VIVOCOM (0069), 0069 0 Why VIVOCOM revenue boost up but Share price keep declining?

The purpose of writing this article is to share my opinion about VIVOCOM to the investors. I would like to allow people to realize why ViVOCOM’s share price is down although investors thinking that VIVOCOM’s fundamental analysis is “good”. I personally think that VIVOCOM is bad, let’s discuss this stock below.

What the investors would like to see?

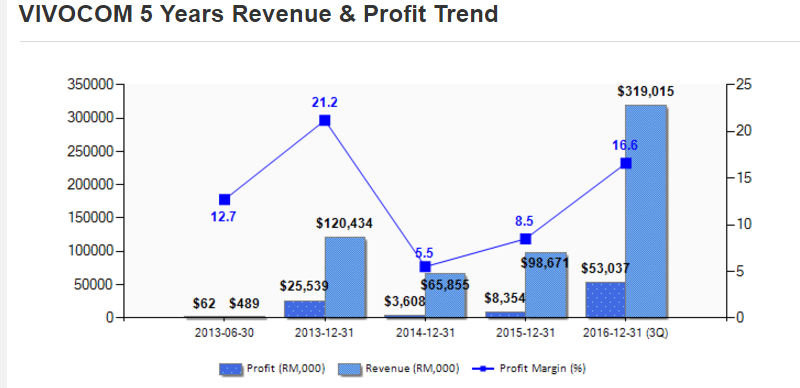

The above picture is a snap shot of the company from Malaysia Stock Biz.

Based on above data, the revenue and net profit margin continuously increased. Is it looks like healthy and is a very good company? Investor like the company which revenue rapidly increase but didn`t figure out what the reason revenue boost up? Is it temporary or one-time gain? I think that many investor should be know the revenue boost up contributed by the construction segment. By the way, Will the company continuously increase the revenue and NPM in the future?

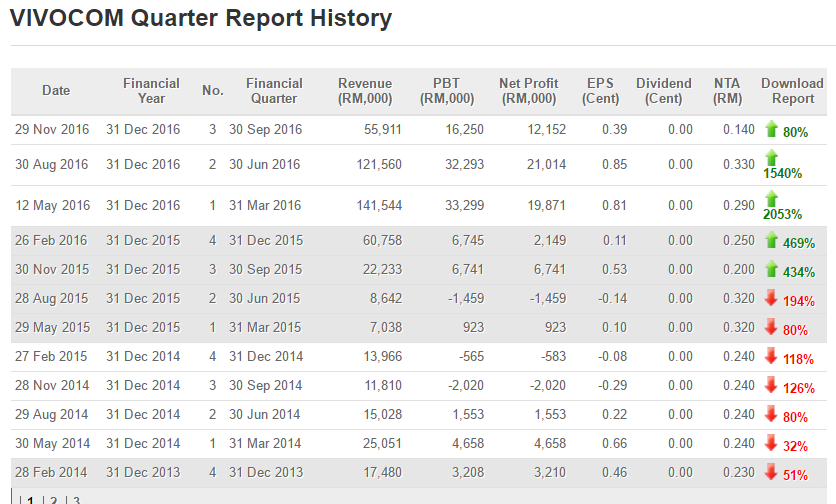

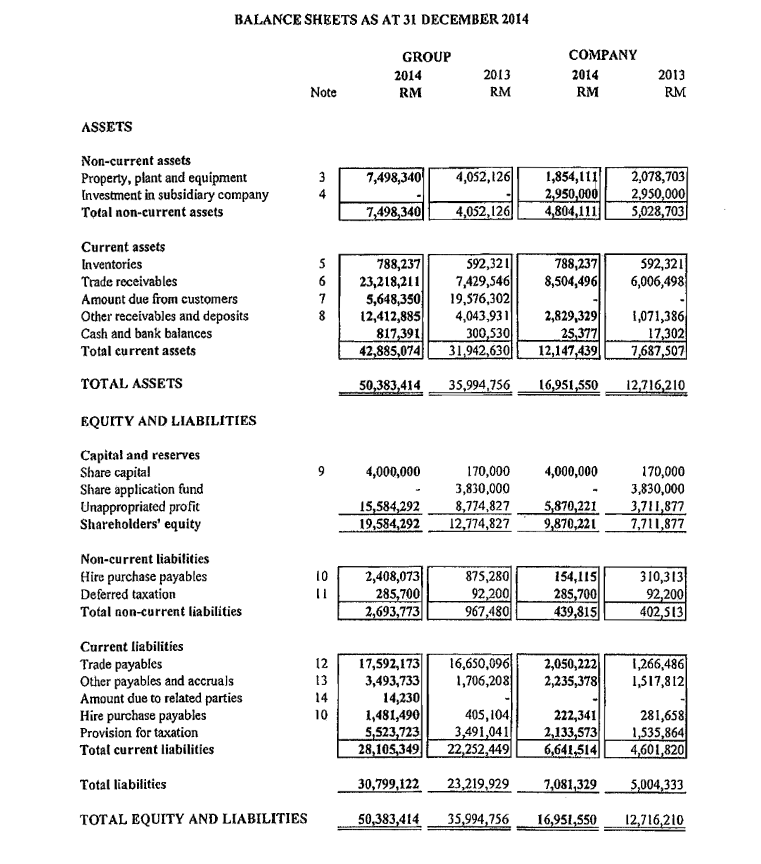

The above picture is a snap shot of the company’s balance sheet from CIMB Platform.

