1. Introduction

Canone used to trade as high as RM5.06 few months ago. Now it is trading at RM3.35, down by 34%.

Its weak March 2016 quarterly profit is one of the major reason for the sell down. But is that quarter's proifit really that bad ?

My objective for this article is very clear and simple - I want to put its recent historical P&Ls in a table, and make adjustments to the figures by excluding all exceptional items. By doing so, I want to find out how much the group has actually been making over the past few years, and make a decision on whether it is a good buy at current price.

I will not be going into details its business, cash flow, etc in this article. Certain forum members have written about Canone extensively. Please refer to those articles if you are interested in finding out more.

http://klse.i3investor.com/blogs/rarecharms/91402.jsp

http://klse.i3investor.com/blogs/canone/92357.jsp

http://klse.i3investor.com/blogs/rarecharms/93026.jsp

http://klse.i3investor.com/blogs/canone/95148.jsp

http://klse.i3investor.com/blogs/ivsastockreview/98589.jsp

2. Historical Profitability

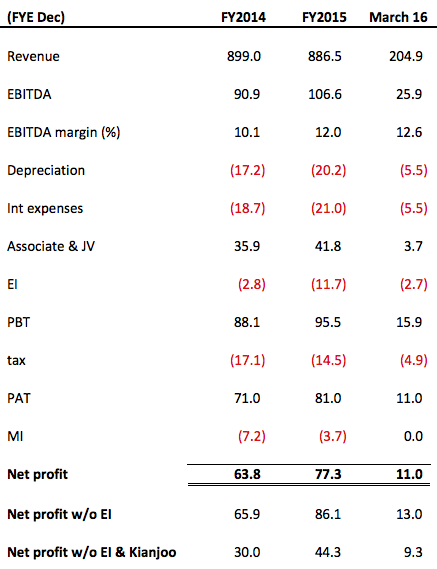

2.1 Kian Joo

If you strip out the exceptional items, Kian Joo's profitability is quite stable at about RM110 mil per annum.

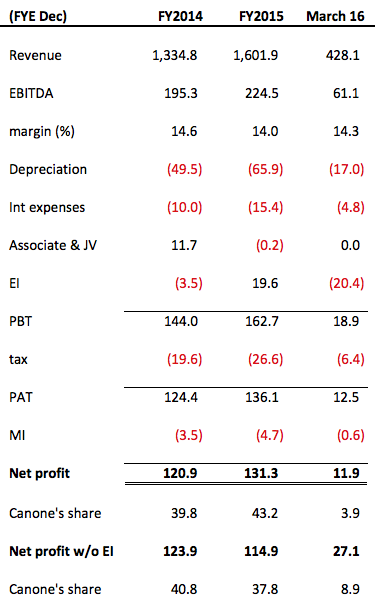

2.2 Canone

Canone reported net profit of RM11 mil in March 2016 quarter. I believe that is not reflective of its actual earning potential.

So how much can Canone make in a normal year ?

2.3 Financial Model

First of all, we need to determine how much Kian Joo can make in a normal year. We have already done that in Section 2.1 above - Kian Joo should make about RM110 mil per annum. Canone's 32.9% share is approximately RM36 mil per annum.

Secondly, we need to determine how much profit Canone's own operation (tin manufacturing as well as dairy) can generate. If you look at the table in Section 2.2 above, those divisions generated net profit of RM30 mil and RM44 mil for FY2014 and FY2015 respectively. Lets take the average. That will give you RM37 mil per annum.

Based on the foregoing, it seemed that Canone's core earning is approximately RM36 mil + RM37 mil = RM73 mil.

Based on 192 mil shares, EPS should be approximately 38 sen.

3. Concluding Remarks

(a) In this article, I built a crude financial model by playing with historical figures. I arrived at core earnings of RM73 mil.

(b) Is this "earning prediction" ? Not really. I think it is more a "pro forma" figure. I derived the core earning without making any assumption of growth rate, profit margin, etc. All I have done is to exclude the exceptional items.

(c) Is the RM73 mil figure reliable ? That depends on how you look at Canone group's business fundamentals.

If you believe that Canone's business is matured, the RM73 mil will be reflective of its future earnings.

However, if you believe that Canone has huge potential to grow, or that Canone's cost structure is sensitive to fluctuation of raw material price, you should throw the financial model out of the window.

(d) I believe that Canone group's business is quite matured. As a contract manufacturer, it's profit margin should be quite stable. As a result, the pro forma figure of RM73 mil is good enough for me.

Based on EPS of 38 sen and PER of 12 times (for F&B companies), I ascribe a fair value of RM4.56 to the stock.

The PER of 12 times is plucked from the air. You can disagree with me and derive a more "authoritative" figure by using financial tools such as EV/EBITDA, Discounted Cashflow, Dividend Discount Model, Sum of Parts Valuation, etc.

CANONE (5105) - (Icon) Can-One Bhd - Can Buy Or Cannot Buy ?

http://klse.i3investor.com/blogs/icon8888/99286.jsp