kk disclaimer first ah no buy call no sell call i just pointing out few penny stocks just for fun***

we not going to point at the few obvious one such as uwc, qes etc etc.

but will be sticking to few automotive industries quiet quiet stock.

1. NOTION

this one ah...

mostly gorenged up due to mask production... novid mask ma, and then

flew again when they announce their glove dipping lines. congrats to

those that manage to profit off this flying counter and my condolences

to those holding at the top.

So yeah, this one follow most of the gloves trend lo, from to the moon

all the way back to earth liao la, bo bian lo as most public conception

is that it is a PPE counter. It is, but MARGINALLY with less than 10%

profit contributed during the last QR.

https://www.thestar.com.my/business/business-news/2020/11/25/notion-vtec-posts-turnaround-in-4q-upbeat-on-outlook

parts they do:

http://www.notionvtec.com/business_segments#automotive

Main business for Notion Vtec is actually from their automotive sector

where they manufactures parts for different companies which have a solid

turnaround during last QR. aiya bored to write more la but in summary:

EV = new car produce = more parts needed = more money for company = everyone HUAT

2. POLY

poly glass fibre (m) bhd, not ASIAPLY. this stock started to pick up in

volume after the dip last year. Diversified into doing mask materials,

as well as obtaining a durian farm... da heck...

But yeah turned out with good q2 and q3 results for 2021.

their main biz is actually doing glass mineral wool, which is also needed in automotive industry.

the spongy thing ah, always on the roof or by the side of car which is

hidden unless u decide to tear your car apart, but quite cool also la

http://ecowool.com.my/solutions-detail.aspx?id=5&name=automotives

3. WILLOW

this stock only came to my radar today with their superb QR, havent really dig into what they able to do.

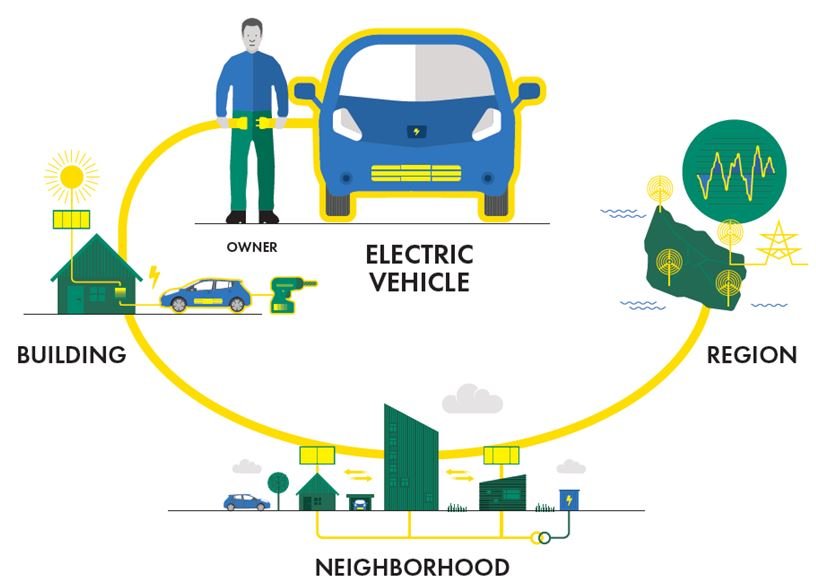

but seems like they will benefit not from EV cars, but from when our

government decides to upgrade the grid to accomodate for the expansion

in electricity need for EV cars this company might actually benefit with

their expertise in energy management

https://www.bcg.com/publications/2019/costs-revving-up-the-grid-for-electric-vehicles

and why i think willowglen will benefit

https://www.willowglen.com.my/industry/electrical-power

but no brainer would be buying tenaga if looking forward to grid upgrade

https://klse.i3investor.com/blogs/hearmeblow/2021-02-26-story-h1541914785-Stocks_that_diam_diam_related_to_EV_automobile_bit_bit.jsp