Highlights:

Pecca is the market leader in the automotive leather upholstery for OEM passenger vehicles in Malaysia. Pecca Group’s current business activities are predominately in the automotive segment. However, the Group continues its effort to penetrate into the aviation segment. The automotive segment includes the following:

Fundamental Data

Currently Pecca is trading at trailing PE ratio of 13.6 (based on current price of RM0.79) with EPS of 5.8 sen. Its profit has been declining over past 1 year but improving in the recent quarter 1Q19 as shown in the figure below:

Source: Malaysiastock.biz

Pecca’s profit in FY18 declined to RM10.2m (-30 % YoY) and revenue decreased to RM112.6m (-8% YoY) due to lower gross profit margin from automotive segment. The Automotive segment accounted for 95% of total revenue. Geographically, Malaysia market remained the largest contributor to the group’s total revenue, accounting about 83%. However, recent release quarter result shows improving in net profit margin to 12.8% with 3.47 mil profit.

Pecca’s financial position has been strong since IPO in 2016 where it has ZERO borrowings. As at end of 30 Sept 2018, Pecca has cash and cash equivalent of 97M which is equal to share per share of 53 sen (about 67% of market capital).

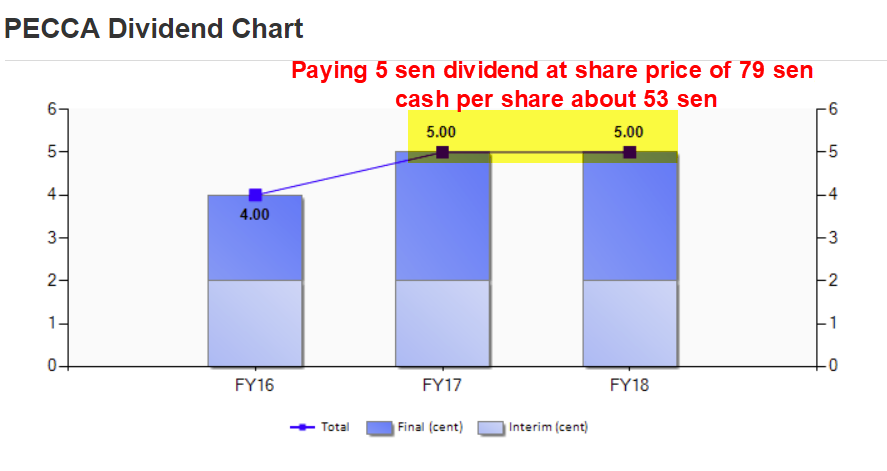

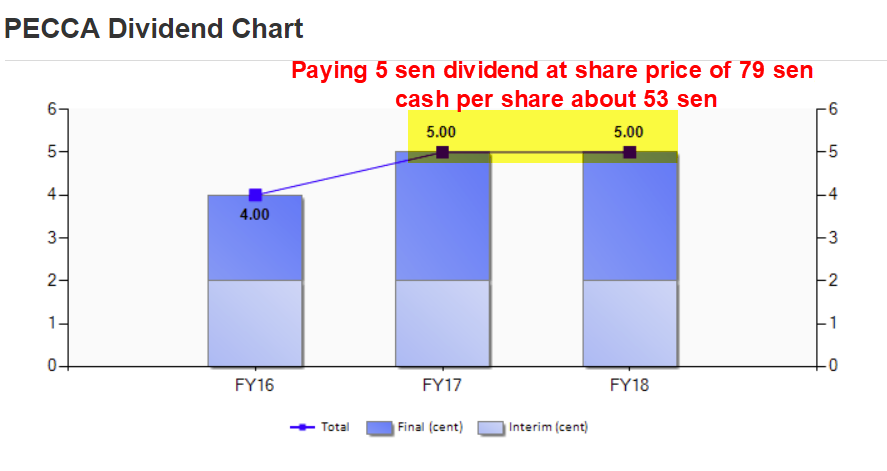

In addition, Pecca has relatively high dividend yield at 6.3% based on current price. It has been paying 4-5 sen dividend over the past 3 years as shown in figure below.

