Dear Investors and IOU Holders,

Unlike my usual extremely long letters. This one will be relatively short as it is a brief update on some of the changes I’m making to the fund.

Previously, I’ve stated that zero leverage will be used. However, I’ve recently signed up for credit facilities of XX with Maybank Investment Bank. This is roughly 27.8% of the current fund size of XX.

Now, make no mistake, there are very good arguments for one to maintain a zero-leverage policy. There is a saying I particularly like from Charlie Munger.

“There is only 3 ways for a smart person to go broke. Ladies, liquor and leverage.”

However, having thought about it very deeply for the last few months, I’ve finally decided to go through with the process (you should read my flip-flopping text messages with my extremely patient remisier).

There are a few reasons for it, and I’ll elaborate about them in full. Before we continue, here are some salient details. Please consider it as an official update and communication.

Overview

Current CDS Account: XX

Pledged CDS Account: XX

Portfolio Value of CDS Account: XX

Portfolio Value of Pledge CDS Account: XX

A certain number of shares with a value of XX have been transferred to the Pledged CDS Account to obtain the credit facility of XX. Interest is 4.95%.

So why did I apply for credit facilities for the fund? There are a few reasons.

To take advantage of the current fall in prices for equities.

As many of you may be aware, equities globally have seen a sell off, with many markets showing drops of more than 20%. Putting us officially in bear market territory.

The KLSE market, or more specifically the “BURSA MALAYSIA MIDS CAP INDEX” (which consist of companies listed in the BURSA with Market Capitalisation of RM200m to RM2bil and is roughly 84% of our portfolio) have fallen from 17,338.5 to 13,063, or 24.65%.

Meanwhile, the portfolio on a fund unit basis have only fallen by 12.6%. This is an outperformance of 12.05%. Those of you who have purchased additional fund units during the year would likely have obtained better returns on an internal rate of return (IRR) basis.

So, what does this all mean?

This means a fantastic insurance company that is growing at roughly 6% percent per year is only selling for 6 times current year earnings or 16.67% earning yield.

A wonderful petrol retailing, and refinery company is selling for only 5 times of its highly depressed current year earnings or 20% yield.

Profitable and dividend giving steel manufacturing companies selling for less than the net cash value or working capital. Buy the cash in their bank accounts, along with some inventory. The factory, land and everything else give you for free!

Property development companies selling at 70% discount to its book value or 5 times earnings. Why buy houses at 15% off, when you can buy them at 70% off!

In many of these cases, we can buy shares in these businesses at prices far below the cost of setting them up! And they also possess wonderful economic moats, which takes ingenuity, blood, sweat and tears to develop. All of which we are now getting for free!!

And I think having credit facilities ready would allow us to get more aggressive as prices potentially fall further and thus lowering our investment risk.

Why not raise funds from current/new investors instead of getting credit?

The reason is twofold. As I’ve always said, in this fund, the safety of your capital comes first and foremost. I would rather lose clients than to lose clients’ money. This is doubly true for our IOU holders.

I’ve previously indicated that I would not accept principal guaranteed funds beyond 50% of my equity. And this is something that is ironclad. Because I believe this is the only way I can ensure my ability to pay back the money invested and the trust given no matter how bad things get. With the guaranteed principals currently quite close to that limit, headroom for further fund raising is limited.

The second reason is that, despite the lock period and the penalties that are in place in the event of an early withdrawal. This is not something I intend to enforce except for the direst of situations. At the end of the day, this fund is mainly a test run, and you’re all close friends or family.

As you may have noticed, I’ve added significant funds in the last month or so to take advantage of the cheap equity prices. It was around that moment, when I realized that I was all in and would not be able to fulfil any sudden withdrawals (like the one that has taken place this year) without selling stock that is extremely cheap. This is not a situation I would want to be in, or have the fund be in.

By utilising the credit facility, I would be able to keep significant savings to meet any sudden withdrawals without affecting the fund.

Having said that, I would not recommend selling your fund units at the current time and prices. I’m always more than happy to buy out anyone here. But it’s not my goal in life to benefit financially from the misfortune or the temporary suspension of intelligence from my friends, family and partners.

Done correctly and conservatively, leverage can be good.

For many here, you may know someone who has lost a lot of money or gone bankrupt in the 1999 Asian Financial Crisis, or the 2008 Financial Crisis.

Personally, my grandfather bought shares using borrowed money near the peak just before the 1999 Asian Financial Crisis. During the crisis, he lost roughly one hill worth of rubber plantation to pay back the loans.

Decades of hard work gone over a moment of stupidity and greed.

Most people in the stock market use borrowed money very aggressively, especially since investment banks allow you to borrow roughly 300% of your capital. For example, our fund of XX, would be able to obtain credit facilities of XX if we wanted to.

However, if one did so, it would only be a matter of time before one goes bankrupt. At 300% debt to equity ratio, the values of one’s stock only needs to fall 30% before you lose it all.

And in times of crisis, the market can fall by 50-60%. We would go from having XX to owing the bank XX.

Even Berkshire Hathaway, one of the greatest and most financially stable company in the world fell by 50%. Google fell from USD346 to USD 155. Imagine being forced to sell it then, and then still owe the bank. Google today is almost USD1,068, even after the 18% drop recently.

Never forget the 6-foot-tall man who drowned crossing the stream that was 5 feet deep on average. In investing and in life, it’s not sufficient to survive on average. We must also survive on the bad days.

The real danger about margin finance is not just because its borrowed money, but because if certain conditions are met, the bank can force you to sell equities at prices you do not want sell.

However, if done correctly and conservatively, it can function just like a typical loan, with no possibility of forced selling.

