By Asia Analytica / The Edge Financial Daily | July 25, 2016 : 10:55 AM MYT

This article first appeared in The Edge Financial Daily, on July 25, 2016.

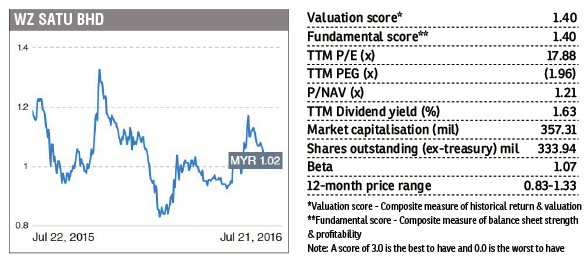

WZ Satu Bhd (-ve)

WZ Satu Bhd (fundamental: 1.4/3, valuation: 1.4/3) triggered our proprietary algorithm last Friday, after its shares rose five sen or 4.9% to close at RM1.07, valuing it at RM357.31 million.

The steel products maker turned civil engineering outfit announced last Wednesday it had bagged a subcontract valued at RM32.7 million from Petrofac E&C Sdn Bhd.

The contract was to carry out field erection of mechanical equipment in relation to the refinery and petrochemical integrated development project in Johor.

Last Thursday, WZ Satu reported a 29% rise in net profit for the third quarter ended June 30, 2016 (3QFY16) to RM5.62 million from RM4.35 million in 3QFY15. It registered lower earnings in 3QFY15 due to a loss of RM2.33 million from discontinued operations.

Revenue for the quarter under review was up 36% at RM125.47 million, from RM92.16 million in 3QFY15, driven by improvements in its civil engineering and construction segment.

http://www.theedgemarkets.com/my/article/stock-momentum-wz-satu-0

WZSATU 7245 - Stock With Momentum: WZ Satu