5 Jul 2016: In the name of holly spirits of Hari Raya Puasa, the small investors should stand up and start questioning the very purpose and existence of certain authorities and the dignity of mass media, which today seems to be machineries for hired and weapon of mass destructions.

The small money little investors invested in a small company called Nexgram, had been crushed by corporate fights which has nothing to do with Nexgram itself. Worst of all, as much as Internet age that reveal the truth of most, if not all, the conspiracy and syndication of such mass scale of organized crime (to undermine Nexgram), the criminals were left in the wild to abuse the law and glitched on the crooked system for such a long period to manufacture false statements to crown names on their victims. If one knows the truth and origin of sin, it would be such disgusting to learn that “the traitor who bites the hand who feeds” is the master mind behind all these conspiracies.

Here are the questions which a responsible media should have verified and clarified at least before publish, even if they were paid to write. Knowing the bigger picture and motives behind would categorize the media as working for the devil if they lend their pens in exchange for blood money. The sin which the imposer carries is as good as handing over mass murderer and robbery money to those who writes for these sinful money. Want to know how sinful are those corrupted money being made? Ask the "corporate lawyer" whom the following media write up kept mentioning, refers to his "pay master".

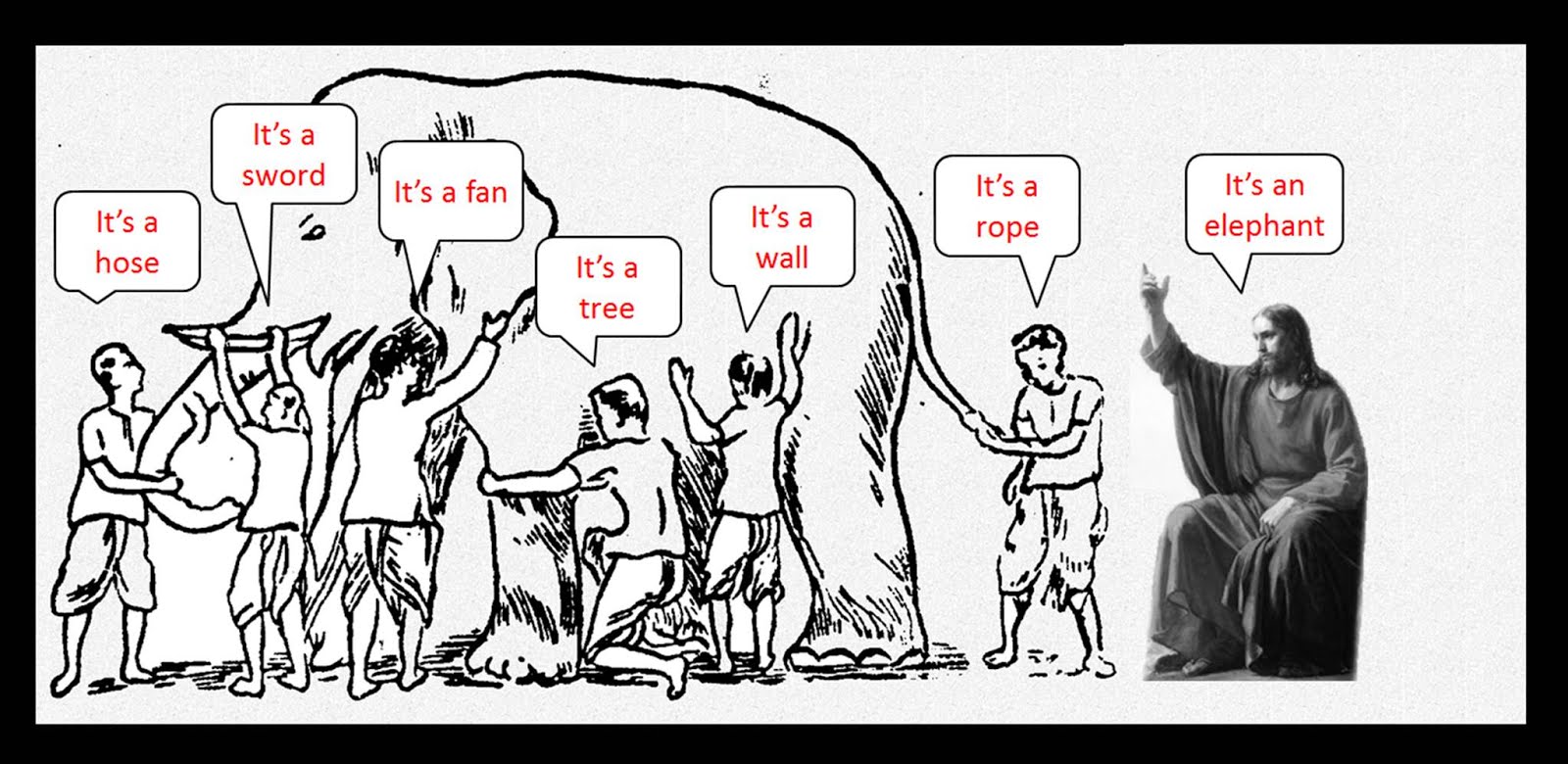

You wonder why would the syndicated personnel (besides the media) involved in such crime? Perhaps they don’t even know they were being used. The analysis below scientifically pointed out the flaws and potential answers to the very "co-incidental" news article being used as part of the syndication scam, as well as the planned attacks involves various parties (and authorities). When these syndicated sinners found their dignity or inner self guilt one day when truth is exposed, perhaps they would have looked back or looked up to find the elephant in the room. That would be another mind blowing mega cover up story in the top rank of the "world corruption hall of shame".

Refers to:

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5143257

Subject: Concerted organized business blackmail, an Act of modern Corporate Terrorism.

Courtesy: University of Michigan (Ann Arbor Ann Arbor, MI). Mental & Psychology.

Case Reference:

http://www.thestar.com.my/business/business-news/2016/01/19/probe-deepens-on-nexgram/

Editor: RISEN JAYASEELAN

Tuesday, 19 January 2016

Probe deepens on Nexgram - Action taken will depend on findings of the investigation

PETALING JAYA: Following the unprecedented action by the Securities Commission (SC) to disclose questionable actions by Nexgram Holdings Bhd, the regulator’s next course of action is a thorough investigation into the money trail relating to the RM84.5mil cash balance that had previously existed in the company, sources said.

Question: Who is the “sources” who commented on business transactions which are deem private information and protected by law?

This investigation will entail, among others, answers from directors, advisors and auditors of Nexgram, which is involved in software and property.

It is learnt that the authorities are looking at the dealings involving three subsidiaries of Nexgram and if the decision to divest them went to the board.

