1. Extremely Strong Profitability

Hengyuan Refining Co ("HRC") was previously known as Shell Refining Company Bhd. In February 2016, Shell International announced that it was disposing 51% equity interest in HRC to Shandong Hengyuan Petrochemical Company (a company from China). The disposal was completed on 22 December 2016.

Shandong Hengyuan's acquisiton of HRC was very timely. In FYE 31 December 2016, HRC chalked up extremely strong earning of RM335 mil. Based on existing market cap of RM1.7 billion, historical PER was 5.1 times only. All of the profit was from operation (as a matter of fact, exceptional items resulted in losses of RM23 mil).

http://klse.i3investor.com/blogs/icon8888/127661.jsp

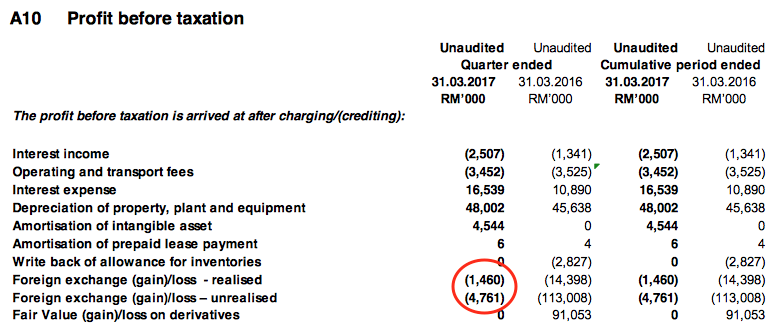

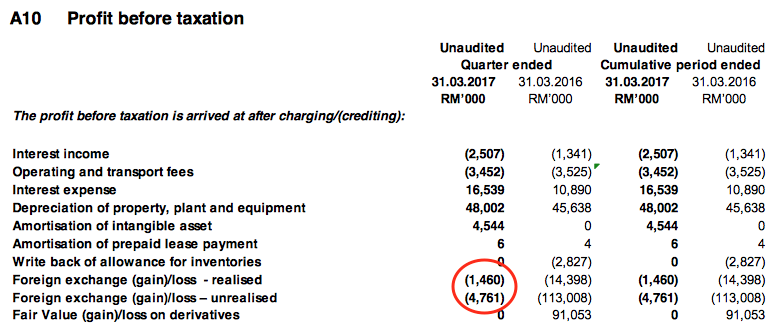

And that was not the end of it. In March 2017 quarter, Hengyuan reported a staggering RM279 mil net profit. Again, the bulk of the profit was from operation with minimal impact from exceptional gain (RM6 mil forex gain).

If annualised, full year net profit would be RMRM1.116 billion. Based on latest market cap of RM1.7 billion, forward PER would be 1.5 times only.

(Note : The 1.5 times forward PER I mentioned above was for the purpose of attracting readers' attention only. If you ask me, it would be silly to invest in HRC based on March 2017 quarter's net profit annualised. I believe a more appropriate figure would be FY2016's RM335 mil, which still translates into very attractive PER and justify a buy)

2. Credibility Not An Issue

The financial figures looked very attractive. However, do those figures have problems ? Not that I discriminate against companies from any particular country, but in general, Malaysian investors had bad experience with entities linked to Country C.

XQ was one good example (if you don't know what is "XQ", please ask Uncle Koon). XQ's balance sheet displays huge amount of cash, but have difficulty submitting quarterly report recently. The stock's market cap has shrunk dramatically since mid 2014 and is now facing delisting. Many investors cry also no tears.

Is HRC's super good profit genuine ? Will it gulung tikar one day ? I am also very jittery. However, after going through HRC's FY2016 annual report, I am HIGHLY convinced that HRC is a totally different story. Please refer to reasons below :

(a) Malaysia Based Operation

Unlike other companies that went into trouble, HRC's operation is fully based in Malaysia. There is no doubt that the refinery, the pipes, the tanks, the warehouse, the computers, the tables, the tea lady, the sexy secretary, etc are all there. No Potemkin Village.

(b) Board Composition Assures Check and Balance

HRC's Managing Director is a Kwailo. I am not a Kwailan, but having a Westerner as the MD does give me a big boost of confidence.

And then, there is Yvonne Cheah....

This lady below was previously from MIDA and was ex Director of Tenaga and Maybank. Very credible person.

If you are not convinced by my reasoning above, you can go check all those Country C companies that get into trouble and see their Board composition. The Board of those companies are overwhelmingly populated by Country C nationals. You can hardly find any independent figures there.

(c) The Bankers Are There

One quick test of whether a company is fake is to see whether it has banking facilities in its balance sheets. This is because fake companies will never dare to deal with banks. Fake companies can talk cock sing song with minority shareholders, but they cannot do that to bankers. THEY WON'T DARE TO GO NEAR BANKERS BECAUSE BANKERS WILL PUT THEM UNDER THE MICROSCOPE TO STUDY.

If you don't believe me, you can check the balance sheets of those troubled Country C companies. I have checked a few. None of them have banking facilities. The one that has borrowing is with a Country C bank, and the amount is very small.

But HRC is different. It has RM1.4 billion borrowings. Don't tell me those bankers are blind and stupid. Banks are VERY PARTICULAR about honesty, integrity and credibility. If they are convinced that you are a conman, they won't touch you with a ten feet pole.