Source: Malaysiastock.biz

To evaluate whether Pecca is still able to maintain its high dividend payout of 5 sen, let see the FCF (free cash flow) from operation from its latest quarter report as below:

Let have a look on Pecca’s free cash flow (after minus out capex of 6.2M) vs market capital ratios as below:

FCF (for FY18)/ Market cap = (15.88M-6.2M) / 141 mil = 6.9% (over past 12 months)

Cash in hand / Market cap = 97 mil / 141 mil = 67%

High level of cash in hand and good cash flow and zero debt provide the sustainability of the future dividend yield (more than 6% or 5 sen annually which is higher than FD rate).

Future growth catalyst

The IPO price of Pecca was at RM1.42 in 2016. Pecca is the market leader in the automotive leather upholstery with over 40% market share where their main customers are Perodua, Toyota, Nissan, Honda and Proton.

Pecca's major client Perodua's best seller Myvi car and upcoming brand new cars launch (Perodua SUV, Toyota Vios and Toyota Yaris) will continue to provide room for growth for Pecca. Besides, there are some capacity, which is about 20% for exports (mainly to Asia like Singapore). I understand that Pecca is the sole leather seat supplier for the new Perodua SUV, with orders expected to come in by Dec 2018 or Jan 2019 (to be launched in Q4’18). Pecca also reconsider to tender to supply leather seats to Proton CKD SUV (X70) but margin in for Proton SUV is low.

Let us go through the following news to estimate how much orders Pecca have received in Oct - Dec 2018:

https://paultan.org/2018/10/05/perodua-myvi-22000-units-yet-to-be-delivered-as-of-end-september-efforts-to-reduce-backlog-ongoing/

Due to Myvi clearing their backlog orders and Pecca currently receive high Myvi order in this quarter and quarter in 2019 (due to Myvi production halt in Aug and Sept, zero Myvi leather delivery in Sep), Management expects stronger earnings in the coming quarters (Oct-Dec 2018 and 2019). FYI, Pecca is Perodua sole OEM leather seat supplier.

Another Pecca's future growth catalyst would be their aviation division where they are awaiting Production Organization Approval ("POA") from Department of Civil Aviation ("DCA"). This POA will enable them to supply to major airline companies in Malaysia for commercial aircraft seat cover replacement. Currently, Pecca's has the approval from DCA for part refurbishment and leather upholstery job scope. This limited scope has generated minimal revenue but has great potential once they obtained POA as they would be able to target potential businesses from Airasia and Malindo.

With its high cash pile level, Pecca is constantly exploring potential new acquisition. Once a new acquisition is completed, I believe Pecca earning will improve and may become a growth stock in FY19-FY20 with high dividend payout from its existing automotive leather business.

For automotive segment outlook, the Malaysian Automotive Association (MAA) reported that TIV for Sep 2018 dropped to 31.2k units (-23.7% YoY; -52.3% MoM). The Sep 2018 sales volume was down due to reintroduction of SST during the month as most customers have brought forward their purchases during the tax holiday Jun-Aug period.

However, year to date TIV improved by 6.9% YoY to 455.0k units, driven by the strong demand during the waiver period of zero-GST. MAA still maintain its 2018 vehicle sales forecast of 588.1k units (+2.0% YoY).

Lastly, let us see the material price movement (downtrend) of Pecca where the reference is from Producer Price Index by Commodity for Skins, Leather, and Related Product as figure below:

Material cost reference of Pecca (source: https://fred.stlouisfed.org/series/WPU041)

Let also see the total car vehicles sales by brand as the table below:

Source: CIMB, MAA

SWOT analysis

Let me have a SWOT analysis on Pecca as below:

SWOT analysis (S-strengths, W-weaknesses, O-opportunities, and T-threats)

Based on Pecca future potential earning growth, sustainable dividend payout from good FCF and strong balance sheet,

the fair forward 12-month PE for should be in the range of 14x-16x

(translated to Rm0.91 to 1.04 with forecast EPS of 6.52 sen) which is

consider reasonable valuation in automotive sector average valuation

Risk

- Pecca’s FY19 domestic sales volume expected to grow, where sales order from main customer Perodua is still going strong especially for the Myvi model. Further sales from new Perodua SUV model (going to launch in Feb).