The first Question is “Why did the total assets boost up?” This is because the short-term receivables and intangible assets increased. Short-term receivables increased from RM39m in year 2014 to RM118m in year 2015 and the intangible assets increased from RM83m in year 2014 to RM192m in year 2015.

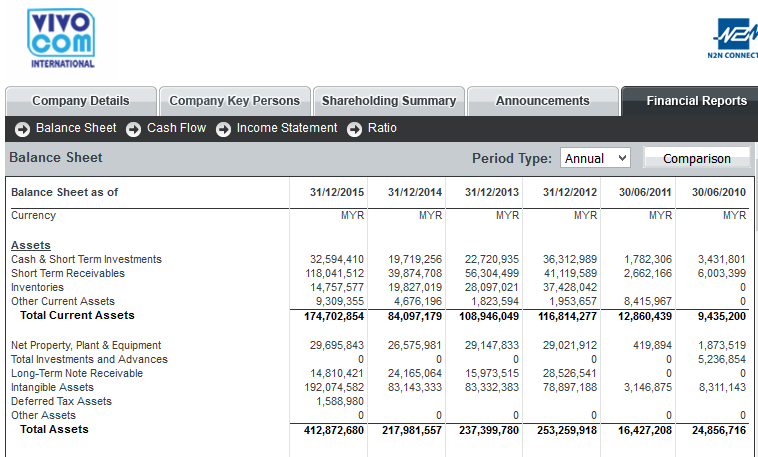

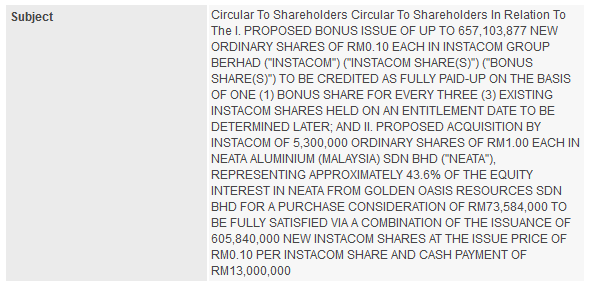

The above picture is a snap shot of the company from Bursa.

In order to become a good trader or analyst, the question “Why?” should always be thought of when an action is presented by a company. The 2nd question: Why did the intangible assets boost up twice? According to the above Bursa information, INSTACOM Group Berhad (Before they changed their name be VIVOCOM) purchased 43.60% of Neate Shares by combining cash payments of RM13m and issuance of 605,840,000 new Instacom shares are at an issue price of RM0.10 per share. The total amount of purchase consideration is RM73,584,000. This is reason why intangible assets and trade receivables boost up since they acquired Neata.

The above picture is a snap shot of the company from Bursa. This information can be found in Bursa and it is not insider information.

The 3rd question: Why did Instacom acquire Neata? According to the above information, Instacom acquired Neata because Neata has a contract value of RM82.480m. For this Neata company, it does not have much property, plant & equipment. The most valuable of Neata is only this contact.

Let us think about it, Instacom used RM73,584,000 acquired 43.6% of Neata shares, IT`S NOT 100% equity of Neata. If the value of NEATA is RM87,780,00, except other assets and liabilities. How much should Instacom acquire? RM87,780,000 X 43.6% = RM38,272,080. We can see that instacom used a higher price to acquired NEATA.

It looks like unfair, right? Since we didn’t include the assets and liabilities. If the total equity of NEATA is higher, then the effect of contract will be lower. Okay! Let us calculate this, total assets minus total liabilities. RM50,383,414 – RM30,799,122 = RM19,586,292. RM19,586,292 X 43.6% = RM8,539,623. So, the total acquisition price should be RM38,272,080 + RM8,539,623 = RM46,811,703. After calculation, it can be concluded that Instacom still uses a higher price to acquire.

What the problem about this acquisition? If the revenue of contract has been recognized, then can VIVCOM continue grow in the long-term? If the revenue of contract has been recognized rapidly by using financial number games strategies, then will the share price sustain??

Noted: Above of the information cannot affect investor make buy or sell decision.

VIVOCOM (0069), 0069 0 Why VIVOCOM revenue boost up but Share price keep declining?

http://klse.i3investor.com/blogs/KLmorGan191216/112025.jsp