Techbond Group Berhad (TECHBND, 5289) is scheduled to be listed in Main Market of Bursa

Malaysia on thisWednesday, 5th December 2018. In this article, we share

a few things that you might need to know about this company.

1) What Techbond does?

Techbond Group and its subsidiaries are mainly involved in developing and manufacting industrial adhesives, namely water based and hot melt adhesives. The industrial adhesives are used in manufacting a variety of products, including wood-based products, paper and personal care products, mattress as well as building and construction application.

2) What’s the plan on utilising its IPO Proceeds?

The company is raising a proceeds of RM 39.67 million from its listing on exchange. From which, it plans to utilise the IPO proceeds to:

i) Expansion of Vietnam operations (72.54%)

RM 10 million – Construction of a factory complex in the Vietnam-Singapore Industrial Park (VSIP).

The factory complex will have a built up area measuring 6,968 sq. m. and construction may start by April 2019 upon authorities’ approval. Completion aimed around 1st quarter 2020.

RM 12.7 million has been allocated to purchase the necessary machinery & equipment.

RM 6.0 million in working capital to kick start its operations at VSIP in April 2020.

ii) Expansion of Malaysia operations (14.84%)

According to its prospectus, Techbond will be allocating RM 4.5 million on machineries & equipment purchase for its Shah Alam plant. It mainly involves the setting up of a new low viscosity hot melt adhesives manufacturing line and purchasing of lab equipment for its Quality Control (QC) department.

Techbond has allocated another RM 1.4 million to finance its working capital at its Shah Alam plant.

iii) Listing Expenses (12.62%)

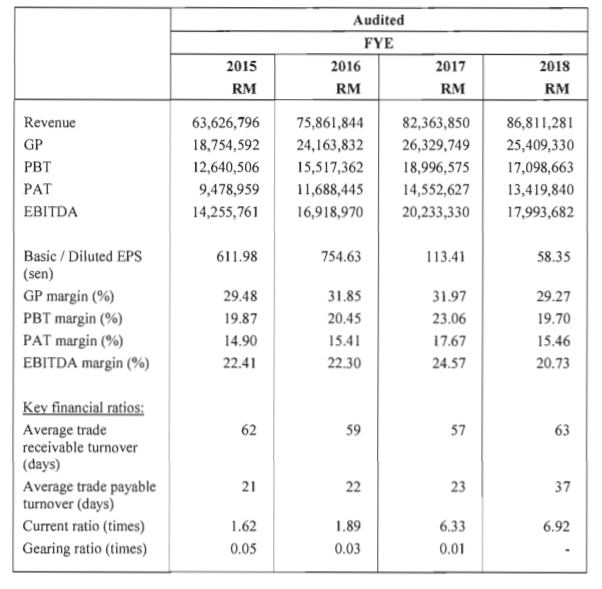

3) How Does Its Financials Look Like?

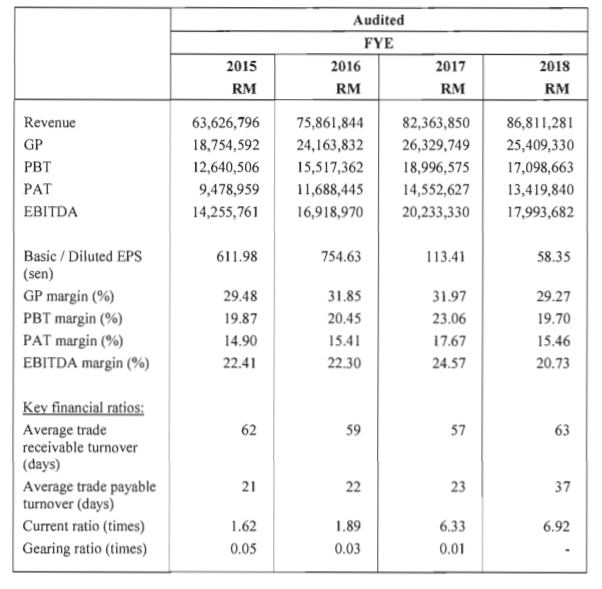

Techbond group berhad maintains a strong balance sheet as it is a net cash company with no debt. As of FYE 2018, the company has a sizeable cash pile of RM 27.68 million.