Question: According to the company, the diversification of business to property was initiated since year 2013, and divestment of assets is part of normal business decision being tabled and approved by the board. Who instigated these questions which are deem business private information?

“The three subsidiaries were already the subject of investigations by the authorities in the capital markets. Knowing that, how did the planned divestments get done?” asked a corporate lawyer. The type of action taken will depend on the findings of the investigation by the regulators.

Question: Based on company report, the three subsidiaries are part of the non performing assets long identified for divestment and was tabled and approved by the board long before announcement. Perhaps the company has no knowledge of any investigation nor any unproven rumor shall interfere the management or the board to jeopardies stakeholders mandate to carry on with business decision. This is the basic core duty and responsibility of a company. The real question is “why the 3 companies which deem internal business information were told by who to who, and who is the corporate lawyer” as per commented in The Star newspaper?

To recap, last Friday, the SC invoked its powers under Section 217(4)(b) of the Capital Markets and Services Act 2007 (CMSA) by issuing a public statement in relation to a proposed takeover of Ire-Tex Corp Bhd by Nexgram, to be funded by the latter’s shares.

The SC’s concerns had related to the value of the assets of Nexgram, noting that the actions of Nexgram to dispose of some of its subsidiary companies “delays and obstructs the ongoing enquiries by the SC and Bursa Malaysia.”

According to sources, both the SC and Bursa had concerns about Nexgram, following the latter’s service of its notice to takeover Ire-Tex last November.

At some point in their investigations, both regulators agreed that there were sufficient grounds for Bursa to require Nexgram to provide verification on the existence of certain assets belonging to these subsidiaries.

It is also understood that as part of the initial investigation into Nexgram, the SC and Bursa had met with the advisors and a representative of the board of Nexgram to request the verification of certain alleged bank balances by an independent accountant.

The trigger point for the SC to take action under Section 217 of the CMSA was the company’s decision to dispose the relevant subsidiaries.

Question: It is dubious why an “external party, some anonymous corporate lawyer” could comment almost immediately as if “knowing the matters as a point of attack” in an internal private business dealing, co-incidentally inline with certain authority alleged point of verification as if “the lawyer” orchestrated and syndicated certain authority officers and media for the ambush and blackmail? It is even more dubious how could financial information without company consent could be “known and used” to raise question and crowned allegations, which could potentially breached FSA. Parties obtained or used illegal information are deem wrong doing and crime. Aren't these “concerted” conspiracy obvious?

The type of actions of the regulators in this case will depend on when the outcome of their investigations are, which is also a complicated matter as it involves bank accounts and other transactions in Indonesia.

