Latest quarter result:

30/4/2016 - 17.6sen

31/1/2016 - 16.3sen

31/10/2015 - 18.8sen

31/7/2015 - 24.3sen

Total - 77sen

Current PE ratio : 6.25 (RM4.81)

Company background

The company owned by a listed company in

Singapore, Sunright Limited (48.41%).

On 1 Apr 2015, the company proposed to

acquire the remaining shares (34.62%) of

KESM Test (M) Sdn Bhd.

Since the acquisition completed on 13 May

2015. the company's EPS have been spiked

up.

I am here to ANSWER a simple question.

Why KESM?

1) Low PE ratio company (PE 6.25)

2) Net cash company with net assets which

higher than their market price

3) Market leader in independent burn-in

test' service provider

4) Others

1) Low PE ratio company (PE 6.25)

On 2 Jun 2016, the company have

announced a stunning quarter result of

earning of 17.6sen despite the the currency

against USD dollar have been dropped from

USD1 = RM4.29 (31 Jan 2016) to USD1=

RM3.90 (30 Apr 2016)

With the announcement of the stunning result, it make

KESM one of the lowest PE ratio net cash company in

Bursa Malaysia.

Although the share price have been increased by 74sen

during Friday, in my opinion it is still undervalue (PE

6.25sen)

higher than their market price

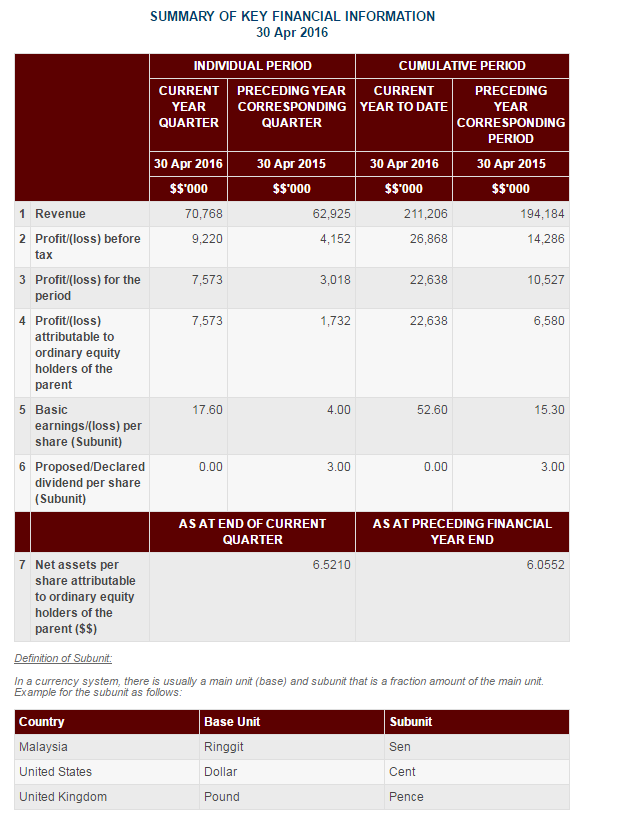

Total cash : RM108mil

Total borrowing: RM45mil

Net cash position = RM63mil or RM1.46 per

share

As per quarter ended 30 April 2016, the

company's net assets position is at RM6.52,

which is 35% lower than current share

price of RM4.81!!

3) Market leader in independent burn-in

test service provider

As per disclosure from annual report, the

group (Sunright Limited) is the market

leader in independent burn-in test service

provider.

Other than that, recently the company has

won Stmicroelectronics Awards

on"Operation Excellent & Lean Awards".

4) Others

With the recent announcement from Federal

Reserve that there might be rate hike in

coming months, the USD dollar have been

appreciated during May 2016.

But with the weak non-farm payroll

announced on last Friday night, the rate

hike might be dealyed. I am not sure

whether USD dollar will be recovered to a

higher level.

If the USD dollar recovered, it might be a

adding point to KESM as some revenue

generated in US dollar.

quarter result, I foresee the company will

be able to maintain or improved the result

in the next couple quarter.

Trade at your own risk!!! Do research before any investment decision!! Happy trading :-)

KESM (9334) - KESM (RM4.81)? Stunning quarter result, net cash company with high NTA (RM6.52)

http://klse.i3investor.com/blogs/undervalue/97852.jsp