This is to update the key answer for the question i raised: What is in it for me? based on the article i shared on 12 Sept 2017.

Background: Pentamaster has decided to list its Automation arm in HK under Pentamaster international limited. Hence, resulted in the earning attributed to the holding company being cut to 63.1%.

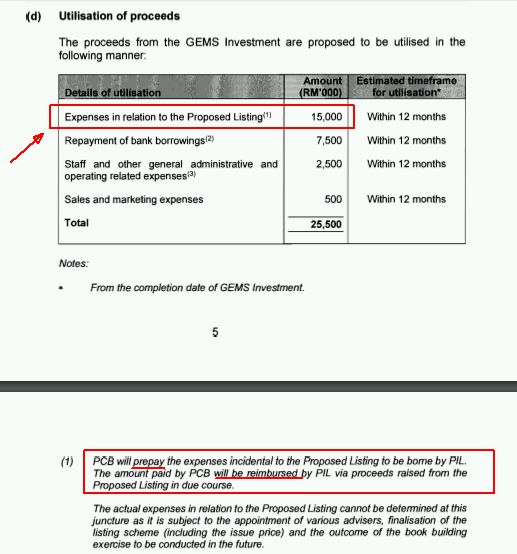

Key Event One:Pentamaster sold some shares to GEMS on 8 August 2017 amounted to RM 25.5 mil. The estimated gain from from this transaction will resulted in Retained Earning of RM 19.1 mil to be added into Equity account as retained earning.

Usage:

>>>> Do take note that the listing fee is expected at RM 15 mil, which is PREPAY by Pentamaster.

>>>> The total sum of proceed RM 25 mil from share disposal and partial listing expenses of RM 4.14 mil has already been reflected in the Pentamaster corporation Berhad (PCB) Q3 2017 quarter result.

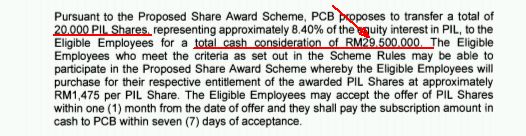

KEY Event 2: Employee Share Award Scheme

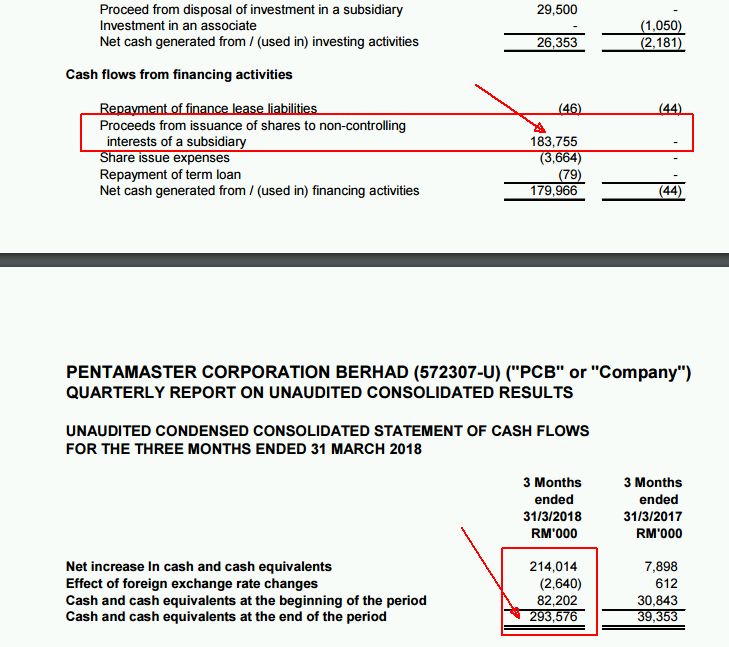

>>> The sum of cash RM 29.5 mil should be reflecting in the latest Pentamaster International Limited quarter Cash Flow Statement. We will counter check later

Key Event 3: PIL Public Share Offering

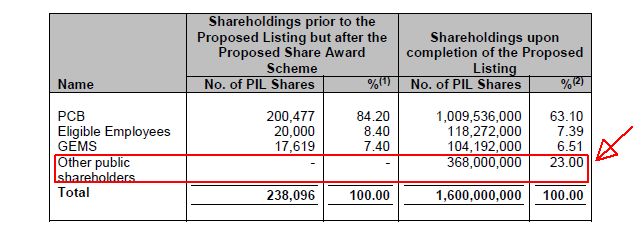

>>>> The Hk Listing enable PIL to raise HKD 368 mil or x 0.50 quarterly HKD Q1 2018 exchange rate = RM 184 mil (of which RM 116.1 mil @ 63.1% belongs to PCB). Balance therefore, RM 67.9 mil will be reflected in PIL cash flow statement.

