the Billion Shares mark.

Source: Klse Screener.

Table 1: Max. and Min. ICPS Conversion vs Total Issued Shares

As shown in the table, the maximum ICPS

issued will exceed the total ICPS issued by around 3.4 billion which is

not likely. The total minimum of 3.9 billion outstanding ICPS seems more

logical. Will this additional ICPS helping AGES growth and glow? Time

will tell, with more conversion and extra $.

As per table 1 above, RM80.627 million

cash added to total issued capital, improving cash flow in the company.

Hopefully, this will translate to EPS of the company as gearing

improved from 0.34 to 0.1 as reported in AR2020.

Therefore, IMHO, AGES support level will be around 13sen. With more

AGES-PA converted to AGES, AGES free cash flow will improve. With the

reduction of AGES-PA ICPS, AGES-PA price will increase due to supply and

demand effect. It is all theories, market condition will finally

dictate market price.

Further information on AGES can be referred to below link (thanks to another i3 blogger):

https://klse.i3investor.com/blogs/fundingforever/433161.jsp

Technical Update on AGESON BERHAD (7145) https://klse.i3investor.com/blogs/fundingforever/434774.jsp

https://klse.i3investor.com/servlets/forum/600435191.jsp

Disclaimer: The above opinion does not represent a buy or sell

recommendation; just a personal opinion and for sharing purposes only.

Any offences and errors are unintentional; my apology in advance.

https://klse.i3investor.com/blogs/BLee_AGES/2021-02-19-story-h1541166877-ICPS_helping_AGES_growth_and_glow.jsp

https://klse.i3investor.com/blogs/BLee_AGES/2021-02-19-story-h1541166877-ICPS_helping_AGES_growth_and_glow.jsp