The company is cash generative, which accounted for RM 2.79 million, RM 3.43 million and RM 10.21 million of positive cash inflow for FYE 2016, FYE 2017 and FYE 2018 respectively. Despite Techbond does not adopt a fixed dividend policy at this stage but we believe it has the capability to distribute a reasonable amount of dividend to its shareholder with its strong cash generating ability.

Looking at its prospectus, we think its growth story is solid as the capacity of the company production is underutilisation. On top of it, we see low concentration risk on the company’s customer base as Techbond has 874 customers for its FYE 2018.

Although its overseas operation exposes the company to foreign exchange risk, we see minimal impact to the company’s operating cashflow. In the past 4 years, Techbond has been recording net cash from its operating activities whereby cash receipts from customers can offset cash paid to suppliers and employees.

4) 24.2x IPO Oversubscription

4) 24.2x IPO Oversubscription

Techbond Group Berhad saw its public portion of its initial public offering (IPO) oversubscribed by 24.2 times which is equivalent to RM 191.24 million. The 24 times oversubscription is a new record in recent years. Refer to the table below, it shows the P/L and subscription responses for the recent IPOs.

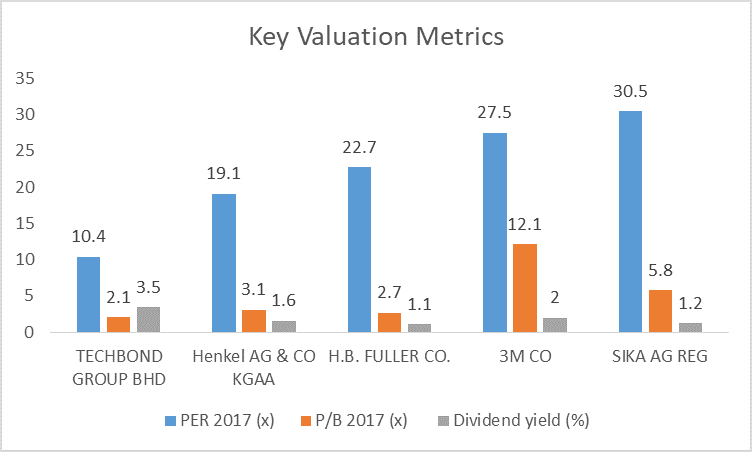

5) Does Techbond Command An Expensive Valuation Given its Solid Fundamentals?

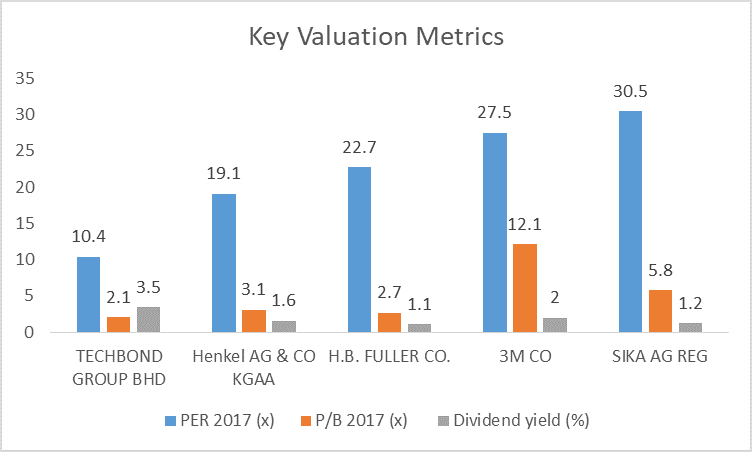

Based on an IPO offer price of RM0.66 per share, Techbond’s valuations look very compelling against its international peers, as its PER and P/B are well below its international peers while offering relatively generous dividend yield in comparison. While international peers having bigger market capitalization and stronger international presence, we still see decent possibility of a valuation re-rating for Techbond, given its strong track records, positive growth prospects and strong balance sheet.

Assuming a conservative fair PER of 15x for Techbond, we would derive a target price of RM0.945 per share, implying a significant upside of 43.18% from IPO offer price of RM0.66 per share.