>>>> Together with the Key Event (2): Employee Share Award Scheme of RM 29.5 mil

>>>>Total Proceed therefore, reflected in PIL'scash flow statement = around RM 97.4 mil (incl. minor expenses)

Summary:

(1) Based on latest quarterly report shown yesterday, below please find cash flow statement of Pentamaster International Limited. (PIL) The number is very close.

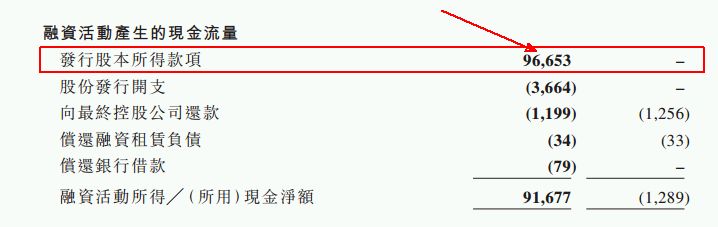

(2) Based on latest quarterly report shown yesterday, below please find cash flow statement of Pentamaster Corporation Berhad (PCB). The amount is also tally.

So, what is in it for me for this whole HK listing exercise?

Based on the latest PCB cash flow statement, a total:(1) RM 25.5 mil cash flow into my account based on key event (1)

(2) RM 115.5 mil cash flow into my account (being RM 184 mil - RM 67.9 mil) based on key event (3)

(3) Key event (2) has nothing to do with me

This sum out total RM 115.5 mil + 25.5 mil = RM 141 mil cash @ RM 0.44 sen per share

equivalent to whooping 10 quarters of earning from 2015 Q3 to 2017 Q4

going into my pocket without need to incur any revenue.

Let calculate forward,

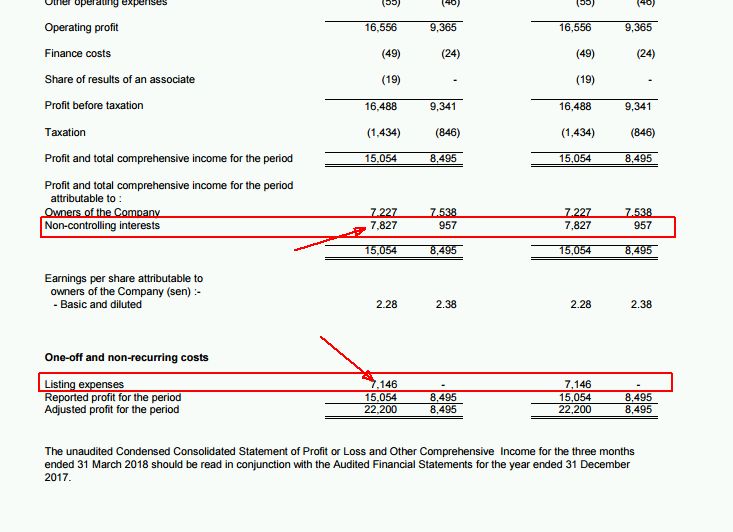

Q1 2018 result has make PCB share out RM 7.8 mil of profit to PIL, or EPS of 2.5 sen. The cash received from whole corporate exercise is 44 sen, a whooping 17.6 times more.

Conclusion:

PCB management has clearly shown thier wisdom in this HK listing stuff process. And it has cash pile of RM 298 mil. Remember, PCB's pocket IS NOT PIL's pocket, but PIL pocket IS PCB's pocket :-)

Cheers!

