Below are details of few 'Cash Rich Penny Stocks' recent acquiring major stakes in 'Beat Down Low Price' Penny Stocks:-

Rich Penny stock No. 1: Fintec

Fintec Cash position:

Asiabio Capital Sdn. Bhd. (“ABC”) disposed in aggregate 73,584,000

shares of Komarkcorp Berhad (“Komarkcorp”) on 21~ 23 June 2021, for an

aggregate sum of RM9,552,830.19.

Asiabio Capital Sdn. Bhd. (“ABC”) disposed 31,543,277 shares of Saudee

Group Berhad (“Saudee”) before and on 23 June 2021, in the open market

for a total cash consideration of RM4,680,181.18.

Asiabio Capital Sdn. Bhd. (“ABC”) disposed in aggregate 232,049,200

shares in VSolar Group Berhad (“VSolar”) on 21~30 June 2021, for an

aggregate sum of RM3,475,044.35.

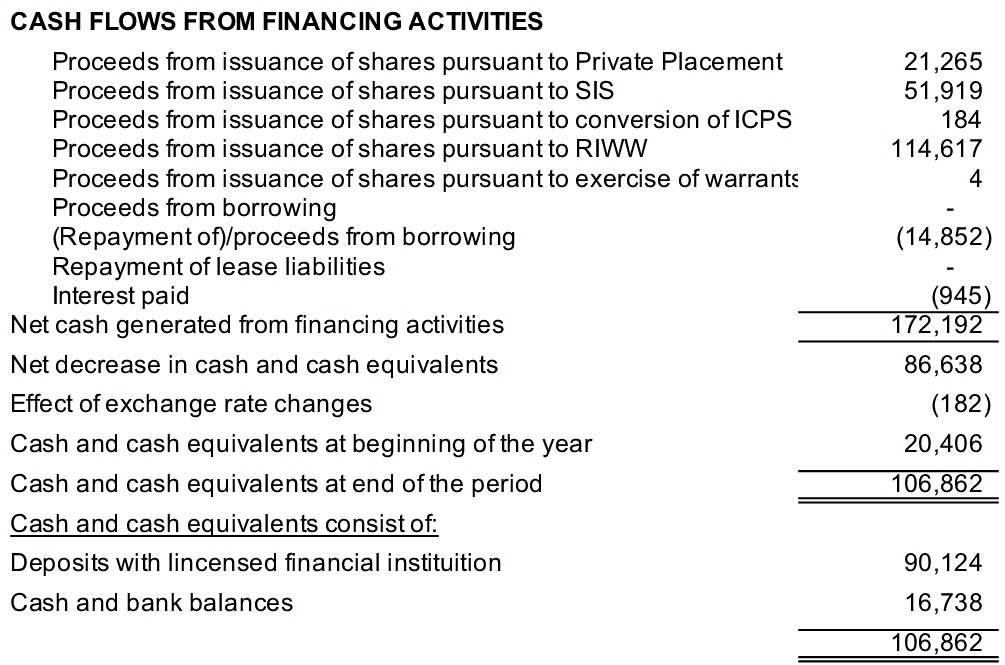

Total cash from disposal: RM17,708,055.72.

Total cash from ESOS, RI and ICPS: RM236,312,640.02

Total cash from PP (assume): RM18,040,604.84

Details from link: https://klse.i3investor.com/blogs/BLee_Fintec/2021-09-25-story-h1571731611-Fintec_Private_Placement.jsp

Detail No. 1: Fintec cash flow shown in Q4 ended Mar. 2021 report.

- Fintec Global Limited (“FGL”) and the Company, have on 9 September

2021 became a substantial shareholder of NetX Holdings Berhad (“NETX”)

upon completion of the acquisition of 53,153,800 ordinary shares or

6.36% equity stake in NETX from the open market. The acquisition of

NEXT’s shares were made within the period from 26 August 2021 to 9

September 2021. Total purchasing cost unknown.

First United Technology Ltd (“FUTL”), a subsidiary of the NETX, had on

15 September 2021 acquired 80,000,000 ordinary shares of MLABS Systems

Berhad (“MLABS”) from the open market, representing 5.52% of the total

issued share capital of MLABS, for a total purchase consideration of

approximately RM3,600,000

- Open market purchasing of Focus D 282,700,000 shares from 23 Aug.