中文版:https://klse.i3investor.com/blogs/bullbearbursa/185059.jsp

Disclaimer: The views above are opinions based on facts and subjective judgement. We do not take any responsibility for any actions rely on the information discussed.

1) What Techbond does?

Techbond Group and its subsidiaries are mainly involved in developing and manufacting industrial adhesives, namely water based and hot melt adhesives. The industrial adhesives are used in manufacting a variety of products, including wood-based products, paper and personal care products, mattress as well as building and construction application.

2) What’s the plan on utilising its IPO Proceeds?

The company is raising a proceeds of RM 39.67 million from its listing on exchange. From which, it plans to utilise the IPO proceeds to:

i) Expansion of Vietnam operations (72.54%)

RM 10 million – Construction of a factory complex in the Vietnam-Singapore Industrial Park (VSIP).

The factory complex will have a built up area measuring 6,968 sq. m. and construction may start by April 2019 upon authorities’ approval. Completion aimed around 1st quarter 2020.

RM 12.7 million has been allocated to purchase the necessary machinery & equipment.

RM 6.0 million in working capital to kick start its operations at VSIP in April 2020.

ii) Expansion of Malaysia operations (14.84%)

According to its prospectus, Techbond will be allocating RM 4.5 million on machineries & equipment purchase for its Shah Alam plant. It mainly involves the setting up of a new low viscosity hot melt adhesives manufacturing line and purchasing of lab equipment for its Quality Control (QC) department.

Techbond has allocated another RM 1.4 million to finance its working capital at its Shah Alam plant.

iii) Listing Expenses (12.62%)

3) How Does Its Financials Look Like?

Techbond group berhad maintains a strong balance sheet as it is a net cash company with no debt. As of FYE 2018, the company has a sizeable cash pile of RM 27.68 million.

The company is cash generative, which accounted for RM 2.79 million, RM 3.43 million and RM 10.21 million of positive cash inflow for FYE 2016, FYE 2017 and FYE 2018 respectively. Despite Techbond does not adopt a fixed dividend policy at this stage but we believe it has the capability to distribute a reasonable amount of dividend to its shareholder with its strong cash generating ability.

Looking at its prospectus, we think its growth story is solid as the capacity of the company production is underutilisation. On top of it, we see low concentration risk on the company’s customer base as Techbond has 874 customers for its FYE 2018.

Although its overseas operation exposes the company to foreign exchange risk, we see minimal impact to the company’s operating cashflow. In the past 4 years, Techbond has been recording net cash from its operating activities whereby cash receipts from customers can offset cash paid to suppliers and employees.

Techbond Group Berhad saw its public portion of its initial public offering (IPO) oversubscribed by 24.2 times which is equivalent to RM 191.24 million. The 24 times oversubscription is a new record in recent years. Refer to the table below, it shows the P/L and subscription responses for the recent IPOs.

| Company | P/L on First Trading Day | Oversubscription (times) |

| Techbond | ??? | 24.2 |

| Securemetric | 114% | 20.26 |

| Revenue | 69% | 11.22 |

| Nova Wellness | 38% | 2.84 |

| Radiant Global | 130% | 6.7 |

5) Does Techbond Command An Expensive Valuation Given its Solid Fundamentals?

Based on an IPO offer price of RM0.66 per share, Techbond’s valuations look very compelling against its international peers, as its PER and P/B are well below its international peers while offering relatively generous dividend yield in comparison. While international peers having bigger market capitalization and stronger international presence, we still see decent possibility of a valuation re-rating for Techbond, given its strong track records, positive growth prospects and strong balance sheet.

Assuming a conservative fair PER of 15x for Techbond, we would derive a target price of RM0.945 per share, implying a significant upside of 43.18% from IPO offer price of RM0.66 per share.

中文版:https://klse.i3investor.com/blogs/bullbearbursa/185059.jsp

Disclaimer: The views above are opinions based on facts and subjective judgement. We do not take any responsibility for any actions rely on the information discussed.

https://klse.i3investor.com/blogs/bullbearbursa/185058.jsp