YiStock

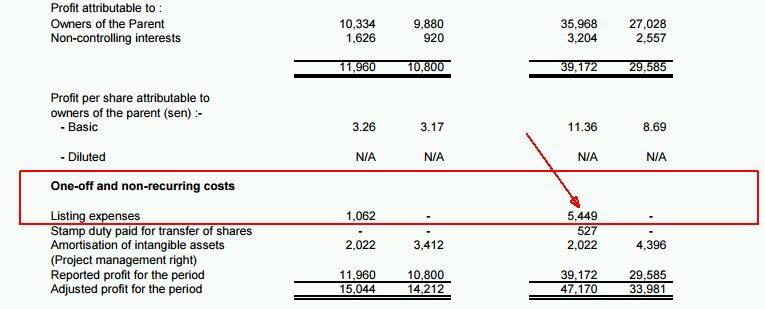

Note 1: Listing Expenses

Based on Q4 2017 & Q1 2018 quarter reports: Listing expenses reported so far was RM 5.449 mil + RM 7.146 mil = RM 12.595 mil. However, according to Key event (1) above, the listing expenses should be RM 15 mil. Therefore, we should anticipate balance RM 2.4 mil to appear in coming quarter?

Anyway, based on Key event (1), this listing Fee is to be repay by PIL to PCB in due course.

Note 2: I have written an article about the sensible reason behind the whole deal, if you are interested, you may click below title. And feeling excited the "sense" behind it.

Pentamaster - It's making lot of "SENSE'" Now (2) YiStock

Author: YiStock | Publish date: Fri, 27 Apr 2018, 09:30 AM

When the bursa sea is red,

is good to off the trading platform and relook the company I have

invested in. Reason is to reaffirm myself that i'm investing in a right

company. It helps to mitigate the fear.

I have written an article about Pentamaster back in 12 Sept 2017. My biggest question on Pentamaster HK listing is still

WHAT IS IN IT FOR ME?

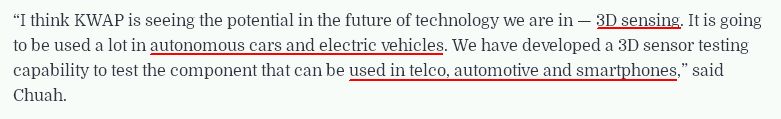

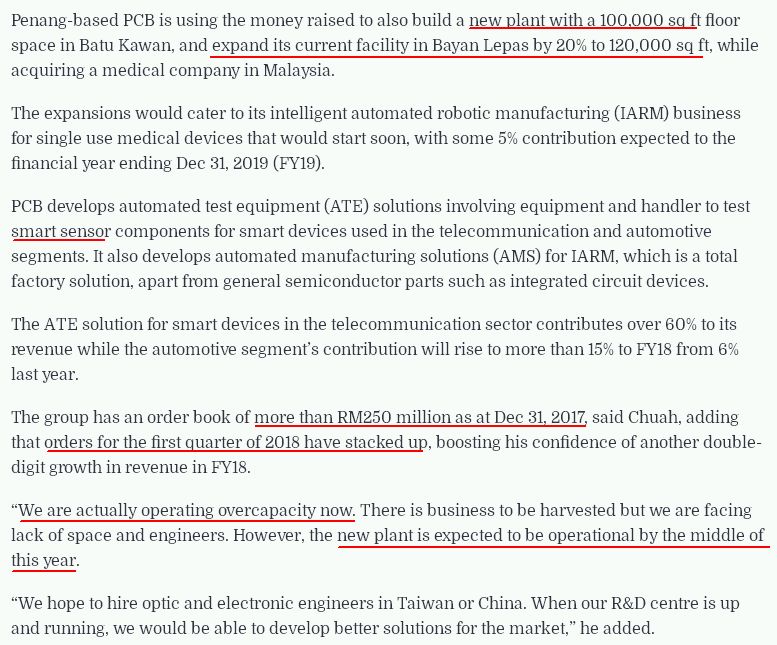

On 26 march 2018, The edge has published an article after inverviewing the Director of Pentamaster. The key finding inside the article i extracted and as below:

As far as i know, Apple is

the front runner of 3D sensing. Reuters claimed that Apple is in lead of

at least 2 years ahead rivals on this technology. https://www.reuters.com/article/us-apple-android-suppliers-analysis/apple-grabs-two-year-lead-in-3d-sensing-race-idUSKBN1GW0GA.