- Export volume to Singapore in FY19 improving from 1Q and 2Q19 (Oct - Dec 2018) according to Management guideline.

- Due to Myvi clearing their backlog orders and Pecca currently receive high Myvi lether seat order in this quarter and quarter in 2019.

- High dividend yields (over 6% based on 5 sen payout in a year, comng 3 sen on 12 Dec) at current Pecca price which are higher than bank FD rate and other automotive stocks.

- Current cash in hand (97M) (53 sen per share) and good free cash flow from operation provides sustainability of the future dividend payment.

- Strong balance sheet with zero borrowing provides high margin of safety under current uncertain investment environment.

- Current ex-cash PEx of Pecca is only 4.5x (mean we pay only 26 sen per share for their biz without considering its 97M cash due to Pecca still can maintain their earning even without the cash). (based on 79 sen current price)

- The fair forward 12-month PEx for should be in the range of 14x-15x (14x PEx is due to their very attractive ex-cash PEx at only 4.5x and strong order from Perodua) which translated to RM0.91 to RM1.04, where this valuation is supported by future potential earning growth, sustainable dividend payout and strong balance sheet with 53 sen per share which consider reasonable valuation in automotive sector.

- Its business model does not require high capital expenditure and its prudent management provide a good defensive investment option where the company have increased their capacity from 120,000 to 170,000 units annually without using their IPO proceeds while it has distributed 5 sen dividend over past 3 years while still maintaining 97M cash.

- Pecca’s director Datin Sam has acquired 5.06 mil shares from open market (price range around 76 sen) which indicates that management team think current price of Pecca is undervalue.

Pecca is the market leader in the automotive leather upholstery for OEM passenger vehicles in Malaysia. Pecca Group’s current business activities are predominately in the automotive segment. However, the Group continues its effort to penetrate into the aviation segment. The automotive segment includes the following:

- Leather cut pieces for the Original Equipment Manufacturer (“OEM”) segment.

- Pre-delivery Inspection (“PDI”) segment (customers include Nissan Malaysia)

- Replacement Equipment Manufacturer (“REM”) segment.

- Aviation segment currently involves the provision of repair and restoration of non-structural cabin interior parts and material under the Part 145 Repair Station license granted by Civil Aviation Authority of Malaysia (“DCA”). On 1 March 2018, Pecca submitted an application for Production Organization Approval (POA) to DCA to confirm our capability to do manufacturing.

Fundamental Data

Currently Pecca is trading at trailing PE ratio of 13.6 (based on current price of RM0.79) with EPS of 5.8 sen. Its profit has been declining over past 1 year but improving in the recent quarter 1Q19 as shown in the figure below:

Source: Malaysiastock.biz

Pecca’s profit in FY18 declined to RM10.2m (-30 % YoY) and revenue decreased to RM112.6m (-8% YoY) due to lower gross profit margin from automotive segment. The Automotive segment accounted for 95% of total revenue. Geographically, Malaysia market remained the largest contributor to the group’s total revenue, accounting about 83%. However, recent release quarter result shows improving in net profit margin to 12.8% with 3.47 mil profit.

Pecca’s financial position has been strong since IPO in 2016 where it has ZERO borrowings. As at end of 30 Sept 2018, Pecca has cash and cash equivalent of 97M which is equal to share per share of 53 sen (about 67% of market capital).

In addition, Pecca has relatively high dividend yield at 6.3% based on current price. It has been paying 4-5 sen dividend over the past 3 years as shown in figure below.