(d) Shandong Hengyuan's Commitment

In December 2016, HRC refinanced its borrowings by drawing down USD200 mil new borrowings. The new borrowings are secured against, inter-alia, the HRC shares held by Shandong Hengyuan.

What I am trying to say is that Shandong Hengyuan has to make sure that HRC is in good shape. Or else, the bankers will force sell / confiscate their HRC shares (held through subsidiary Malaysia Hengyuan International Ltd (MHIL)). With this kind of arrangement, do you think Shandong Hengyuan will mess around with HRC by for example, faking financial figures ?

3. Concluding Remarks

I am attracted to the stock because of its low PER. Before me, a few other bloggers have already written about Hengyuan and Petronm (which is in more or less same industry). There is a lot of information in those articles, especially those related to crack spread. I suggest you go through all those articles before you commit your funds to invest in this stock. That will give you a more comprehensive and balance view.

Hengyuan Refining Co ("HRC") was previously known as Shell Refining Company Bhd. In February 2016, Shell International announced that it was disposing 51% equity interest in HRC to Shandong Hengyuan Petrochemical Company (a company from China). The disposal was completed on 22 December 2016.

Shandong Hengyuan's acquisiton of HRC was very timely. In FYE 31 December 2016, HRC chalked up extremely strong earning of RM335 mil. Based on existing market cap of RM1.7 billion, historical PER was 5.1 times only. All of the profit was from operation (as a matter of fact, exceptional items resulted in losses of RM23 mil).

http://klse.i3investor.com/blogs/icon8888/127661.jsp

And that was not the end of it. In March 2017 quarter, Hengyuan reported a staggering RM279 mil net profit. Again, the bulk of the profit was from operation with minimal impact from exceptional gain (RM6 mil forex gain).

If annualised, full year net profit would be RMRM1.116 billion. Based on latest market cap of RM1.7 billion, forward PER would be 1.5 times only.

(Note : The 1.5 times forward PER I mentioned above was for the purpose of attracting readers' attention only. If you ask me, it would be silly to invest in HRC based on March 2017 quarter's net profit annualised. I believe a more appropriate figure would be FY2016's RM335 mil, which still translates into very attractive PER and justify a buy)

2. Credibility Not An Issue

The financial figures looked very attractive. However, do those figures have problems ? Not that I discriminate against companies from any particular country, but in general, Malaysian investors had bad experience with entities linked to Country C.

XQ was one good example (if you don't know what is "XQ", please ask Uncle Koon). XQ's balance sheet displays huge amount of cash, but have difficulty submitting quarterly report recently. The stock's market cap has shrunk dramatically since mid 2014 and is now facing delisting. Many investors cry also no tears.

Is HRC's super good profit genuine ? Will it gulung tikar one day ? I am also very jittery. However, after going through HRC's FY2016 annual report, I am HIGHLY convinced that HRC is a totally different story. Please refer to reasons below :

(a) Malaysia Based Operation

Unlike other companies that went into trouble, HRC's operation is fully based in Malaysia. There is no doubt that the refinery, the pipes, the tanks, the warehouse, the computers, the tables, the tea lady, the sexy secretary, etc are all there. No Potemkin Village.

(b) Board Composition Assures Check and Balance

HRC's Managing Director is a Kwailo. I am not a Kwailan, but having a Westerner as the MD does give me a big boost of confidence.

And then, there is Yvonne Cheah....

This lady below was previously from MIDA and was ex Director of Tenaga and Maybank. Very credible person.

If you are not convinced by my reasoning above, you can go check all those Country C companies that get into trouble and see their Board composition. The Board of those companies are overwhelmingly populated by Country C nationals. You can hardly find any independent figures there.

(c) The Bankers Are There

One quick test of whether a company is fake is to see whether it has banking facilities in its balance sheets. This is because fake companies will never dare to deal with banks. Fake companies can talk cock sing song with minority shareholders, but they cannot do that to bankers. THEY WON'T DARE TO GO NEAR BANKERS BECAUSE BANKERS WILL PUT THEM UNDER THE MICROSCOPE TO STUDY.

If you don't believe me, you can check the balance sheets of those troubled Country C companies. I have checked a few. None of them have banking facilities. The one that has borrowing is with a Country C bank, and the amount is very small.

But HRC is different. It has RM1.4 billion borrowings. Don't tell me those bankers are blind and stupid. Banks are VERY PARTICULAR about honesty, integrity and credibility. If they are convinced that you are a conman, they won't touch you with a ten feet pole.

(d) Shandong Hengyuan's Commitment

In December 2016, HRC refinanced its borrowings by drawing down USD200 mil new borrowings. The new borrowings are secured against, inter-alia, the HRC shares held by Shandong Hengyuan.

What I am trying to say is that Shandong Hengyuan has to make sure that HRC is in good shape. Or else, the bankers will force sell / confiscate their HRC shares (held through subsidiary Malaysia Hengyuan International Ltd (MHIL)). With this kind of arrangement, do you think Shandong Hengyuan will mess around with HRC by for example, faking financial figures ?

3. Concluding Remarks

I am attracted to the stock because of its low PER. Before me, a few other bloggers have already written about Hengyuan and Petronm (which is in more or less same industry). There is a lot of information in those articles, especially those related to crack spread. I suggest you go through all those articles before you commit your funds to invest in this stock. That will give you a more comprehensive and balance view.