$DNONCE / 7114 (D'NONCE TECHNOLOGY BHD) - Unfairly sold off from recent negative sentiment and press media in the glove sector.

- Dnonce in my opinion is being unfairly sold off in line to recent Malaysian glove correction trend, especially on TopGlove CBP issue.

- There's actually no change in the fundamentals of the company. Business is as usual, and there’s no impact on sales.

- From what I understand, Topglove CBP issue only affects Malaysia subsidiaries hence Topglove may actually shift more production to Sadao, Thailand - benefiting Dnonce.

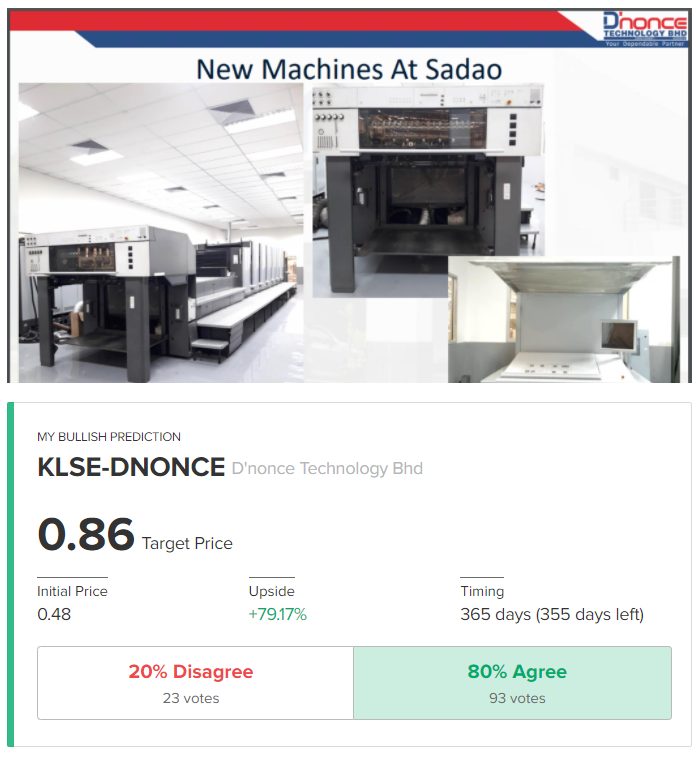

- New glove capacity in Sadao, Thailand on track to start mass production this month. Q4 2021 should be better as it has one month of additional capacity. Full impact to be felt in FY22. (see image of new machineries)

- D'nonce's long-term investor and largest shareholder, Blackstream recently bought close to 400k of shares in open market.

- Management thus far had shown efforts to turn around a bad apple, laying foundation in financial year 2021 across healthcare and E&E segment for growth into 2022. While the progress seems slow at times from financial point of view, transformation and expansion is indeed being done in times of pandemic.

- Unlike glove players, this IS NOT an ASP game but a VOLUME game. And volume will remain robust as long as glove is needed globally. ASP should maintain or slowly goes up as there's no known new entrants in Sadao for packaging to increase supply while glove players in TH are increasing their demand from expansion.

- DNONCE is currently trading at around 10x PE of their FY2021 figure (expecting Q4 numbers to be around RM4-5m) and 7-8x PE of their projected FY2022 figure (expecting a PAT range of RM18-20m)

- The company deserve some time to prove that their business is growing. I expect QoQ performance to keep improving in the next 2-3 quarters.

- Reiterating my previous bullish prediction based on the same assumptions.

- Risks to investments are: 1) machine downtime, 2) inability to ramp up orders from the newly setup facilities 3) Inability to pass on higher costs to end clients

https://klse.i3investor.com/blogs/idea/2021-04-18-story-h1563390042-DNONCE_Unfairly_sold_off_from_recent_negative_sentiment_and_press_media.jsp