Question: Small investors shall urge the company to engaged corporate lawyer to look into potential breach of FSA, especially in Indonesia, which the board would have been brief having similar financial secretive act to protect public interest. Officers in the bank or external parties which breaches the code are subject to hefty fines and jail term, means either request, possess or use of such material, are all illegal and deem committed crime. The company should leave it to the corporate lawyer to take further action if necessary to protect investors interest.

Depending on the timing of the findings, the SC could file for an injunction to stop the offer from proceeding or leave the offer to lapse. This is because Bursa has already notified Nexgram through its advisors that it will not clear the circular to shareholders and thus an EGM cannot be held for Nexgram shareholders to vote on matter, and this in turn would lead to the offer lapsing.

Question: Small investors shall ask why the bizarre decision by certain authority by “approving” the potential acquisition (IRE-TEX BHD), and subsequently “caused to delay” which was announced on Bursa Malaysia as follows, raised investors eyebrows as if there is indeed “concerted” conspiracy with sole purpose is to cause “delay and damages” to the company. An internal conflict of decision is apparent as per evidence and trail read by public investors, the company shall engage corporate lawyer to handle such conspiracy study to pin the names involved in causing damages to investors and nothing good comes out of such reckless syndicates.

For those interested to read the findings, refers to: http://www.bursamalaysia.com/market/listed-companies/company-announcements/4963745

|

TAKE-OVERS & MERGERS (CHAPTER 11 OF LISTING REQUIREMENTS)

IRE-TEX CORPORATION BERHAD ("Ire-Tex" or "the Company") - EXTENSION OF

TIME TO DESPATCH INDEPENDENT ADVICE CIRCULAR ("IAC") IRE-TEX CORPORATION BERHAD Type Announcement Subject TAKE-OVERS & MERGERS (CHAPTER 11 OF LISTING REQUIREMENTS) Description IRE-TEX CORPORATION BERHAD ("Ire-Tex" or "the Company") - EXTENSION OF TIME TO DESPATCH INDEPENDENT ADVICE CIRCULAR ("IAC") Reference is made to the Company’s announcements dated 20 November 2015, 26 November 2015 and 30 November 2015 in relation to the Offer. All capitalised terms used herein shall have the same meanings as those set out in the announcement dated 20 November 2015 in relation to the Offer unless otherwise stated. The Company wishes to inform that DWA Advisory Sdn Bhd, the Independent Adviser to the Offer had on 30 December 2015 received an approval letter from Securities Commission Malaysia in respect of the application for an extension of time to despatch the IAC to the shareholders of Ire-Tex. This announcement is dated 30 December 2015. |

“The combined efforts of the SC and Bursa are ensuring that the shareholders of the target company, namely Ire-Tex, are not in danger of receiving payment in shares that may have a questionable value,” explained the corporate lawyer.

Question: the lost of shareholder’s interest which is supposed to “combined stronger entity and creates business synergies” was caused by some potential “manufactured conspiracy”, concerted with potential inducement and instigation of certain authority officers, with further potential abuse of certain media personnel with purpose of character assassination was the “actual danger” as far as small investors are concerned, pertaining to FH report findings where no irregularity nor changes in asset value or lost within the company after a long time wasting corporate attack. This is the real danger of shareholder’s interest being affected by dubious allegations. Again, who is “the corporate lawyer” whom explained to “the media”? This is well “organized business blackmailing”, in other words, a syndicated “organized crime" in business assassination and defamation with clear objective – to made delay business progress at the cost of innocent public investors, especially minority shareholders. Who shall govern these officers who being used and refuse to admit, or worst, being paid to carry on assassination? If they were being used, how would small investors seek justice and compensation for their losses? Perhaps police or MACC has a role to seek the truth on public behalf in corporate blackmail.

The SC raised eyebrows at the value of Nexgram that was sitting on a cash balance of RM84.5mil as at April 30, 2014. Its accounts showed that in the following financial year, most of that cash looked like it had been converted into inventories.

Question: Small investors really puzzled why company did not hire lawyer to point out, at the “independence of certain media in quoting anonymous comments” which selectively twisted the use of normal business transactions, which are carried within shareholders mandated on-going business activities and time frame, as if there is conspiracy. According to company report, “The company spent 3 years since 2013 to diversify, identify and secured Angkasa contract among others. The Development Order was obtained on July 2015, with a GDV of over RM1.15 billion, and company had engaged consultants to secure the contract which is completed by then. This is part of the on-going commercial decision”. Question is such a good effort, why the twist with clear purpose to undermine it were not captured and questioned by authority?

The company could have used the cash to purchase inventories, indicative by the accounts which showed inventories move from zero to RM89.8mil as at 2015. At the same time, cash balances fell to RM31.1mil. Sources said the SC’s enquiries could have centred around the paper and cashtrail of how those inventories were built up.