With that in mind, I’ve decided that credit of roughly 30%-50% would be very conservative, especially with markets already down 25%.

So how does it work?

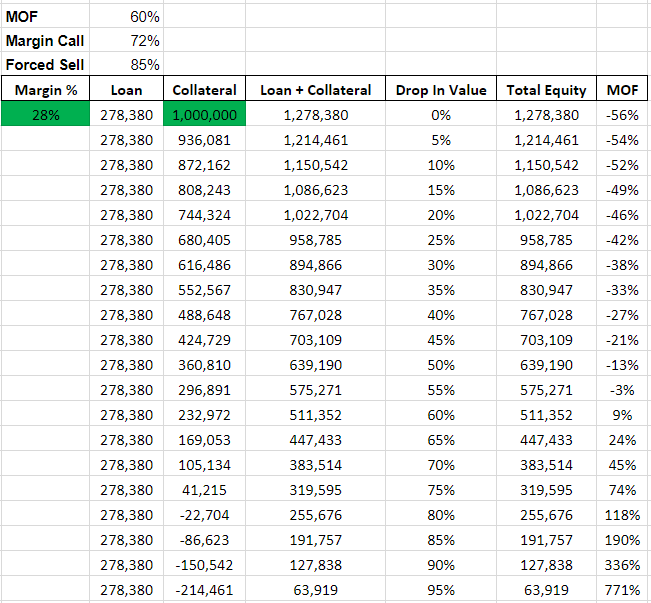

When borrowing money, the investment banks have this rule called a “Margin of Finance” (“MOF”) rule. MOF is basically the net borrowings over the portfolio value. Don’t worry about understanding it for now, I will provide you a table you can see and play with if you wish.

In our case, Maybank Investment Bank would borrow us money up to 60% MOF.

Margin Call is at 72% MOF, where they will request for top up.

Forced selling is at 85% MOF, when the bank will sell your stock for you, regardless of the price, because at 100% MOF, you would have lost it all, and the banks want their money to be safe.

For our more curious IOU holders and investors, below is a link.

https://docs.google.com/spreadsheets/d/1RbxBuvY3h70giCbJPwN6P7tY_MnIyyBSY0XXUgGGMXI/edit?usp=sharing

Based on the table above, our loan of XX starts us off at a very comfortable NEGATIVE 56% MOF.

The markets will need to fall an additional 75% from the current 24.6% drop, before the fund will need to meet any cash calls.

And in the event the 75% drop does happen, a deposit of just XX will bring us back to safety. Which I am very confident of meeting given the ample savings I have.

Incidentally, when Warren Buffet had his own fund or partnership. He too used credit facilities of roughly 35%.

What does a 75% drop mean for us in terms of stock prices?

It means, you can now buy property development companies that pay out dividends of effectively 24% per year at roughly 90-95% discount to revalued book value.

It means that the petrol retailer and refinery company is now selling at 1.5 times earnings or 66.7% earnings yield.

Being long term stock buyers, very few things would be better for us than such incredibly low price.

I would be taking out the special bottle of whiskey (and selling to buy more stocks!) , for any purchases then is virtually guaranteed to make a profit. The profit is earned the moment a bargain is bought, we just must count it later.

Having said that, the nature of borrowings, not matter how small, still results in the probability of bankruptcy going from zero to non-zero. But having considered things very carefully, those are odds I’m willing to take.

Will this result in any additional charges to the fund?

In short, yes. However, it will be very minor.

Our current transaction cost is: RM8 or 0.09% whichever higher. Plus 0.1% stamp duty and 0.03% in clearing fees.

Purchases in the pledged account is: RM12 or 0.38% whichever is higher. Plus 0.1% stamp duty and 0.03% in clearing fees.

As I tend to buy in small numbers when topping up, we are likely to incur only the additional RM4 per transaction. Which considering my past buying or selling history, works out to RM8-RM12 extra per month.

In addition, the investment bank also charges RM2 to collect dividends on our behalf. Which is also why I’ve only transferred out biggest 5 holdings to the account. No point spending money that can be saved.

However, one of the benefits of a nominees account, is the ability for the bank to help us in in participating in any corporate exercises such as subscribing for right issues etc for a nominal fee of RM10 plus cost. These exercises are usually quite tedious and require a lot of form filling, stamp buying, driving around, going to the post office and making sure the company secretary gets everything.

There is also 0.5% stamp duty on the credit facility obtained along with RM10 for each company’s shares transferred. But these are refundable.

The only cost here is the RM60 charged to the fund for the opening of the account.

And in exchange for all this, we now have RM70,000 at 4.95% that we can use to purchase companies yielding 16-20%. Pretty decent deal.

Conclusion

Our more perceptive investors or IOU holders, would have noticed and wondered why not all the stock is transferred.

The reason is simple. At the end of the day, the safety of your capital is paramount. The XX is roughly 140% of the total third-party funds. I believe this provides an adequate buffer.

Also, we would be saving roughly RM60 a year in dividend collection cost, plus any additional RM4 transaction incurred in the event I sell anything. That is at the very minimum 12 plates of garlic chicken rice at Sunway!!

In addition, as your fund manager, I don’t think I will be using the full facility unless truly fantastic opportunities occur. For a day to day basis, only 50% or XX will be used. In the event it exceeds this amount, I’m likely to pay it back down via my own deposits.

There is also likely to be a change in the report presented whenever a new deposit is placed. But I promise it will be clear, concise and easy to understand.

As always, if you have any questions, just call or text me.

https://klse.i3investor.com/blogs/PilosopoCapital/183547.jsp