PANSAR (8419) - PANSAR - Beneficiaries of Sarawak Development

PANSAR - Beneficiaries of Sarawak Development

Like we always do, we like to look for deeply undervalued stocks known as GEM. An unpolised gem to be diamond in future. Indeed we have many history in doing so i.e. KGB, PTB, PSIPTEK, LNGRES, SYMLIFE, BDB, LEESK, JERASIA, CCK, PARAGON, PWF, RCECAP, KFIMA, etc. Stocks other than that require longer time frame and fundamental to reflect on share price.

What we are going to reveal to you today is PANSAR. First you need to understand what PANSAR does:

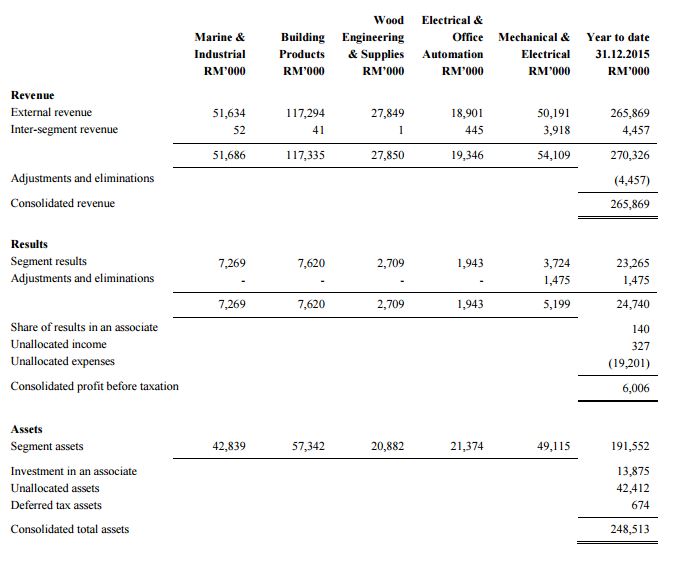

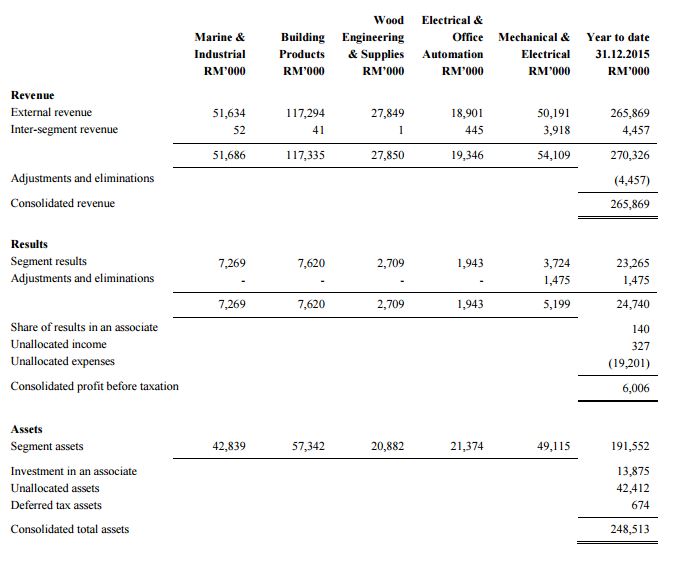

Segmental Analysis

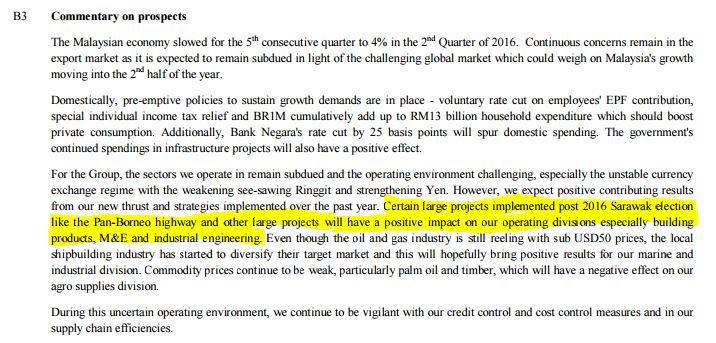

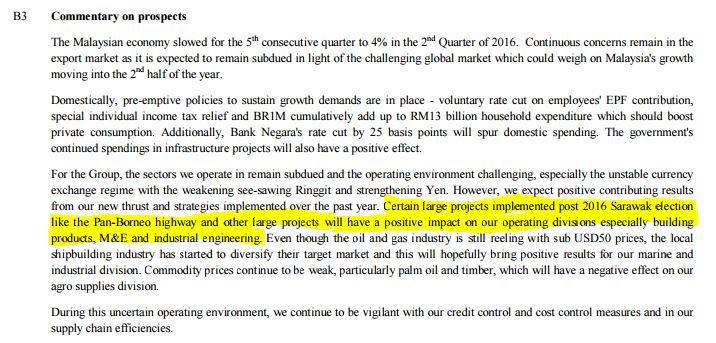

Sarawak Development

Sarawak Development

As we enter 2017 with renewed optimism and hope, there are new opportunities and challenges waiting to be embraced. For Sarawak, more infrastructure projects are going to be impletmented to bridge the gap between urban and rural developments. The late chief minister of Sarawak introduced Socio-Economic Transformation Plan (SETP). The programme will be implemented in phases from 2016 to 2030. The first phase of SETP will be carried out in the Sarawak Eleventh Malaysia Plan (11MP) from 2016 to 2020 which include below developments:

1. PAN BORNEO

The project for Second Phase RM16.5bil is only being announced in December 2016 to various contractor. The third phase, he said, would commence in 2018, from Lawas to Limbang. The whole Pan Borneo Highway is expected to be completed by 2022.

2. SCORE Development

Sarawak is in construction of the 600MW Balingian coal-fired power plant, the construction of 600km 500 kilovolt (kV) backbone transmission grid and construction and expansion of associated extra high-voltage substations. The upcoming projects will be Tanjung Kidurong Combine Cycle Gas Turbine (CCGT) power plant with 400 megawatt (MW), the Samalaju CCGT with 1,200MW, Northern Grid Expansion to Limbang and Lawas by 2021 and the Baleh hydroelectric project (HEP) with 1,285MW.

What are these have anything to do with PANSAR?

Dividend Yield

Dividend Yield

The management is very generous on distributing dividends every single year without failure. The dividend yield is approximately 4.8 -5.0% higher than FD.

NTA