Question: According to the announcement, the company gets shareholders and board approval, and took 3 years to get awarded the Angkasa contract. Fund raised from shareholders, spent and got the project secured, it’s all within the approved normal business activities, and that is most important to shareholders. The ratio and business arrangement are all commercial decisions within scope of approved business activities, and how the company delivers the result for stakeholders are within the business internal information. Such simple yet confidential information was accessible by “media” and “anonymous corporate lawyer” pre-matured, as if the “concerted blackmailing” indeed existed. Minority shareholders shall urge the board to leaves the legal implication and action to the corporate lawyer in dealing with wrongfully obtained and used of confidential information.

The case involving Nexgram has drawn attention to one businessman in particular, Datuk Tey Por Yee, who on Jan 14, resigned as executive director to “pursue his personal interest and goals”. Since his resignation, Nexgram has six directors left sitting on its board.

Question: Refers to the report, there is not even a “case” as far as the board is concerned pertaining to FH report findings, yet, “the media” which “premature and wrongfully” quotes as “The Case” linking Nexgram to its former officer, as if the main purpose and intention is to undermine selective personal character assassination, by scarifying public investors interest which was taken for a “ride” by certain culprits. The board should leave such findings and trails to company lawyer to further verify.

The rare statement by the SC sent Nexgram’s shares reeling to as low as 7.5 sen yesterday, representing an 11.76% drop.

The stock saw 34.5 million shares exchange hands. The shares closed at 8.5 sen last Friday.

|

ATTENTION. BELOW IS THE EVIDENCE OF “REAL INTENTION” |

Tey was also involved in the Protasco Bhd boardroom tussle, which saw him together with director Ooi Kock Aun voted out of the board at an EGM.

This came after allegations of a questionable investment in an Indonesian oil and gas company.

Question: The “repeated” manufacturing of allegation news by certain media is dubious. With disregard of the facts and final outcome, potentially being “induced” to co-relate the company with other non-related public listed company’s “another allegation”, with sole purpose to undermine certain targeted persons. It is the company duty to engage the corporate lawyer to look into such potential public defamation by using authority and media to undermine company business. If there are further abuse and manufactured media report which use as the tool to assassinate certain person's image, if it involves defamation of company name, investors shall urge company to take legal action, including report police the names and source of such syndicated attacks, be it involves media.

Meanwhile, in a related development, Nexgram shed some additional details about its plans to sell its entire 69.6% stake in Godynamic Investmentd Ltd for RM34.8mil on Jan 12.

This was in response to a query by the stock exchange.

Nexgram said while proceeds from the disposal would be used to pay for the 51% stake in Transeaways Shipping Sdn Bhd, which was announced on Jan 14, the company was “unable to quantify the exact amount” to be utilised for the planned acquisition.

Question: Impression building and suggestive comments seems to be the new normal and modus operandi of certain media personnel, which is a shame of abusing media independence and the influence it possesses. On the knees when comes to commercial driven patterns of writing, without even verify and ask for the truth, would such a comment of <<“unable to quantify the exact amount” to be utilized for the planned acquisition.>> could be published on a leading media. Even if shame to ask the company, Bursa Malaysia would have published the announcements, at least read and verify. (refers to: http://www.bursamalaysia.com/market/listed-companies/company-announcements/5006965 ) What does such people wanted to indicated? The amount and conditions were publicly announced. Wasn't such a form of blackmail to undermine the targeted victim?

Summary:

Media personnel needs to keep the minimum balanced view, and seek verification to the truth before even ink the draft, not to mention publish. In the name of devil, some dubious “lawyer or so” are hired assassin to manufacture turbulence and false alarm in exchange for money to be milked from the pay master when fire works are played. The real motive and purpose of such “syndicated organized crime” to undermine the target victims, would be devastating if one knew the truth, the scale of cover up and the sin which they carry. The devil may paint others as sinful, as Jesus said, “you were born sinners”. Only if you turned back and saw the elephant in the room, you will seek truth, nothing but the truth. Can you see the elephant in the room?

The original sinner trails could be found everywhere, beyond the paid media which of cause (paid media are paid by the sinner who cheated his bosses and splash money using public listed company which doesn't belongs to him in the first place), such as other public listed companies invested by his target victims. Count authorities he claims "control", it would be the most crazy organised crime glued with blood money. (Search: https://www.google.com/search?q=chong+ket+pen+thief)

It's public money, sinful money to be more precise, and that is another sorrow story of the other public listed company’s minorities which was taken for a ride by one greedy man. A faith which could have been avoided in this modern world of corporate terrorism, if there is indeed true corporate governance. Perhaps the so called governance watch dog shall be watched instead.

NEXGRAM (0096) - Probe deepens on Nexgram? Perhaps conspiracy deepens? Who governs the governance?

http://klse.i3investor.com/blogs/governancewho/99752.jsp