From this report, we can see also other phone makers are also going

into same dicrection. Including major phone players in China. Probably 1

of the key reason promted Penta's listing in HK.

Well, one might start

thinking the Apple X is not selling well, and will not be selling well.

See below, expecting 40% of smart devices will be equiped with 3D

camera. Plus, 3D sensing will also be used in upcoming mega automotive

trend, i will explain why later.

How i get a clue on Pentamaster is major beneficiary in sensor mega trend, and in particular 3D Sensor?

Let check back the financial reports:

| Automated Equipment | Manufacturing solution | Smart Control Solution | ||

| 2016 Q1 | REV | 23,042 | 8,012 | 476 |

| PAT | 3,520 | 509 | -447 | |

| 2016 Q2 | REV | 29,585 | 8,182 | 3,548 |

| PAT | 4,531 | 2,360 | 1,272 | |

| 2016 Q3 | REV | 19,647 | 19,089 | 1,862 |

| PAT | 5,892 | 2,553 | -421 | |

| 2016 Q4 | REV | 31,548 | 8,746 | 3,425 |

| PAT | 14,267 | -492 | 391 | |

| TOTAL | REV | 103,822 | 44,029 | 9,311 |

| PBT | 28,210 | 4,930 | 795 | |

| 2017 Q1 | REV | 43,094 | 3,128 | 1,598 |

| PAT | 11,010 | -2,053 | -559 | |

| 2017 Q2 | REV | 40,633 | 16,867 | 3,968 |

| PAT | 6,523 | 5,364 | 749 | |

| 2017 Q3 | REV | 72,731 | 9,430 | 3,007 |

| PAT | 13,337 | -1,312 | -219 | |

| 2017 Q4 | REV | 79,646 | 19,790 | 4,405 |

| PAT | 13,937 | 2,612 | 1,139 | |

| TOTAL | REV | 236,104 | 49,215 | 12,978 |

| PBT | 44,807 | 4,611 | 1,110 | |

For easy reference, i focus on Automated Equipment segment.

In 2017 1H, Pentamaster recorded a total revenue RM 83.7 mil revenue against RM 52.6 mil in 2016 1H. A jump of approximately 60%.

In 2017 2H, Pentamaster recorded RM 152.4 mil revenue against RM 51.2 mil in 2016 2H. A jump of massive 198%

Pentamaster rallied all the way close to RM 3.20 before Donald Trump making enough trouble, plus recent tech stock sell down.

To me i view the price now super attractive.

Of course, i need to know (1) what caused the big jump in Revenue and, (2) more concrete evident if such massive jump in Revenue is sustainable.

I can't find any clue what

triggered the massive revenue jump via quarter report. The report only

mentioned sensor sensor and sensor.

To confirm this, i

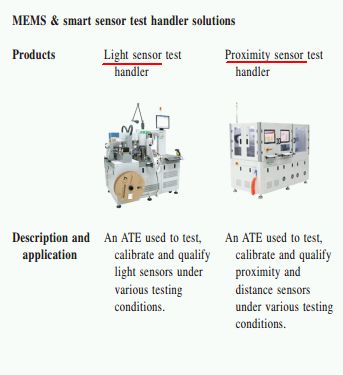

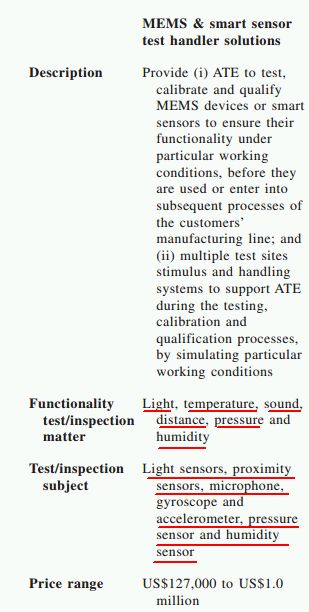

did a search in HK PIL listing prospectus. And i found below info

(Please note that the prospectus is only comparing 1H 2016 vs 1 H2017; so it involves a lot of guesstimate, as usual)