PANSAR has strong cash and have zero gearing. With NTA of RM0.59, the price (closed at 0.460) is 28% discounted of the NTA value.

More exciting events:

1. Proposal share buyback - This is a very familiar event where company will only propose share buyback if they have confident on the company prospect in the long run. This is pending from shareholders' approval.

2. Set up company in Singapore - PANSAR is keen to venture into Singapore market in the sale and distribution of various building materials, marine and industrial products, wood-engineering equipment and supplies, electrical products and office automation supplies. Any sales arises will be a plus point to the revenue looking at many projects undergoing in Singapore.

Conclusion

With the trilling events we have mentioned above, we strongly believe PANSAR is the upcoming GEM to be discovered. With the industry PE of Seacera (PE:49), Johan (Negative PE) approximately 25, the share price should be valued at RM0.685 (havent taken account of future earning growth), 50% upside from current price.

Disclaimer:

The information contained in this channel is for general information purposes only and NOT a recommendation for buying or selling stock. Any reliance you place on such information which incur profits/losses is therefore strictly at your own risk. We are merely sharing our trades and hold no enforcement on issuing buy calls. If you share the same view with us on stocks, let time prevail.

Like we always do, we like to look for deeply undervalued stocks known as GEM. An unpolised gem to be diamond in future. Indeed we have many history in doing so i.e. KGB, PTB, PSIPTEK, LNGRES, SYMLIFE, BDB, LEESK, JERASIA, CCK, PARAGON, PWF, RCECAP, KFIMA, etc. Stocks other than that require longer time frame and fundamental to reflect on share price.

What we are going to reveal to you today is PANSAR. First you need to understand what PANSAR does:

Segmental Analysis

Building Products segment sells and distributes steel bars, cement, roofing materials, construction chemicals, and industrial materials.

Marine & Industrial segment supplies and distributes power generating and water pressure systems, welding and pump sets, etc.

Wood Engineering & Supplies segment supplies steel wire ropes, packaging systems, precision measuring instruments, and wood treatment chemicals.