2021 to 6 Sept. 2021 at an unknown cost. (assume from 4sen to 5.5sen)

(Details at link:

https://klse.i3investor.com/m/blog/BLee_AGES/2021-09-05-story-h1570726405-Focus_Dynamic_last_7_days_collection.jsp

)

Rich Penny stock No. 2: Focus D

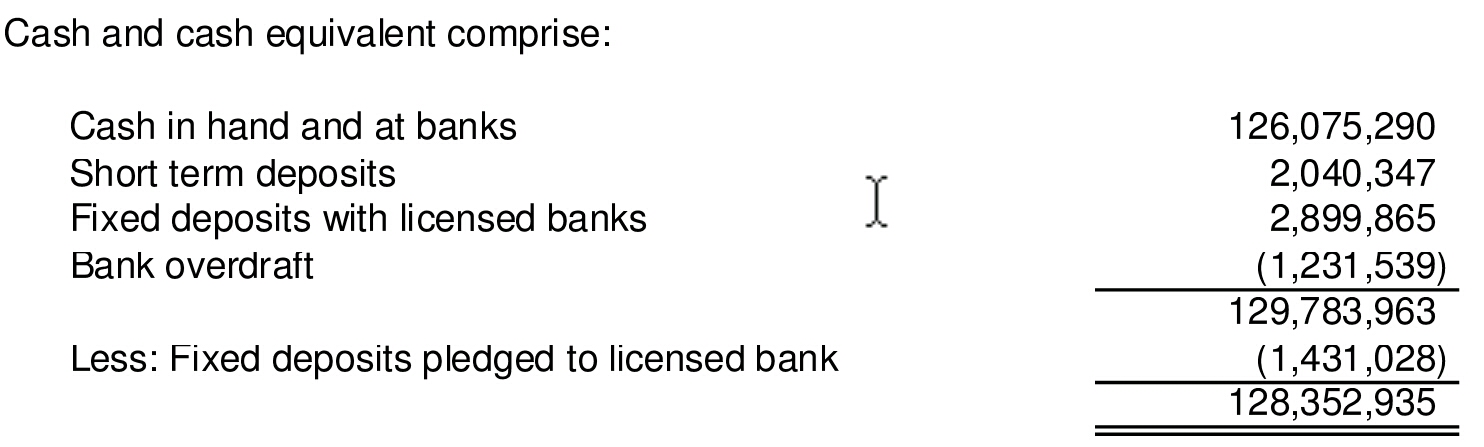

Cash position:

Deposits with licenced banks of RM2,899,865

Cash and bank balances of RM126,075,290

Proceeds from conversion of ICPS: RM59,905,097

Detail No. 2: Focus D cash flow shown in Q2 ended June 2021 report.

- Focus Dynamics Centre Sdn. Bhd., the wholly-owned subsidiary of the

Company, had on 26 August 2021 subscribed 351,932,000 placement shares

in Green Ocean, representing 16.67% of the issued and paid up capital of

Green Ocean, at RM0.0231 per share for a total cash consideration of

RM8,129,629.20.

- Focus Dynamics Centre Sdn. Bhd., the wholly-owned subsidiary of the

Company, had on 17 June 2021 subscribed 138,050,000 rights issue in

Saudee, representing 19.37% of the issued and paid up capital of Saudee,

at RM0.15 per share for a total cash consideration of RM20,707,500.00.

