Uem Sunrise Bhd. Current Price 1.18

Uems will be a strong beneficiary of KL – Singapore High Speed Rail (HSR) Project.

UEMS is the master developer of Gerbang Nusajaya which hosts Iskandar Puteri HSR station. Gerbang Nusajaya commands a gross development value (GDV) of RM42 billion.

How strong is the demand for UEM’s properties near the HSR station anyway?

“The speed of sales of Melia Residences has been phenomenal with a total of 206

phase one and phase two units completely taken up within the first two days of its

launch, surpassing our original target of three to six months,” said Raymond

Cheah, UEM Sunrise’s chief operating officer, commercial.

“We are very pleased with the sales contribution that has been coming from our

Southern region projects”. There is also “renewed interest” for our premium Estuari

Gardens as reflected from the improved take-up for the product, CEO, Anwar Syahrin

Abdul Ajib ( Q3 FY17 )

Recent land disposals in Iskandar would allow the group to monetise its vast land bank in Iskandar Johor and redeploy the capital either to pare down its debt or invest in new land bank. This would result in positive earnings in the upcoming quarterly reports.

As of 21 Nov 2017, unbilled sales stood at RM2.9bn. Based on the current financial

performance of UEMS, this stock is undervalued. Its growth prospects in the central

region and overseas development remain bright and stable.

Election Stock

In 2013 general election, UEMS was the BEST performing GLC stock whereby it rose

from 1.63 to 3.66 (+123%) .

Technical Analysis

1) MACD crossing is signifying a firm uptrend

2) 5 year downtrend since 2013 is bottoming out.

3) Strong risk to reward ratio

4) Well supported despite the general market selloff between 15- 17 January 2018.

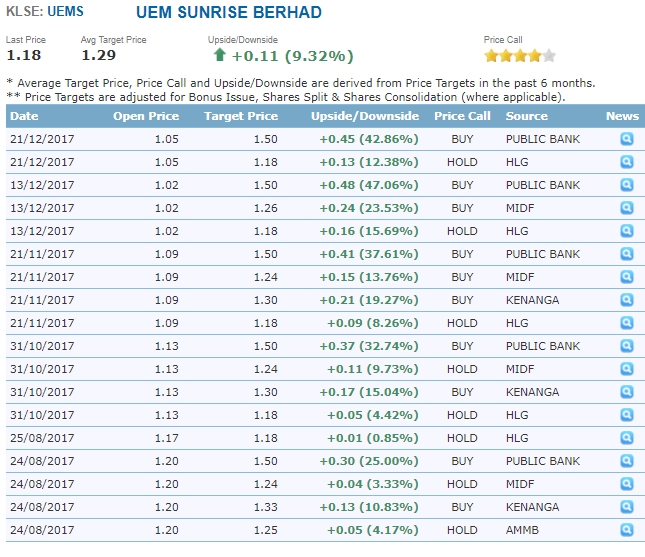

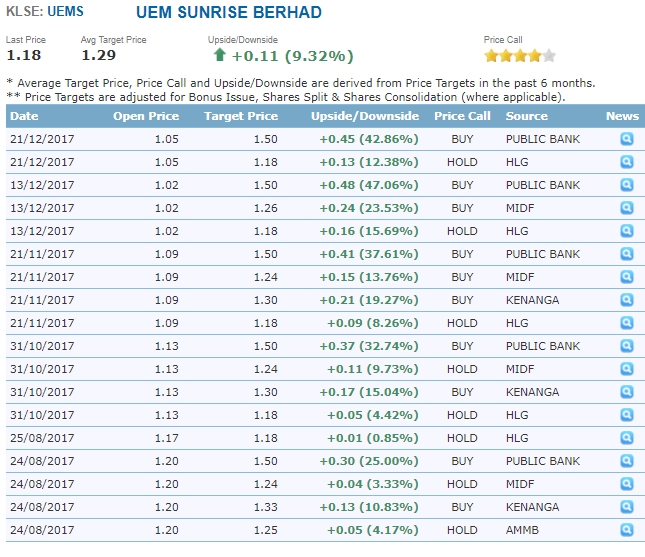

If you analyse all of these bullish target prices, NONE of these reports mentioned about

the HSR station and its direct benefits to UEMS.

Catalyst Summary

1) Management mentioned that resumption of dividends will be determined in 4Q17. Therefore, should there be an announcement of dividends, there will be a spike.

2) Benefits of HSR to UEMS and the increase in land value has not been factored in the price.

3) Election 2018 is in less than 6 months.

4) Lembaga Tabung Haji has been aggressively collecting its shares.

5) Strong fundamentals backed by growth.

http://klse.i3investor.com/blogs/greentrade/145117.jsp

It has been a long dreadful 5 years of stock price declines for UEMS shareholders.

Therefore, after careful considerations with regards to risks, prospects and performance.

Greentrade$ is now prepared to enjoy a Beautiful Sun Rise.

Uems will be a strong beneficiary of KL – Singapore High Speed Rail (HSR) Project.

UEMS is the master developer of Gerbang Nusajaya which hosts Iskandar Puteri HSR station. Gerbang Nusajaya commands a gross development value (GDV) of RM42 billion.

How strong is the demand for UEM’s properties near the HSR station anyway?

“The speed of sales of Melia Residences has been phenomenal with a total of 206

phase one and phase two units completely taken up within the first two days of its

launch, surpassing our original target of three to six months,” said Raymond

Cheah, UEM Sunrise’s chief operating officer, commercial.

“We are very pleased with the sales contribution that has been coming from our

Southern region projects”. There is also “renewed interest” for our premium Estuari

Gardens as reflected from the improved take-up for the product, CEO, Anwar Syahrin

Abdul Ajib ( Q3 FY17 )

Recent land disposals in Iskandar would allow the group to monetise its vast land bank in Iskandar Johor and redeploy the capital either to pare down its debt or invest in new land bank. This would result in positive earnings in the upcoming quarterly reports.

As of 21 Nov 2017, unbilled sales stood at RM2.9bn. Based on the current financial

performance of UEMS, this stock is undervalued. Its growth prospects in the central

region and overseas development remain bright and stable.

Election Stock

In 2013 general election, UEMS was the BEST performing GLC stock whereby it rose

from 1.63 to 3.66 (+123%) .

Technical Analysis

1) MACD crossing is signifying a firm uptrend

2) 5 year downtrend since 2013 is bottoming out.

3) Strong risk to reward ratio

4) Well supported despite the general market selloff between 15- 17 January 2018.

If you analyse all of these bullish target prices, NONE of these reports mentioned about

the HSR station and its direct benefits to UEMS.

Catalyst Summary

1) Management mentioned that resumption of dividends will be determined in 4Q17. Therefore, should there be an announcement of dividends, there will be a spike.

2) Benefits of HSR to UEMS and the increase in land value has not been factored in the price.

3) Election 2018 is in less than 6 months.

4) Lembaga Tabung Haji has been aggressively collecting its shares.

5) Strong fundamentals backed by growth.

http://klse.i3investor.com/blogs/greentrade/145117.jsp

It has been a long dreadful 5 years of stock price declines for UEMS shareholders.

Therefore, after careful considerations with regards to risks, prospects and performance.

Greentrade$ is now prepared to enjoy a Beautiful Sun Rise.

Trade at your own risk.

The Author of this article WILL NOT be held responsible for any losses or decisions made.

Kindly Click Here For Contact Enquiries

Copyright 2017 @ Greentrade$

Kindly Click Here For Contact Enquiries

Copyright 2017 @ Greentrade$