Electrical & Office Automation segment sells and distributes lighting and air-conditioning systems.

Mechanical & Electrical segment designs and installs air-conditioning and ventilation, plumbing, and fire protection systems.

(Source: Q3 2017 Quarter Report)

As

you can seen above, the core revenue and profit generator segment are

Building Products, Marine & Industrial and Mechanical &

Electrical. In the upcoming quarters, we shall expect more contribution

from these three segments. Why? Kindly refer below for more information.

As we enter 2017 with renewed optimism and hope, there are new opportunities and challenges waiting to be embraced. For Sarawak, more infrastructure projects are going to be impletmented to bridge the gap between urban and rural developments. The late chief minister of Sarawak introduced Socio-Economic Transformation Plan (SETP). The programme will be implemented in phases from 2016 to 2030. The first phase of SETP will be carried out in the Sarawak Eleventh Malaysia Plan (11MP) from 2016 to 2020 which include below developments:

1. PAN BORNEO

The project for Second Phase RM16.5bil is only being announced in December 2016 to various contractor. The third phase, he said, would commence in 2018, from Lawas to Limbang. The whole Pan Borneo Highway is expected to be completed by 2022.

2. SCORE Development

Sarawak is in construction of the 600MW Balingian coal-fired power plant, the construction of 600km 500 kilovolt (kV) backbone transmission grid and construction and expansion of associated extra high-voltage substations. The upcoming projects will be Tanjung Kidurong Combine Cycle Gas Turbine (CCGT) power plant with 400 megawatt (MW), the Samalaju CCGT with 1,200MW, Northern Grid Expansion to Limbang and Lawas by 2021 and the Baleh hydroelectric project (HEP) with 1,285MW.

What are these have anything to do with PANSAR?

(Source: Q1 2017 Quarter Report)

The management has already given strong hint that 2017 will be a year for PANSAR. FYI, I am just stating facts. PANSAR is doing Building

Products, Marine & Industrial and Mechanical & Electrical in

which PANSAR is the direct beneficiary of Sarawak infrastruture

development! Apart from that, commodity crude oil prices has recovered

to above USD50 and many more capex projects introduced by goverment and

Petronas, the project will generate additional revenue to PANSAR.

The management is very generous on distributing dividends every single year without failure. The dividend yield is approximately 4.8 -5.0% higher than FD.

NTA

PANSAR has strong cash and have zero gearing. With NTA of RM0.59, the price (closed at 0.460) is 28% discounted of the NTA value.

More exciting events:

1. Proposal share buyback - This is a very familiar event where company will only propose share buyback if they have confident on the company prospect in the long run. This is pending from shareholders' approval.

2. Set up company in Singapore - PANSAR is keen to venture into Singapore market in the sale and distribution of various building materials, marine and industrial products, wood-engineering equipment and supplies, electrical products and office automation supplies. Any sales arises will be a plus point to the revenue looking at many projects undergoing in Singapore.

Conclusion

With the trilling events we have mentioned above, we strongly believe PANSAR is the upcoming GEM to be discovered. With the industry PE of Seacera (PE:49), Johan (Negative PE) approximately 25, the share price should be valued at RM0.685 (havent taken account of future earning growth), 50% upside from current price.

Disclaimer:

The information contained in this channel is for general information purposes only and NOT a recommendation for buying or selling stock. Any reliance you place on such information which incur profits/losses is therefore strictly at your own risk. We are merely sharing our trades and hold no enforcement on issuing buy calls. If you share the same view with us on stocks, let time prevail.

Stock Alliance

The information contained in this channel is for general information purposes only. Any reliance you place on such information is therefore strictly at your own risk.

We hope to bring profit to everyone as we did in today.

Do help us share out our channel link

Add our new fb:

https://www.facebook.com/stockalliance

Join our Channel and check out our performance.

https://telegram.me/stockalliance

We hope to bring profit to everyone as we did in today.

Do help us share out our channel link

Add our new fb:

https://www.facebook.com/stockalliance

Join our Channel and check out our performance.

https://telegram.me/stockalliance

PANSAR (8419) - PANSAR - Beneficiaries of Sarawak Development

http://klse.i3investor.com/blogs/stockalliance/120442.jsp