It is no exaggeration to say that Kobay is a mini SAM Engineering. Both also started as supplier of components to semiconductor industry. By using their expertise in precision engineering, they later diversified into manufacturing of arcraft components.

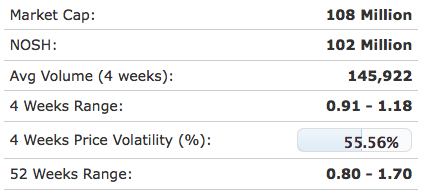

However, Kobay is a much smaller player. While SAM has market cap of RM1 billion, Kobay's market cap is only about RM100 mil.

(Kobay share price)

As shown in chart above, Kobay's share price spiked in February 2018 after reporting a strong set of results for its December 2017 quarter (EPS of 4.45 sen). It touched RM1.70 on 5 March 2018. However, share price slowly retraced to RM1.00 over the subsequent few months. This could be attributed to bearish sentiment caused by Trump trade war threat and GE14 turbulence during that period.

And probably due to insiders selling down ahead of poor results as well.

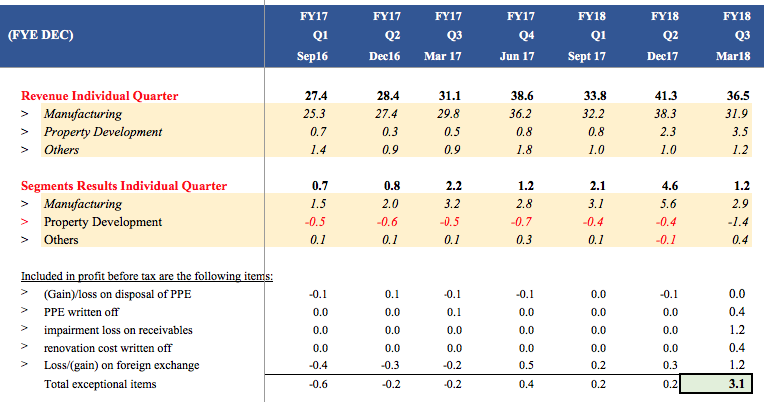

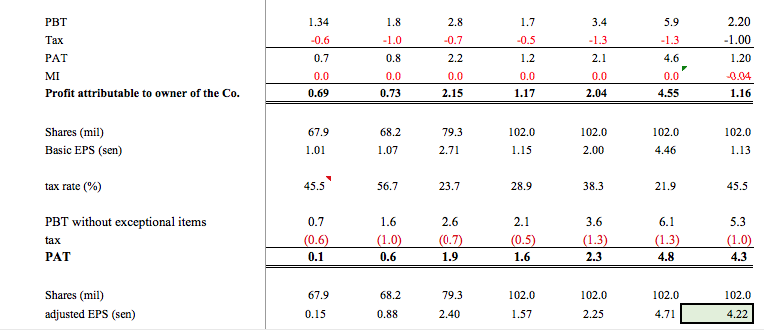

True enough, the company released its March 2018 quarter in May 2018. This round, quarterly EPS was only 1.09 sen (vs. previous quarter 4.45 sen). What a big disappointment.

Did earning really disappoint ?

Nope. If you look at the March quarterly result in detail, you will notice that core earning has actually remained more or less the same. The presence of exceptional items dragged down its EPS.

As shown in table above, the group actually reported PBT pf RM5.3 mil. It was only after factoring in exceptional items of RM3.1 mil that profit declined substantially.

Excluding the RM3.1 mil exceptional items (which is not recurrent), core EPS was actually 4.22 sen, quite closed to the 4.55 sen reported in December 2017 quarter.

Concluding Remarks

As we all know, I wrote about SAM Engineering recently (it announced a massive 23 sen dividend yesterday). Kobay is another stock that I like for exposure to precision engineering related indutries (semiconductor and aerospace).

The semiconductor industry is currently doing well, with US Semicon index touching new heights. On the other hand, Malaysia is emerging as a increasingly attractive destination for aerospace related FDI. Even UMW recently sets up a new aerospace division.

Strictly speaking, Kobay does not yet qualify as a company with moat (in my opinion, SAM Engineering does have moat). But unlike its peers in general metal stamping and injection moulding, Kobay's expertise in precision engineering lands it in a niche area that faces less competition. With the booming semiconductor and aerospace industry, I believe it stands a good chance of doing well going forward. All eyes on coming quarter results.

Appendix - 2018 NST Article On Malaysia's Aerospace Industry

http://klse.i3investor.com/servlets/cube/icon8888.jsp