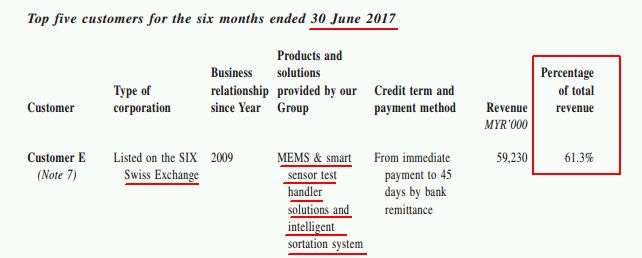

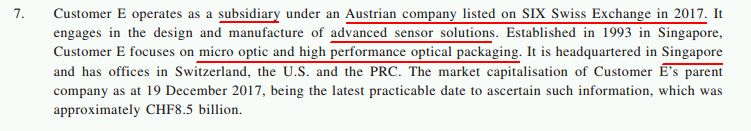

(1) The above customer E is listed in Swiss, so i pretty sure IT IS NOT APPLE!

(2) Total RM 59.23 mil revenue from this customer E or 61.3% (pretty big percentage)

(3) From above description, I think we are 99.9% sure, the company is Heptagon, a jan 2017 acquired company by AMS AG, one of the biggest Sensor company in the World. http://www.eenewsanalog.com/news/ams-pay-850-million-optical-business-0

If you are an investor of Gtronic, you should know this company.

The above 3 make Apple 3D Camera possible.

How about other function? Example:

Now, Is Pentamaster recent revenue surge sustainable?

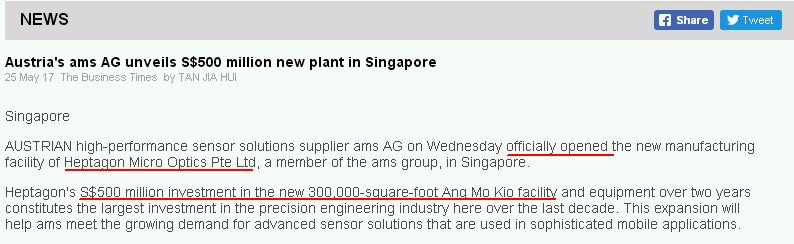

The surge in Pentamaster Revenue for FY 2017 i believe is from AMS's heptagon expansion for their Ang Mo Kio facility.

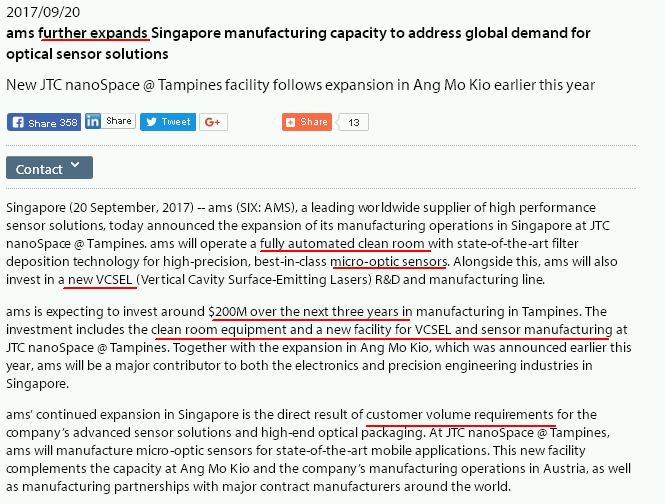

On 20 Sept 2017, AMS

annouced it will further expand it regional manufacturing facility in

singapore Tampines. The investment amount is expected to be USD 200 mil

(RM 800 mil)

Based on above date, I believe Pentamaster should continue to benefit from AMS singapore expansion and IT IS URGENT! Reason i say so:

(1) AMS AG's Guidance

(2) Gtronic latest release quarter earning report guidance:

