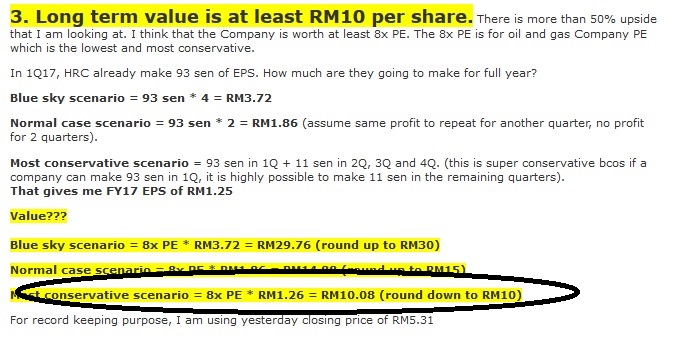

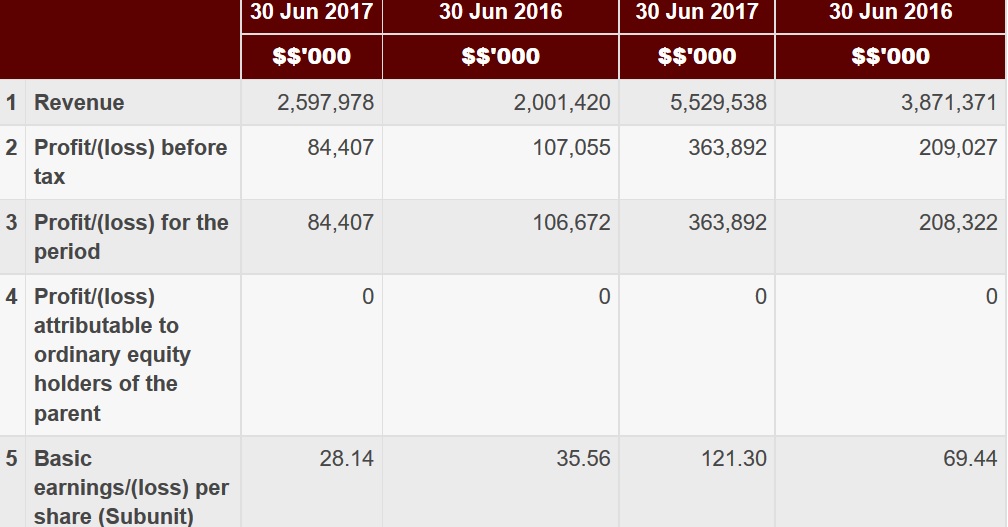

1. Result beating estimate @ 97% of my full year estimate. The 1H17 EPS of RM1.21 is already achieving 97% of my FY17 Full Year Estimate of RM1.25. Refer here for my previous post in which I stated clearly that my MOST CONSERVATIVE TP of RM10 is based on 8x PE on RM1.25 FY17 EPS. I have been too conservative in estimating only 11 sen for 2Q but HENGYUAN delivered 28 sen.

http://klse.i3investor.com/blogs/richDad/123573.jsp

The picture is here and to check the full content you can click the link above.

2. Good result despite temporary shutdown. There was a temporary shutdown for ~3 weeks for one of the crude distillers and this is planned in May 2017. Now you can understand why I was only estimating 11 sen of EPS (lower than 1Q). Having said that, the planned shutdown has improved the refinery production as the unplanned downtime has declined. If you don't understand the techinical terms, just think that the maintenance work has improved the efficiency. Going forward, I think the unplanned downtime will remain lower than before the maintenance. All in, the lower unplanned downtime explained why the 2Q EPS actually come in at 28 sen (better than my estimate of 11 sen).

3. Raising EPS and so new TP of RM15. I am raising my Target Price Scenario to the "Normal Case Scenario" which means 8 times PE to EPS of RM1.86. As the first half of FY17 earnings already achieved 97% of my full year forecast previously, I relook into my numbers and increase my EPS. The new EPS target of RM1.86 is still conservative considering refinery margin has improved from July onwards and there's unlikely another shutdown after recent shutdown in May 2017. The efficieny has also increased (lower unplanned downtime) as explained previously.

8x PE * RM1.86 = RM14.88 (round up to RM15)

http://klse.i3investor.com/blogs/richDad/130961.jsp