Hey guys !

We already know, in every 10 years there is a cycle of economic crisis - 1988, 1997, 2008, and ... would the next one be in 2017 or 2018 ? You know the commodity crash, asian financial (currency) crisis, US sub-prime loan, ......

I reckon ... the next crisis (2018) would be a oil related crisis and this down trend would be a boom to airline industry !

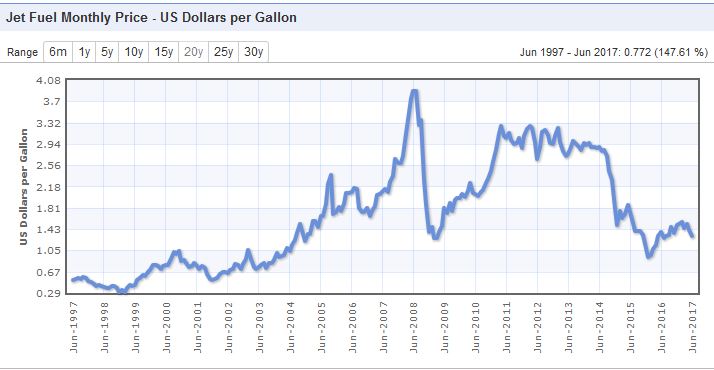

As an overview, let me present the jet fuel prices evolution from year 2007 to today, as in the chart below.

As you guys can see over there, jet fuel price was only around 50 cents per gallon in 1997, and the oil boom which started in 2003 , has pushed the price to above USD 2.56 per gallon until year 2015. But in year 2015 something had happened and jet fuel price has variably dropped to USD 1.30 per gallon last month.

Comparatively, 1.30 per gallon is a hell of 147% higher than the price in Jun 1997, and can it drop more to below 60 cents level ?

The data that I have gathered and read shows that , by many means the price could drop to below 60 cents. So, what - short the oil ?

Nah... if you want to short the oil, you should do it from year 2014, and you have become a multi-million air (I have written some articles about oil price is not sustainable and too high in 2013 and it has dropped big time already). So, let me propose the other way around - Long the airline stocks ! Buy AAX , it is just RM 0.40 today and keep it for a few years, you could quadruple the price. Hahaha.. it is a simple way, since many of you guys have already a CDS account in Bursa Malaysia, it is easy to buy , right !

Anyway, dont believe what "Radzi" says, check first...... So, the burden of proof is on me and I have to give my justification - why 2018 would be an Oil Crisis Year ! Why did I say so ?

My Justifications

(1) Current High Oil Price is Artificial - It makes no sense to have this price unless someone is buying and storing them.

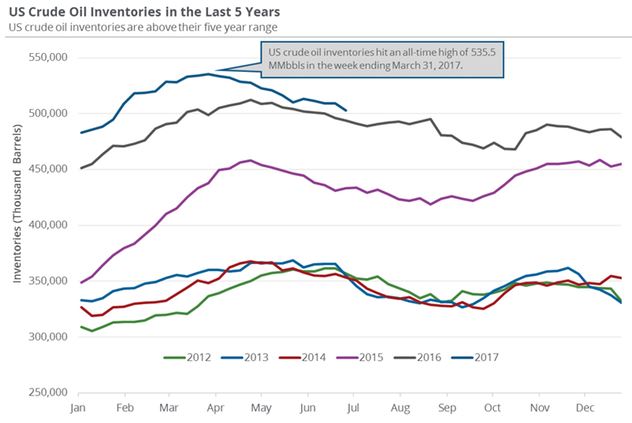

Let me show you the United States inventories of crude oil ( the one that they stored) since year 2012, as below:

United States oil inventories has goes up by more than 60% , from 310 million barrels in 2012 to a peak of 540 million barrels in March 2017, and it keeps on increasing YOY. Thanks to shale gas, USA now does not import a lot of petrol from Saudi Arabia and other countries, but in fact , they keep on producing till the extent USA now become a net exporter of oil.

So where does Saudi Arabia and the rest of the world oil goes to ? It goes into the ship below:

That ship is called Very Large Crude Carrier (VLCC) and nowadays they have a bit larger ship called Ultra Large Crude Carrier (anyway I have not seen the acroniym ULCC used widely just yet ).

Andddddd..... what does VLCC do....It becomes floating storage for crude oil ... It is an offshore storage ! Well, if you go to Singapore Port, you can see many ships crowd the straits as below :

And pretty much, stationary ships in Singapore are mostly VLCC used to store or keep oil in large volumess.....and let us see where in the world most VLCC are located.