(3) The director's guidance

(4) Aminvest Guidance of more RM 300 mil Order book as of Q1 2018

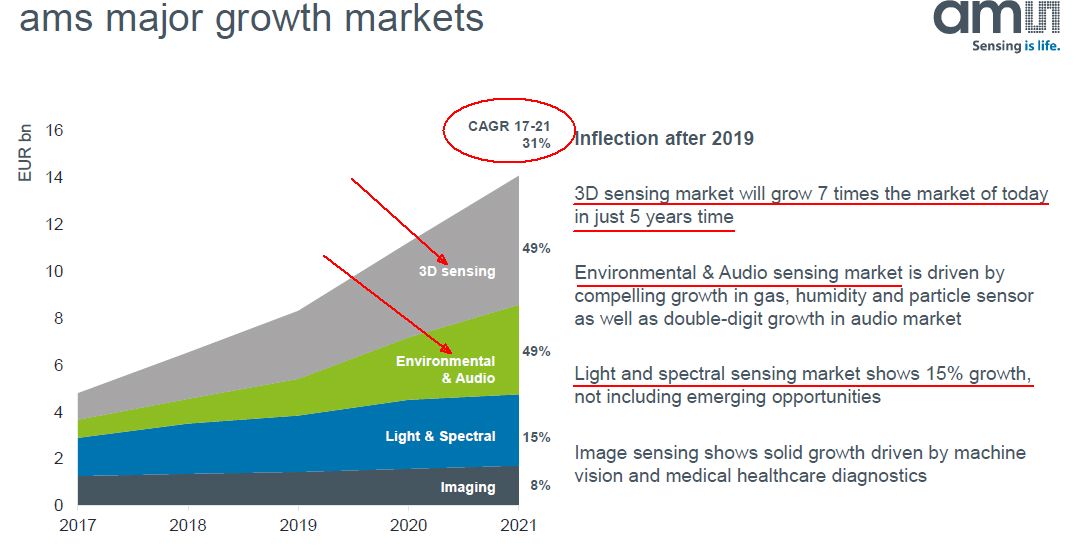

THE FUTURE OF SENSOR

Pentamaster should continue

to expand together with AMS since their relationship has been

established since 2009. I have extracted some key info from AMS AG

website. AMS AG key focus expansion should be on:

