KSL (5038) - KSL Holdings Berhad: If you really want to HUAT this year, then you really need to read this

Today, I would like to take this golden opportunity to continue your HUAT journey in the KLSE. So, despite a lot of people are telling a lot of people that 2017 will be a very tough year, business market will be bad, property market will be bad, share market will be worst and Malaysian currency market will even perform from bad to worst, it had been most astonishing that the local KLSE market had been charging up ever, and funds start to flow back into emerging market going into the inauguration of President Donald Trump.

What I am going to introduce to you for this week dish is something that most of the mass market will try to avoid - Properties segment. As you had been hearing that in order to beat the market, you have to do what the 90% of people are not doing currently, so does the property counter come fitting into this picture?

Of course, not all the property counter are good, hence it is very important to be very selective and pick the real good ones, with good fundamental, historical earning, future forecast earning, good NTA and good prospect.

As you can see in the below 3 property counter that is in the KLSE, they are doing not too bad as of lately as volume start to pick up back on them.

So, what is the "dish" that I am going to introduce to you now is the next big question.

Without wasting much time, I want to introduce this undervalue company named - KSL Holdings Berhad (KSL - 5038)

Before I would go into the details, I need to show you the chart first in order to ensure you know that you are not chasing something that had been pumped up all over the sky, hence wasting your time and probably money. At least now you can know my noble intention here, and you must always remember that I always always and always have noble intention. Agree or not is up to you again la.

Since some funds are guiding back their way back to emerging market, such funds are looking into company that are really undervalue, or lack behind in price based on valuation derived from their earnings. I am going to talk about KSL earnings part later on, but for now, you have to look at the technical chart first.

As you can see, KSL had been sliding down in a long term downtrend line for more than 1 year. And according to the resistant line drawn, we are now sitting at a Reversal Point where technical reading will support a strong short term reversal. Now that KSL is sitting at RM 1.00, there is high potential for the reversal to hit RM 1.12.

But before chasing KSL down the road when market open, I will show you again what you will be getting for that RM 1.00 paid for a share of KSL. Remember, it is what you will be getting, not what I am going to get, because this is about You and KSL, KSL and You.

Since the Annual Report 2015 is 138 pages, I will help you summarize 2 very point that I feel is very strong and influential.

Some land are really undervalue until almost underwater

First Point is very easy and straight forward for most of the retailer. KSL got a big piece of land at Klang - Bandar Bestari, which they had acquired in 2007. According to the book, that land is carrying a 2007 valuation (RM 12.5 psf) , and now we are 2017. Since this parcel of land is intended for landed property development, the current market rate is going for about RM 350 psf for a completed landed project. Ok lar, let's be very skeptical and pessimistic and assume that the land is value at RM 25 per square feet, ok or not ?

Based on RM 25 psf, this piece of land is worth RM 328.5 million !!! Eh, that is almost a RM 160 million valuation gain from that land at a very skeptical value oh. And this is just one of the land, there are plenty more in Johor which is still carrying valuation of 2002, and this I will leave it to you to do your own homework lar.

The result is still good actually

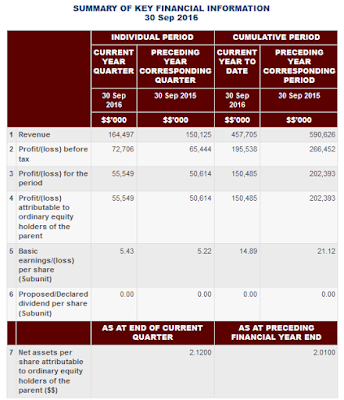

Now the second point is also very straight forward with a little bit of prediction. So what you need to predict here is - The 4th Quarter result for FYE 2016.

According to news from The Star in 2014, KSL still have a remaining GDV of RM 5 billion. Since the group are still actively selling landed property in Klang and Johor, and preparing to undertake KSL 2 city mall in Klang, that will position the group still busy with projects, probably estimating at RM 4 billion.

So, now I want to predict that KSL maybe can deliver 4 cents EPS in 4th Quarter FYE 2016 (Again skeptical). So my projection will see FYE 2016 total EPS at 19 cents.

Since I am so skeptical already, I again use a skeptical PER of x7, that will value KSL at RM 1.33 (My friend, this is a very skeptical prediction lar, if you predict 5 cents for 4th quarter and PER x 10, that will be RM 2.00 already you know ? )

Actually, based on the above 2 information + the technical chart, KSL is already very attractive. But since I want to make sure you HUAT, I need to show you KSL hidden weapon as well. I will try to explain as easy as I can to let u understand easier.

Actually, many people do not understand what is Share Premium Account and it's intended use. And because of this, many retailer miss out on potential corporate exercise that can benefit them.

So, how does this share premium account appear? Let me give you an example. Let's say the company Par Value is RM 0.50, but the company do a private placement at RM 1.00, so there is a Premium of RM 0.50. That RM 0.50 will then be stored inside the share premium account, and it cannot be simply used for normal operation such as company operation. The money here can only be utilized for corporate exercise such as Bonus Issue. When the company do bonus issue, it will then capitalized the money in the share premium account into share capital, and can utilize them for company day to day operation.

So with RM 180 million in share premium, and KSL Par Value being RM 0.50, that means KSL can issue bonus share up to 360 million units. So based on the current total share issued, I think KSL can do a bonus issue of 1 bonus share for every 5 ordinary share.

Now your question might be - Why KSL want to do Bonus Issue again? 2014 they just did a 1 to 1 bonus issue.

If you allow me to explain, I will reckon there is a very high tendency that KSL will undertake bonus issue this year 2017. The reason is because KSL will need this money for their major undertaking in Klang, featuring the KSL City Mall 2 with anticipation of RM 10 billion in GDV with 10 main development.

So now I had already presented to you 3 HUAT points along with a HUAT chart of KSL. But if you are still not convinced on it, then I will let KSL talk to you personally, because KSL will only tell you to "Kindly Sai Lang" !!! Hahaha

KSL (5038) - KSL Holdings Berhad: If you really want to HUAT this year, then you really need to read this

http://bonescythe.blogspot.my/2017/02/if-you-really-want-to-huat-this-year.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+BonescytheStockWatch+(Bonescythe+Stock+Watch)