Sending notification to the company IR or CFO because of their financial reporting error has almost become one of my activity. In the past, I have sent such notification to HAIO and TONGHER concerning to their reporting error in the quarterly result. I felt glad that their financial reporting team have acted fast to issue amendment announcement.

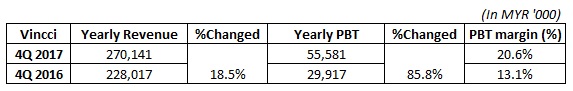

Over this week, I also discovered one unusual figure in the latest PADINI 4Q FY2017 reports. In their segmental reporting in the explanatory note, I noticed that the PBT of Vincci has almost doubled up (86%) to MYR 55,581k if compared to the PBT in 4Q FY2016, which is MYR 29,917k. However, the revenue from Vincci has only increased 18% to MYR 270,141k compared to the revenue of MYR 228,017k in the FY2016. At the same time, its PBT margin, calculated as PBT/Revenue, has increased to the historical high of 21%. See exhibit 1 below.

Exhibit 1: Y-to-Y Comparison of Revenue and PBT for Vincci

(Source: Padini 4Q FY2017 explanatory note and annual report FY2016)

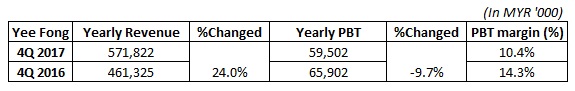

In the opposite, the PBT of Yee Fong Hung segment, which is one of the most important segment in the Padini Group has declined 9.7% although its revenue has increased 24%. See exhibit 2 below.

Exhibit 2: Y-to-Y Comparison of Revenue and PBT for Yee Fong Hung

(Source: Padini 4Q FY2017 explanatory note and annual report FY2016)

Due to the above finding, I have sent my inquiry to the Padini’s IR team for the reason why the PBT of Vincci increased sharply in FY2017. However, at the time of writing this blog, I received the response from the CFO, Ms. Sharon Sung, saying that their audit process currently have not 100% done yet and no further clarification.

In my personal opinion, the financial result of Vincci in FY2017 is unusual. The reason is the group has mainly concentrated in expanding both Padini and Brands Outlet in FY2017. Without any rigid reason, it is unconvincing that the PBT margin of Vincci was improved this much. I am also wondering why no other analyst mention this matter and question the management. If the PBT margin of Vincci had improved to 21%, then the management should put more efforts to further expand this segment in the future because the current financial result also implies that Vincci is the most profitable segment in the Padini Group.

https://streetanalystblog.wordpress.com/2017/09/10/padini-has-vincci-doubled-its-pbt-in-fy2017/