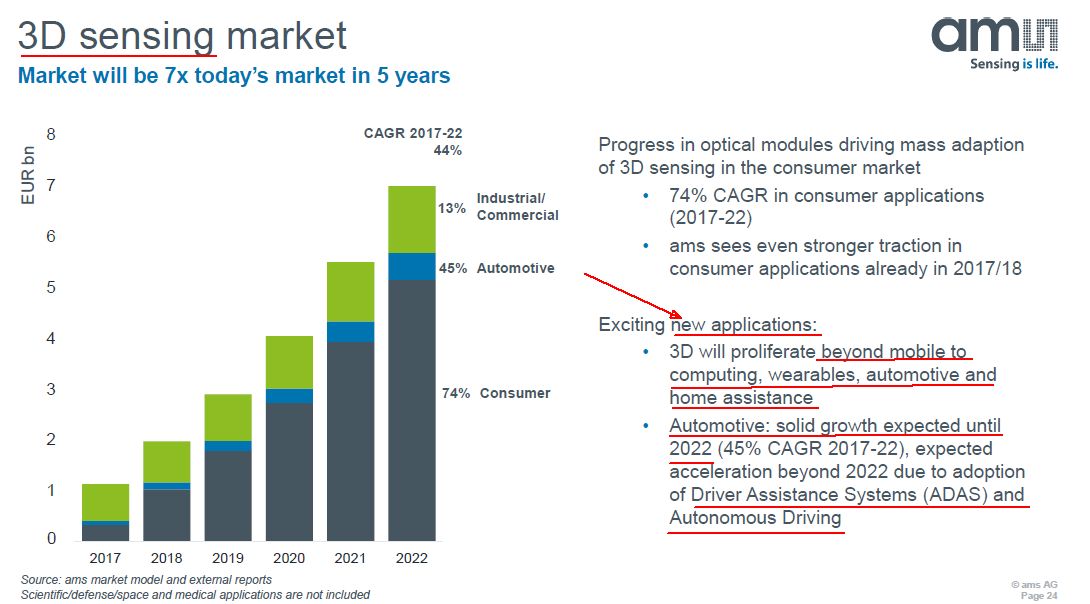

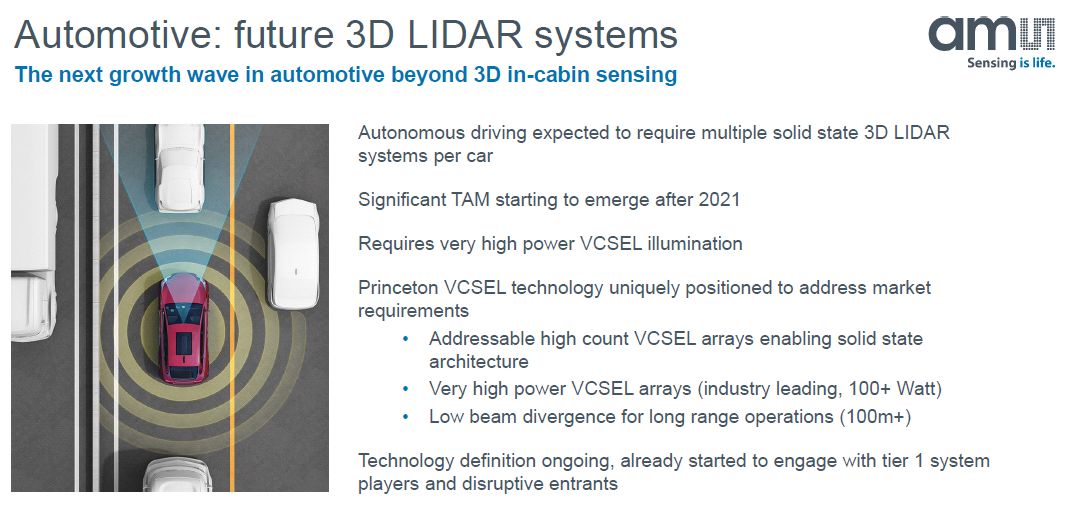

(1) 3D sensing

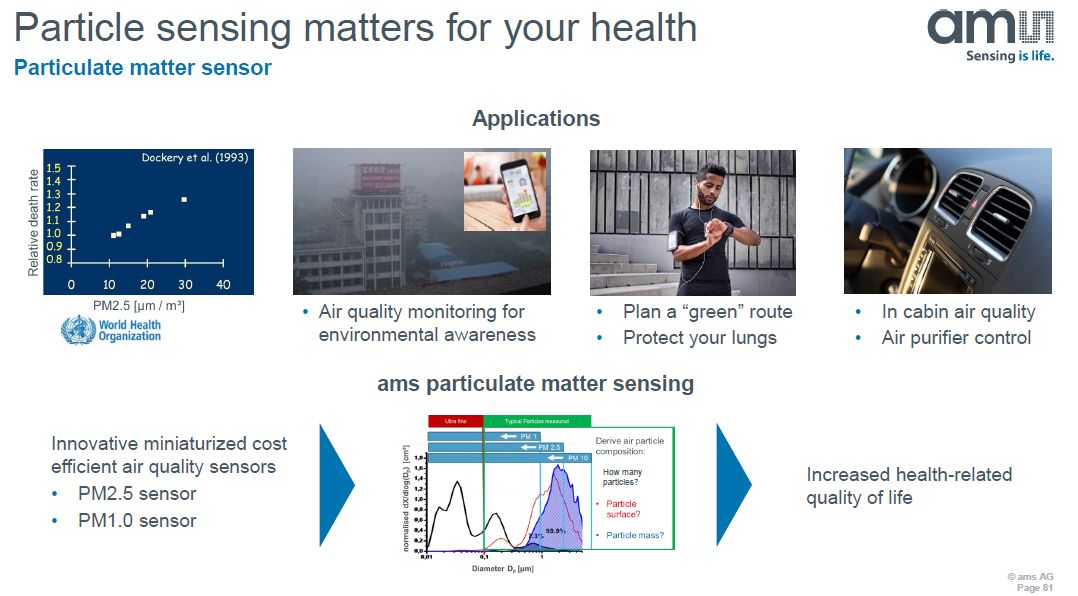

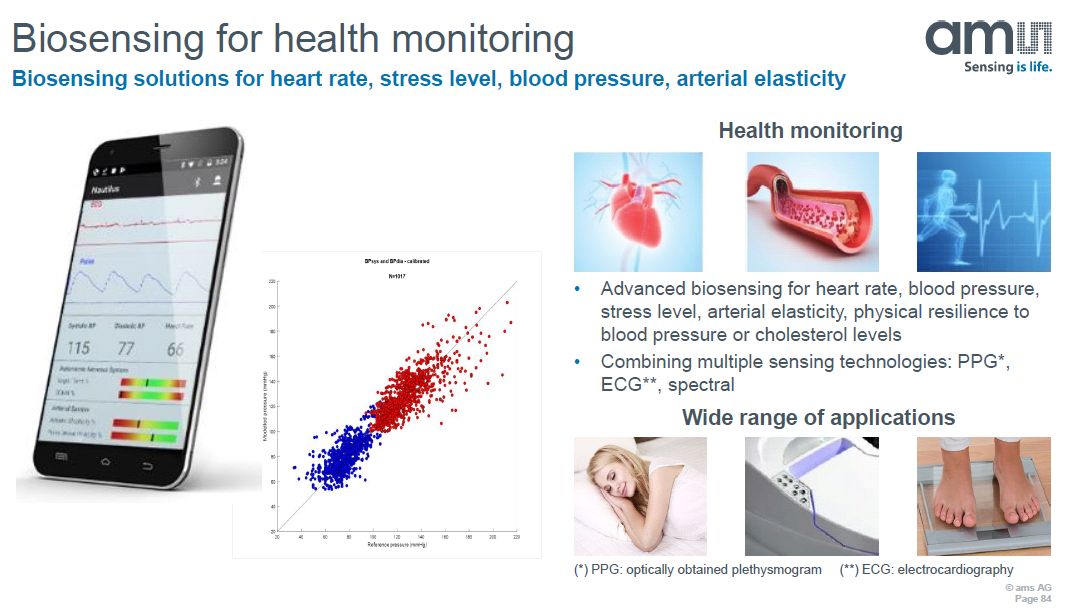

(2) Enviroment & Audio sensing

Out of 3D sensing, AMS highlighted the pontential of 3D sensing application:

Thats all, for current business prospective of PENTAMASTER.

Next, let talk about China and the important of listing in HK.

One of the news hottest in town today is the ZTE. Normally when there is a threat, there is always an opportunity.

I foresee a MEGA TECH RACE BETWEEN CHINA & USA all the way to 2025.

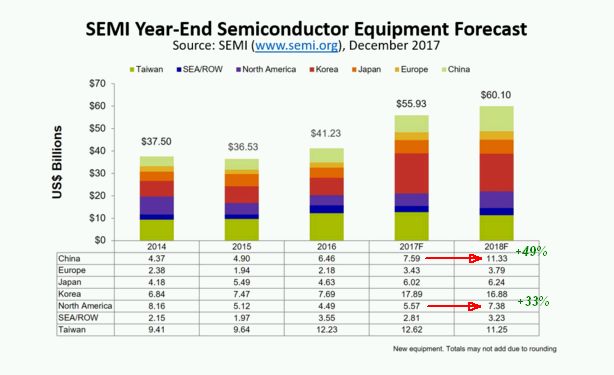

According to article purblished in December 2017 by SEMI, Semiconductor Equipment forecasted for China for 2018 is amounted to USD 11.33 billion or a growth of 49% compared to previous years. Followed by North America USD 7.38 bil or a growth of 33%. These 2 market continue to be major growth region for the semiconductor equipment.

I attended previous EGM. Pentamaster is grabbing BOTH piece of cake via HK listing.

The director in his press interview has constantly highligted the listing in HK is to gain good publicity to mainland market. I suppose the above growth data/ forecast is the reason for his HK listing decision.

With the strong growth story, I hope the impact of the dilution of earning, perhaps can be mitigated.

Most importantly, being a equipment manufacturer, Pentamaster is not suppose to be that sensitive on seasonal up down of

Apple directly. Simply because, AMS need to get the production capacity

and capability ready for peak season. Obviously AMS cannot wait till

last minute and tell penta to deliver equipment. Further more, AMS is

not 100% on Iphone X. It got so many area of usage for it's sensor

product. Another fear that trigger by clueless factor?

This is how i think.

Cheers,

YiStock

http://klse.i3investor.com/blogs/YiStock/158009.jsp

http://klse.i3investor.com/blogs/YiStock/158009.jsp