Hi Guys,

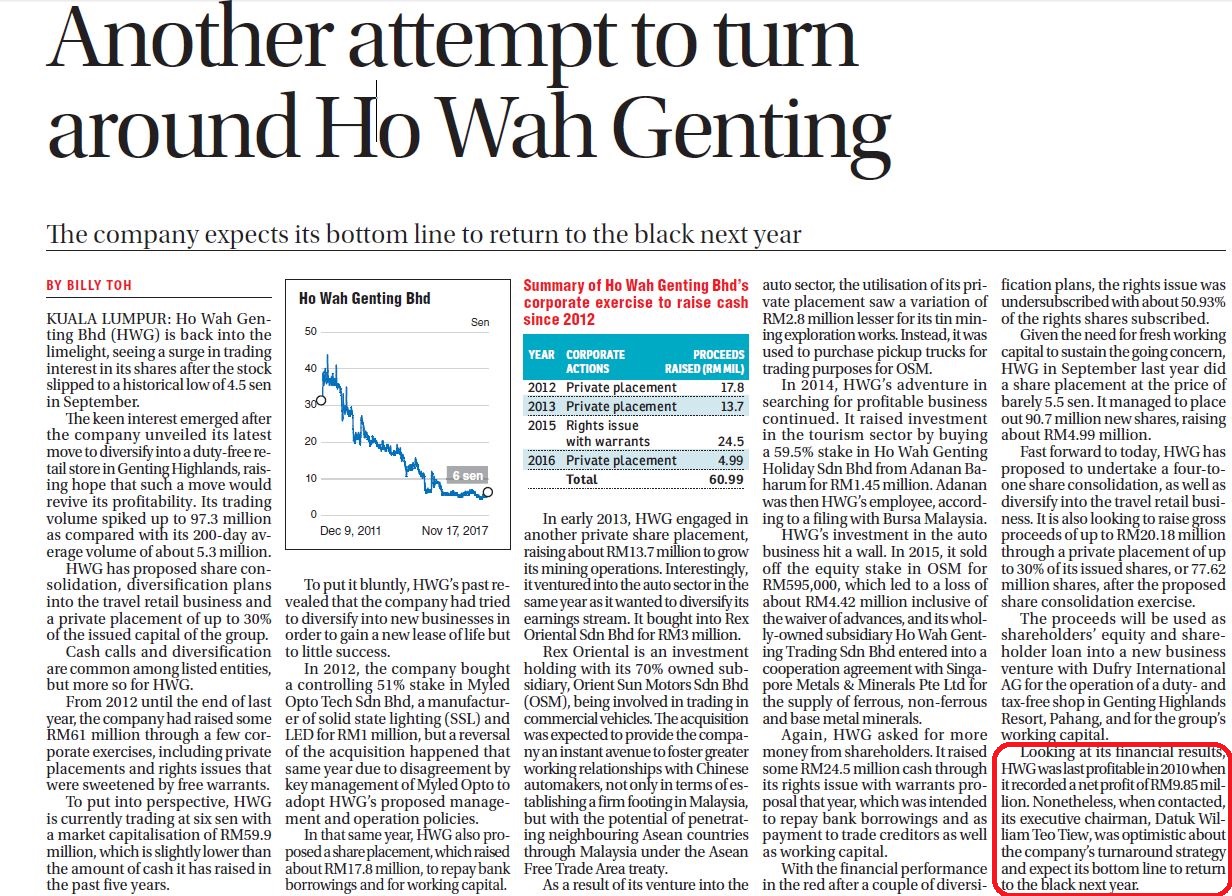

What I want to share here is the story of HWGB written by The Edge Financial daily today.

The story shared similar story with what I wrote in the past weeks.

1. https://klse.i3investor.com/blogs/fatprofitfatwealth/137302.jsp

2. https://klse.i3investor.com/blogs/fatprofitfatwealth/138218.jsp

What else I can say, it is just about the trust in its turnaround story this time around after few attempts in the past.

I believe in this company as "to succeed one time, you would fail many times before it".

Why I believe in this time attempt?

I view its partner, Dufry, one of the largest and an established duty free operator in the world will translate its succesful stories in other countries into JV with HWGB for duty free shop in Genting Highlands Resort.

Private placement of 30% is abnormal to the market, but huge call for its existing business to turn into profit and sustain going forward. Very smart move, this would also not dilute the Group's earnings as its no. of shares would only increase to 300 plus million post-shares consolidation, which is STILL below current 998 million shares.

Boombing tourism sector and current expansion plans in Genting Highlands under the Genting Integrated Tourism Plan (GITP) are set to lure in more visitors. This would definitely increase number of footfalls in HWGB-Dufry JV' duty free shop.

Last but not least, Malaysia economic data is on positive note too, which released last week. Zooming further for the benefit of consumption in Duty free shop, Malaysia consumer spending growth has continued picking up this year. Real private consumption expenditure growth momentum was sustained in 3Q this year came at +7.2%yoy (2Q 2017 were +7.1%yoy).

Conclusion

I believe HWGB can deliver its turnaround this time with bottomline to return to black next year.

In fact, this stock still laggard as compared to other penny stocks that has similar story of turnaround such as the glaring one is Palette. They have been trading more than 3x PBV. Some have been trading to 7x and 10x PBV. I shared about this in my previous article here.

https://klse.i3investor.com/blogs/fatprofitfatwealth/137532.jsp

So, if we were to apply conservative 3x PBV for HWGB, it could be trading at 18sen at least pre-shares consolidation!

The goreng will be even more after the shares consolidation as no of shares will reduce. So, it would be easy to goreng. Look at Grand Hoover recently, very small no of shares, in turn, it was easily to LIMIT UP.

Also laggard as the stock has yet reacted to positive news in tourism sector, consumer spending and Genting expansion plans.

As nobody realise this stock yet, or lack of trust in this stock, my investment philosophy is simple; whoever makes an early move, they will be the one gain the most!

When the Company shows or deliver the numbers at that time, everyone would be rushing to grab a piece of shares in the stock, which surely hard as no of shares very little. Share price will surely spike up.

https://klse.i3investor.com/blogs/fatprofitfatwealth/138645.jsp