Source: Malaysiastock.biz

To evaluate whether Pecca is still able to maintain its high dividend payout of 5 sen, let see the FCF (free cash flow) from operation from its latest quarter report as below:

Let have a look on Pecca’s free cash flow (after minus out capex of 6.2M) vs market capital ratios as below:

FCF (for FY18)/ Market cap = (15.88M-6.2M) / 141 mil = 6.9% (over past 12 months)

Cash in hand / Market cap = 97 mil / 141 mil = 67%

High level of cash in hand and good cash flow and zero debt provide the sustainability of the future dividend yield (more than 6% or 5 sen annually which is higher than FD rate).

Future growth catalyst

The IPO price of Pecca was at RM1.42 in 2016. Pecca is the market leader in the automotive leather upholstery with over 40% market share where their main customers are Perodua, Toyota, Nissan, Honda and Proton.

Pecca's major client Perodua's best seller Myvi car and upcoming brand new cars launch (Perodua SUV, Toyota Vios and Toyota Yaris) will continue to provide room for growth for Pecca. Besides, there are some capacity, which is about 20% for exports (mainly to Asia like Singapore). I understand that Pecca is the sole leather seat supplier for the new Perodua SUV, with orders expected to come in by Dec 2018 or Jan 2019 (to be launched in Q4’18). Pecca also reconsider to tender to supply leather seats to Proton CKD SUV (X70) but margin in for Proton SUV is low.

Let us go through the following news to estimate how much orders Pecca have received in Oct - Dec 2018:

https://paultan.org/2018/10/05/perodua-myvi-22000-units-yet-to-be-delivered-as-of-end-september-efforts-to-reduce-backlog-ongoing/

Due to Myvi clearing their backlog orders and Pecca currently receive high Myvi order in this quarter and quarter in 2019 (due to Myvi production halt in Aug and Sept, zero Myvi leather delivery in Sep), Management expects stronger earnings in the coming quarters (Oct-Dec 2018 and 2019). FYI, Pecca is Perodua sole OEM leather seat supplier.

Another Pecca's future growth catalyst would be their aviation division where they are awaiting Production Organization Approval ("POA") from Department of Civil Aviation ("DCA"). This POA will enable them to supply to major airline companies in Malaysia for commercial aircraft seat cover replacement. Currently, Pecca's has the approval from DCA for part refurbishment and leather upholstery job scope. This limited scope has generated minimal revenue but has great potential once they obtained POA as they would be able to target potential businesses from Airasia and Malindo.

With its high cash pile level, Pecca is constantly exploring potential new acquisition. Once a new acquisition is completed, I believe Pecca earning will improve and may become a growth stock in FY19-FY20 with high dividend payout from its existing automotive leather business.

For automotive segment outlook, the Malaysian Automotive Association (MAA) reported that TIV for Sep 2018 dropped to 31.2k units (-23.7% YoY; -52.3% MoM). The Sep 2018 sales volume was down due to reintroduction of SST during the month as most customers have brought forward their purchases during the tax holiday Jun-Aug period.

However, year to date TIV improved by 6.9% YoY to 455.0k units, driven by the strong demand during the waiver period of zero-GST. MAA still maintain its 2018 vehicle sales forecast of 588.1k units (+2.0% YoY).

Lastly, let us see the material price movement (downtrend) of Pecca where the reference is from Producer Price Index by Commodity for Skins, Leather, and Related Product as figure below:

Material cost reference of Pecca (source: https://fred.stlouisfed.org/series/WPU041)

Let also see the total car vehicles sales by brand as the table below:

Source: CIMB, MAA

SWOT analysis

Let me have a SWOT analysis on Pecca as below:

SWOT analysis (S-strengths, W-weaknesses, O-opportunities, and T-threats)

| Strengths | Weaknesses |

|

|

| Opportunities | Threats |

|

|

Risk

- Rising labour cost (minimum wages increment in 2019)

- Slower than expected sales in major customers like Perodua and Toyota

- Weaker export sales if economy slow down in Asia.

If you interested on my analysis report, please contact me at davidlimtsi3@gmail.com

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is

strictly for sharing purpose, not a buy or sell call of the company.

https://klse.i3investor.com/blogs/lionind/184468.jsp