母股大涨可舍母取子 买汉联机构(HARNLEN,7501,主板种植股)WB HARNLEN-WB参与增长

汉联机构 HARNLEN

环球股市在过去数周大跌,导致大马股市也一片苦雨,不过,向来交易不太活跃的种植公司汉联机构(HARNLEN,7501,主板种植股)的股票,却在4月中开始价量齐升,股价从约90仙,上涨至上周最高1.31令吉,并在上周五以1.22令吉结束上周交易。

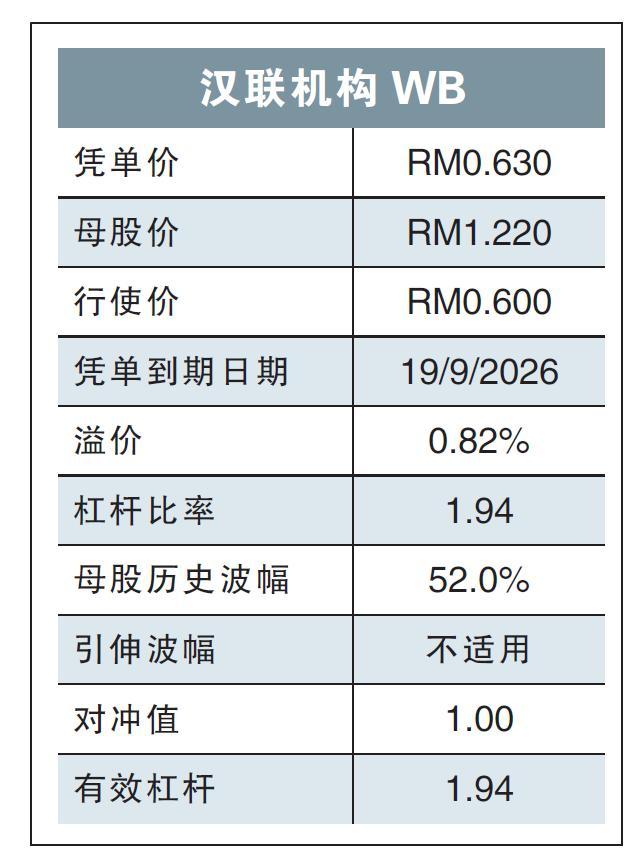

该公司的凭单汉联机构WB(HARNLEN-WB),则以63仙闭市。值得一提的是,该公司上周四向大马交易所披露,公司大股东最近增持公司股票。

汉联的主要业务是种植油棕。该集团的油棕园丘主要分布在彭亨和砂劳越,种植面积达到1万5000公顷。该集团也经营一个每小时可处理60公吨鲜果串的炼油厂。

除了种植业以外,汉联也进行产业投资等业务。虽然棕油价高涨而营业额也大涨80%至2亿1943万令吉,汉联在2021年12月31日结束的财政年,却承受高达2219万令吉的净亏损,远比2020年获得9876万令吉的净盈利逊色。

除了因为2020年汉联脱售资产大赚一笔以外,汉联在年报披露营运成本大涨以及劳工短缺,再加上一些坏账被注销,导致集团陷入亏损。

集团产业部也因租金受疫情影响而亏损接近500万令吉。棕油价在2022年处于高位,应该能够为汉联带来更高的业绩。不过,该集团却还是面对劳工短缺问题。

汉联机构WB经过母股一轮大涨后,已经处于极度价内水平而并没有什么溢价。

由于凭单的杠杆比率接近2倍,持有公司股票的朋友,可以考虑卖掉母股套现部分资金,并转持凭单继续参与公司增长。

想买进汉联母股的投资者,也可以通过HARNLEN-WB减低入场费。

声明:本文作者不持有文中公司股权

汉联机构WB

免责声明

本栏纯属学术上或经验上建议,读者若有兴趣投资,应该自行深入研究或询问股票经纪才决定,盈亏自负。我们鼓励通过正确的投资方式创造财富。

https://www.enanyang.my/%E5%90%8D%E5%AE%B6%E4%B8%93%E6%A0%8F/%E6%AF%8D%E8%82%A1%E5%A4%A7%E6%B6%A8%E5%8F%AF%E8%88%8D%E6%AF%8D%E5%8F%96%E5%AD%90-%E4%B9%B0%E6%B1%89%E8%81%94%E6%9C%BA%E6%9E%84wb%E5%8F%82%E4%B8%8E%E5%A2%9E%E9%95%BF

Singapore Investment

-

-

January 2026 Deals Round-up9 hours ago

-

-

Beautiful 1 oz Pamp Silver Bar showcase9 hours ago

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

SPDR Gold Shares ETF2 days ago

-

-

-

CNY New Notes 20263 days ago

-

Seeing China from Guangzhou3 days ago

-

-

-

-

-

-

How to Invest in Copper in Singapore4 days ago

-

-

Portfolio Returns for Jan 20266 days ago

-

-

-

-

-

-

-

-

Finance Investment Movement 651 week ago

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Portfolio Dec 20252 weeks ago

-

-

-

Best Countries to Invest in 20262 weeks ago

-

-

-

-

-

FG Year in Review 20253 weeks ago

-

-

4Q 2025 Investment Strategy Update3 weeks ago

-

-

Portfolio (Dec 31, 2025)3 weeks ago

-

Portfolio (Dec 31, 2025)3 weeks ago

-

-

-

-

Portfolio Summary for December 20253 weeks ago

-

-

-

Portfolio -- Dec 20253 weeks ago

-

-

Restarting on Substack...4 weeks ago

-

Important notice for all members5 weeks ago

-

-

Dec 20251 month ago

-

letter to myself1 month ago

-

-

-

-

-

-

-

-

-

What Shall We Do About VERS?2 months ago

-

人生意义是什么?2 months ago

-

-

-

iFAST 3Q25: Achieving record AUA2 months ago

-

-

-

-

-

-

-

-

Key Collection4 months ago

-

-

-

-

Been a while!5 months ago

-

-

-

-

-

-

-

-

FAQ on Quantitative Investing Part 29 months ago

-

-

-

-

-

-

-

Top 10 Highlights of 20241 year ago

-

-

-

-

STI ETF1 year ago

-

-

-

Unibet Casino Bonus Codes 20241 year ago

-

-

-

-

Monthly IBKR Update – June 20241 year ago

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Monthly Summary of November 20232 years ago

-

Migration of website2 years ago

-

-

-

-

-

Hello SP Group, I'm Back!2 years ago

-

-

-

A New Light2 years ago

-

-

-

-

-

2022 Thoughts, Hello 2023!3 years ago

-

Series of Defaults for Maple Finance3 years ago

-

Takeaways from “Sea Change”3 years ago

-

Greed is Coming Back3 years ago

-

-

-

-

-

-

-

-

What is Overemployment3 years ago

-

Terra Hill Condo (former Flynn Park)3 years ago

-

Alibaba VS Tencent: The Battle Royale3 years ago

-

-

-

-

-

-

-

-

-

-

-

-

-