WHAT I LEARNT FROM GEORGE SOROS ABOUT MISTAKES

You can do whatever you want.

I believe that anything is possible.

I believe that anything is possible.

But that is not how I started.

When I was younger I used to get beaten up every time I made a mistake.

When I was younger I used to get beaten up every time I made a mistake.

I quickly learnt that making mistakes wasn’t a good thing.

School and college just reinforced those beliefs.

Then I joined Wall Street.

School and college just reinforced those beliefs.

Then I joined Wall Street.

There were a lot of people making mistakes there too.

Some learnt, some just blew up.

I don’t want you to blow up.

Some learnt, some just blew up.

I don’t want you to blow up.

Here’s what I learnt about making mistakes and learning from them.

Remember what George said:

Here’s what a guy who’s worth $25bn, and who made $1bln on just one trade said:

That’s right, get comfortable admitting and understanding your mistakes.

Allow yourself to make mistakes and admit that it’s part of the process of whatever you want to be good at. Tell yourself that you aren’t perfect, yet.

It’s easy to run away from mistakes though.

Pretend they never happened.

It takes courage to say what went wrong, what you could have done better.

It’s hard to take responsibility. But you have to.

Pretend they never happened.

It takes courage to say what went wrong, what you could have done better.

It’s hard to take responsibility. But you have to.

After admitting your mistakes, ask yourself these questions:

When do you make them?

How can you prevent them?

What systems can you put in place?

How can you prevent them?

What systems can you put in place?

Why it’s hard to admit mistakes:

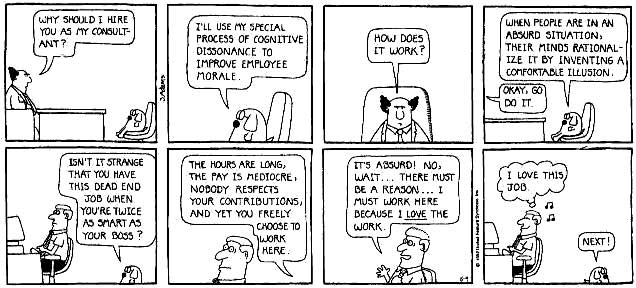

It all comes down to Cognitive Dissonance.

Cognitive Dissonance is just a complicated way to say that we have a hard time admitting to things that make us uncomfortable or don’t tie with our other beliefs.

Rather than re-examine our beliefs or try to re-interpret the world, we instead choose to ignore the facts around us.

Cognitive Dissonance is just a complicated way to say that we have a hard time admitting to things that make us uncomfortable or don’t tie with our other beliefs.

Rather than re-examine our beliefs or try to re-interpret the world, we instead choose to ignore the facts around us.

Credit: Scott Adams and his book How to Fail at Everything.

I’ve been guilty of this.

When I

started investing, a position would sometimes go against me, and I would

get married to the position. My ego would get tied to my

predictions. Soon I would start justifying the changing evidence while

the stock headed down.

Cognitive

dissonance occurs because we would rather think that we are great at

what we do (even when things aren’t perfect), rather than admit that we

might be wrong. It’s easier to say that other people just don’t get it.

Don’t forget what Richard Feynman said about the easiest person to fool.

How to Learn from mistakes:

Prof. Carol Dweck has done decades worth of work on this.

This is what Prof. Dweck found about people who enjoy and learn from mistakes – something she calls; a growth mindset.

- They just want to learn – that is the only goal

- They understand that it’s about hard work and putting in the effort

- They welcome failure and deal with their weakness

According to Prof. Dweck, here are signs that you have a fixed mindset (don’t worry if this is you, we can change it):

- Have you ever thought about cheating on an exam or test?

- Have you ever tried to find people doing worse than you to feel better about your own results or goals?

- Have you ever tried to blame your mistakes & failures on others?

Here’s how to get a growth mindset:

- Whenever you fail or make a mistake, say to yourself “Wow, this is a chance to grow. What can I learn from this?”

- Focus on the experience gained and the process, rather than the outcome

- Whenever you say that you didn’t do something, add a “yet” after it. “I’m not a Partner….yet”

- Seek criticism and feedback

How does this apply to Wall Street?

Charlie Munger said:

Unfortunately on Wall Street there can be a lot of opinion without a lot of thought.

Maybe

because we deal with numbers or because of how much people get paid,

it’s easy to have this false sense of accuracy and security. People

sometimes say to themselves, “I can’t be wrong, because I’m smart enough

to be getting paid a million bucks for my views”.

This is how we blow ourselves up.

On

every trade, every project, every advice – know that you are likely to

be wrong. Try to find people with the opposite view and try to think

about how you could be wrong.

Beware the narrative fallacy:

The brain tries to explain the world using simple stories.

Finance, Wall Street, Investing are all very complex, yet we are wired to see and believe simple stories.

We think these stories can explain the world.

The risks come from putting these stories or thesis together on why to do something and then believing the story more than the data.

Finance, Wall Street, Investing are all very complex, yet we are wired to see and believe simple stories.

We think these stories can explain the world.

The risks come from putting these stories or thesis together on why to do something and then believing the story more than the data.

Do any of these stories sound familiar to you?

- US Home prices never go down

- The World is running out of Oil

- Emerging Markets grow faster than Developed Markets

- China is going to take over the World

These were all simple narratives that came to define markets for long periods of time.

We know how these stories ended….

Beware of simple narratives.

What story are you telling yourself now?

Use Marginal Gains:

Warren

Buffett figured this trick out decades ago. It’s called compounding when

it comes to investing, and marginal gains when it comes to systems and

processes.

The idea is simple: Get progressively better every day.

Figure out

how you can be 1% better in the most important areas of your life every

day. If you can do that, this is what your life can look like:

The problem

is that most people talk about success like its an event. We talk about

being promoted, getting hired, getting paid a huge bonus as if they are

events.

But

the truth is that most of the significant things in your life or career

are not stand alone events, but rather the sum of all the decisions when

we chose to do things 1% better or 1% worse.

Aggregating these marginal gains makes a big difference.

Do this:

Here are some ideas for you to try in your life that I guarantee will make you more successful.

- Review your recent failures – what can you learn from them?

- Re-think long-held assumptions – why are you doing things this way? Is there a better way?

- Plan for failure – realize you are probably going to be wrong, that it’s ok to be wrong, so plan, adjust, think accordingly.

- Plan backwards – decide what you want, figure out what it will take. Work backwards from what you want to do & where you are today. Create a plan to close that gap. Execute it.

- Experiment – What experiments or tests can you run in your life today?

- Improve by 1% – Every day find one thing that you can get 1% better at.

I hope these quick tips were helpful to you.

Go ahead, see what you’ve been missing.

http://klse.i3investor.com/blogs/undervaluedstocks/98356.jsp