38 of these tankers locations are in Singapore itself ! whie around 35 is in Saudi Arabia, and about 16 is in China. Actually, the VLCC numbers keep on increasing. And what is the trend of VLCC numbers ?

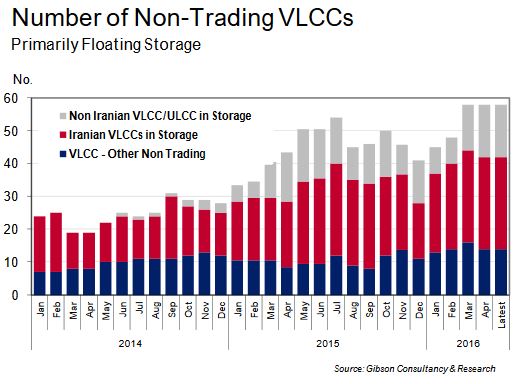

Gibson consultancy estimate the numbers are as such, but most important, the numbers are increasing from year 2014 to 2016.

What does all this data means ? The oil speculators , the purchaser (but not user) of oil, the hedge fund have resorted to storing the oil, to anticipate (or perhaps push up) oil price, and this created an Artificial Demand. And oh boy ! who are going to purchase from them ? The oil refineries in Singapore are full, and cannot accept new crude oil, because they are lack of buyer of their refined product. And the seller of oil has to resort to store the oil at sea, just within distance of the refinery to sell them when demand uptrend, paying USD 40,000 a day of storage cost.

Third, we have OPEC cartel. OPEC has in vain distorted the price of oil through cartel means. Yeah , it is a cartel to reduce production of oil output. And this agreement will lapse in March 2018. So far, Russia has started to feel uneasy with this agreement ... Why ? Any output cut by OPEC members represents an opportunity by non-OPEC members to increase their petroleum production. America has consistently increase output, not only that , Iran , Libya, Nigeria and Iraq are yet to go to their fullest capacity.

Fourth, America has go to sudden shift from keeping quiet to major exporter... first - shale gas makes it technologically cheaper to produce liquified shale gas, and second - some of "High Oil Money" goes to ISIS . When ISIS conquer new area in Iraq, they capture oil well, and they sell oil in the black market....so this has become something uneasy to the American government, so they will let the oil price goes down - nothing Geroge Bush Jr. can shout against nowadays.

Fifth, renewable energy. We have Peter Bellew , the CEO of MAS talks about RE in vimeo, if you have not watch it, you can watch it in the link here.

https://vimeo.com/225041543

Someone call this Airline Super Profit in 2021... What the heck , 2021 is too late for super investor, the super profit would start to roll in 2018 and 2021 is the time for super investor to sell their airline stock

So, we have oil and gas prices supported by artificial demand (sea storage), cartel (production cut) and higher US inventories. Oil price is just like a condominum with weak pillars. When the pillars are taken out one by one , then Kabooommm !!!! The roof of the condominium will crash full down.

Final Point

I have written in great length about my prediction of AAX Profit Before Tax in this article

http://klse.i3investor.com/blogs/radziarticles/125138.jsp

and I have given out a formula based on my statistical analysis there as below:

Profit Before Tax / Quarter (in '000) = 335240 (Currency Gain/Loss) - 61629 (Fuel Index) +378126.

Let us assume, there is zero currency movement, and let me take exchange rate as 4.30 and fuel price per gallon as 0.6, then we have Fuel Index as 2.58, if I plug in the figure into that formula,

I get :

Profit Before Tax/ Quarter = 378126 - 159003 = RM 219 million per quarter. Well that is a super profit for me ! Or RM 1 billion a year.

I hope you guys enjoy this article. Apart from AAX, you can apply the same concept to AirAsia, PetronM (refinery) and checmical related manufacturer (lower raw material cost).

No wonder Benjamin is full of smiles nowadays. Watch this video.

http://www.theedgemarkets.com/content/talking-edge%C2%A0aax-shorter-flights-more-routes

Last but not least, Happy Investing !

..................................

A note about the author.

(1) He is a holder of B.(Hon) Engineering , MBA (Finance (Investment)), and PhD Eng. , well verse with the business framework used by McKinsey, Boston Consulting Group and Bain & Company.

http://klse.i3investor.com/blogs/radziarticles/127668.jsp