MMCCORP (BSKL : 2194)

TP 1 : 1.75, TP 2 : 1.90, TP 3 : 2.20

MMCCORP-C8

TP 1 : 5c, TP2 : 7c, TP3 : 10c

Background

MMC Corporation Berhad (MMC) is a leading utilities and infrastructure group with diversified businesses under three divisions, namely ports and logistics, energy and utilities and engineering.

Few key units under its core businesses:

1. Ports and Logistics : Pelabuhan Tanjung Pelepas Sdn Bhd,Johor Port Berhad, Northport (Malaysia) Bhd, Penang Port Sdn Bhd, Tanjung Bruas Port Sdn Bhd, JP Logistics Sdn Bhd and Kontena Nasional Berhad. Internationally, MMC has presence in Saudi Arabia via Red Sea Gateway Terminal Company Limited, a container port terminal within the Jeddah Islamic Port.

2. Energy and Utilities : MMC is the single largest shareholder of both Malakoff Corporation Berhad and Gas Malaysia Berhad.

3. Engineering : leading role as the Project Delivery Partner (PDP) and underground works package contractor for the 51 km Klang Valley Mass Rapid Transit (KVMRT) Sungai Buloh-Kajang project (SBK Line) and Sungai Buloh-Serdang-Putrajaya project (SSP Line).

4. Construction : Langat Centralised Sewerage Treatment Plant, Langat 2 Water Treatment Plant and Refinery and Petrochemical Integrated Development (RAPID) Pengerang Cogeneration Plant. MMC also has a 20% effective interest in Borneo Highway PDP Sdn Bhd (BHP), the appointed project delivery partner for the Pan Borneo Highway Project in Sabah.

5. Other businesses : water treament plant operator, Senai Airport Terminal operator, developments in Iskandar Malaysia, Johor and Kulim, Kedah, namely Senai Airport City, Tanjung Bin Petrochemical & Maritime Industrial Centre (TBPMIC) and Northern Technocity (NTC).

Major Shareholders as at 20017 Annual Report

1. Seaport Terminal (Johore) Sdn Bhd (Vehicle for Tan Sri Syed Mokhtar Albukhary) - 1,576,108,840 shares (51.76%)

2. Amanahraya Trustees Berhad - 552,836,200 shares (18.16%)

3. Lembaga Tabung Haji - 231,569,700 shares (7.60%)

Earning Growth Prospects For Coming Quarters (extract from company reports)

1. http://www.theedgemarkets.com/article/mmc-corp-optimistic-business-friendly-tun-m-will-benefit-logistics-cargo-players2.

2. Ports & Logistics division is expected to register higher revenue across all the ports. The completion of 49% acquisition in Penang Port Sdn Bhd (“PPSB”) and the proposed acquisition of the remaining 51% equity interest is expected to contribute positively to the Group’s future earnings as it allows full consolidation of PPSB as a wholly-owned subsidiary

3. The Energy & Utilities division will continue to contribute positively from the Group’s associated companies, namely Malakoff and Gas Malaysia.

4. Substantial existing order-book provides earnings visibility for the Engineering & Construction division anchored by the KVMRT-SSP Line underground work and Project Delivery Partner (PDP) role for elevated portion. Furthermore, the earnings contribution from Engineering & Construction division will be sustained by on-going projects namely Langat 2 Water Treatment Plant, Langat Centralized Sewerage Treatment Project and our involvement in the PDP role for Pan Borneo Sabah Highway.

Recent Shareholding Changes

EPF and Tabung Haji are among institutions recently added shareholdings in MMCCORP.

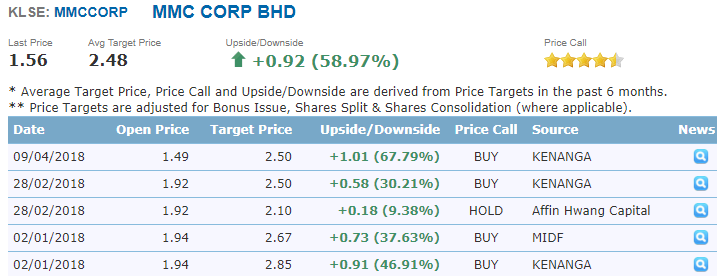

Recent Price Targets by Investment House

In 2018, few brokerages houses have initiated coverage and provided target of between 2.10 to 2.85.

http://klse.i3investor.com/ptservlet.jsp?sa=pts&q=MMCCORP

Conclusion

With the recent correction in MMCCORP price, I believe it is a steal for long term investors looking to hold a position in this strategic company. Prospects are looking bright ahead moving forward 2018 onwards.

http://klse.i3investor.com/blogs/InvesthorsHammer/157966.jsp