Total cash spent: RM28,837,129.20

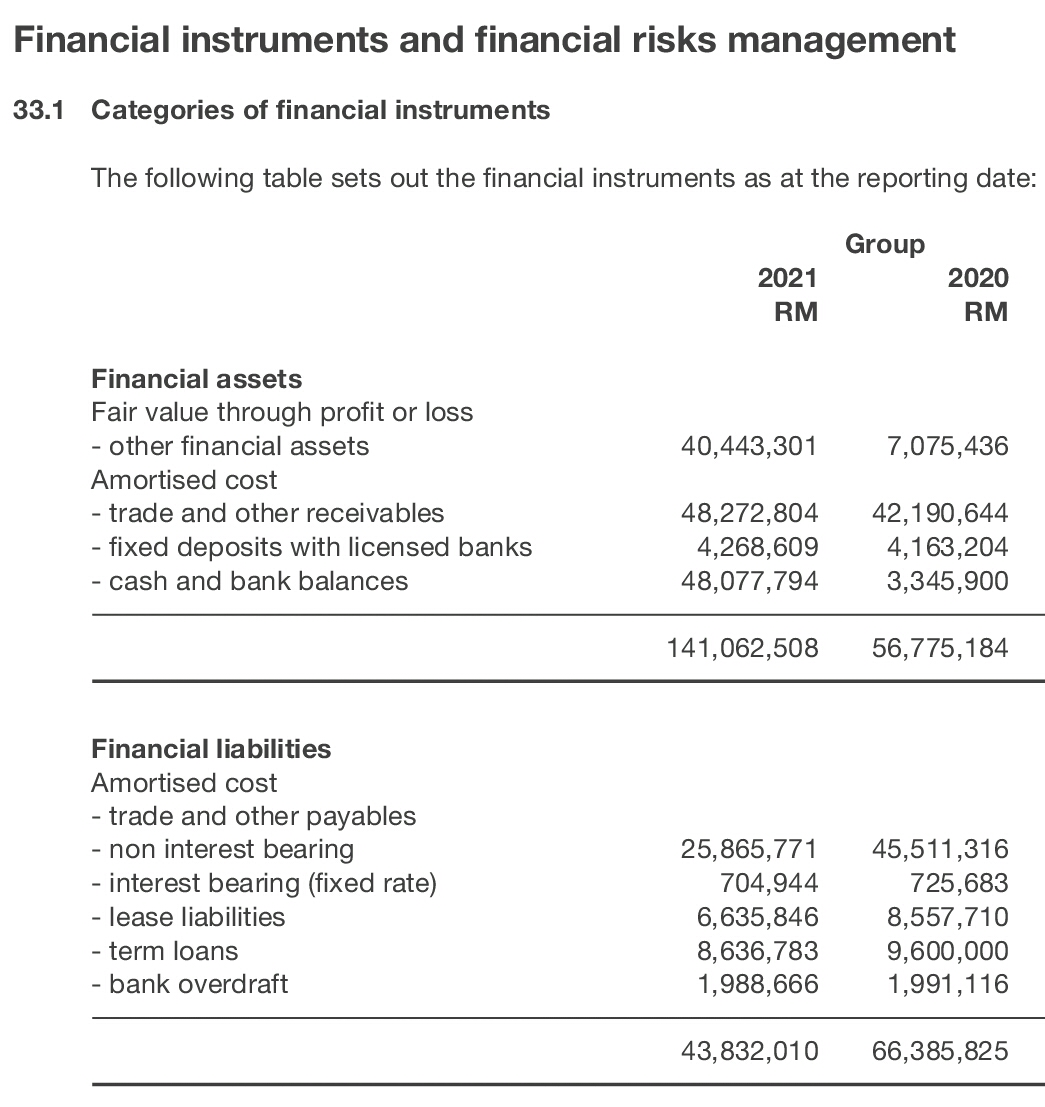

Rich Penny stock No. 3:Key Alliance Group

Cash position:

Detail No.3: Key Alliance Group Berhad AR ended Mar.2021

- Key Alliance Group Berhad had from the period between 6~13 Sept.

2021 acquired from the open market an aggregate of 55,962,600 ordinary

shares of MACPIE Berhad (“MACPIE”), representing 5.91% of the total

issued and paid up share capital of MACPIE, for a total purchase

consideration of approximately RM5,335,366

- Key Alliance Group Berhad had acquired of 450,000 Ordinary Shares in

Tree Med Sdn Bhd, representing 30% equity interest in Tree Med for a

purchase consideration of RM14,000,000 via a combination RM4,000,000 in

cash and RM10,000,000 via the issuance of 200,000,000 new KAG shared at

an issue price of RM0.05 per KAG share.

- On 26 March 2021, KAG acquired from the open market of additional

7,170,800 ordinary shares of Komarkcorp Berhad at average RM0.362 per

share, representing 1.49% of the total issued and paid up share capital

of KOMARK for a total purchase consideration of RM2,595,829.60

Subsequently, on 12 August 2021, Key Alliance Group had acquired from

the open market additional 9,000,000 ordinary shares of Komarkcorp

Berhad at average RM0.16 per share, representing 1.56% (total acquired

36,600,800 shares representing of 6.34%) of the total issued and paid up

share capital of KOMARK for a total purchase consideration of

RM1,440,000.00.

- Reference is made to the announcement dated 27 February 2020; the

total ICPS subscribed is 398,600,000 with 99,650,000 Warrant B at an

issue price of RM0.025 per ICPS.

The number of XOX shares held by KAG after the Conversion is

347,900,000 units and the shareholding percentage of the enlarged issued

shares of XOX as at 29 July 2020 is 16.88%.

Number of ICPS to surrender: 248,600,000

Total Issue price of ICPS surrendered: RM6,215,000

Total additional payment: RM6,215,000

On 14 October 2020, KAG had acquired 30,000,000 ordinary shares of XOX

Berhad (“XOX”) at RM0.12 per share (“XOX Shares”) for a total cash

consideration of RM3,600,000 from open market.

On 15 October 2020, KAG had acquired 3,000,000 ordinary shares of XOX

Berhad (XOX) at RM0.12 per share for a total cash consideration of

RM360,000 from open market.

On 20 October 2020, KAG had acquired 6,000,000 ordinary shares of XOX

Berhad (“XOX”) at RM0.12 per share (“XOX Shares”) for a total cash

consideration of RM720,000.

Reference read: https://www.theedgemarkets.com/article/fintec-global-and-associates-buy-stakes-other-listed-companies

Sources of information: klsescreener, i3investor, theedge and various internet surfing.

All the above details are for general information only. Since all this acquisition and disposal has become a very 'hot topic', I will reserve my opinion and would not like to take any position on this 'hot topic'. TQ

Disclaimer: The above opinion does not represent a buy, hold or sell recommendation; just a personal opinion and for sharing purposes only. Any offences and errors are unintentional; my apology in advance.

https://klse.i3investor.com/blogs/BLee_Fintec/2021-09-25-story-h1571732448-Fintec_Cash_Rich_Penny_stocks_acquiring_Beat_Down_Penny_stocks.jsp