OpenSys

is a leading solutions provider for the financial services and banking

industry. OpenSys also provides end-to-end managed services outsourcing,

particularly for self-service terminals, bill payment kiosks and

back-office cheque processing services.

Its

customer base includes mainly blue-chip companies such as AEON Credit,

Alliance Bank, AmBank, Bank Islam, CIMB Bank, Hong Leong Bank, Maybank,

Public Bank, RHB Bank, Standard Chartered Bank, UOB, Celcom, Maxis, TNB,

TM, Sabah Electricity and Sarawak Energy.

Full background

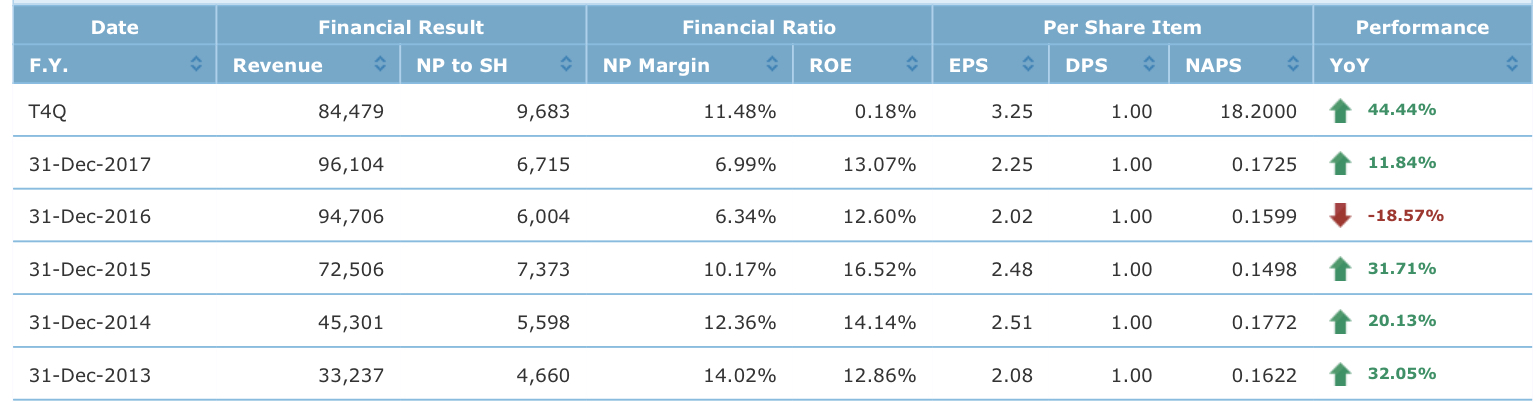

Cheap valuation

Trailing 4Q earnings growth= 44.44%

Trailing 4Q earnings =RM9.68 million

Average equity =RM52.58 million

ROE = 18.4%

(Click to enlarge)

Despite

the high growth in earnings, shares of this low-profile company have

been range-bound, trading between 26 sen and 37.5 sen over the past

year. As a result, its trailing 12-month PE compressed from 19.7 times

in 2014 to 15.6 times in 2015 and 13.3 times in 2017 and further to 9.7

times.

Its

valuation appears comparatively cheap compared with its ACE

Market-listed peers, such as Rexit Bhd (14.7 times), Microlink Solutions

Bhd (N.A. lossmaking), Excel Force MSC Bhd (31.6 times) and GHL Systems

Bhd (54.5 times).

Currently, there is zero coverage on Opensys by any research house.

Fair Valuation?

Trailing 4Q EPS= 3.25 sen

Low end PE= 14.7 times x 3.25= RM0.48

High end PE= 54.4 times x 3.25= RM1.77

What is the fair value for Opensys? In

the latest announcement, Opensys mentioned “In the last five years, the

total number of CRMs in the market has grown exponentially with a

Compound Annual Growth Rate (CAGR) of close to 40 percent.” Its trailing

4Q earnings growth is 44.44%.

To be realistic, the 40% growth rate can’t go on forever. 25% is more realistic over the next few years. Based on PE ratio of 25 times, the fair value is RM0.82.

Future prospects

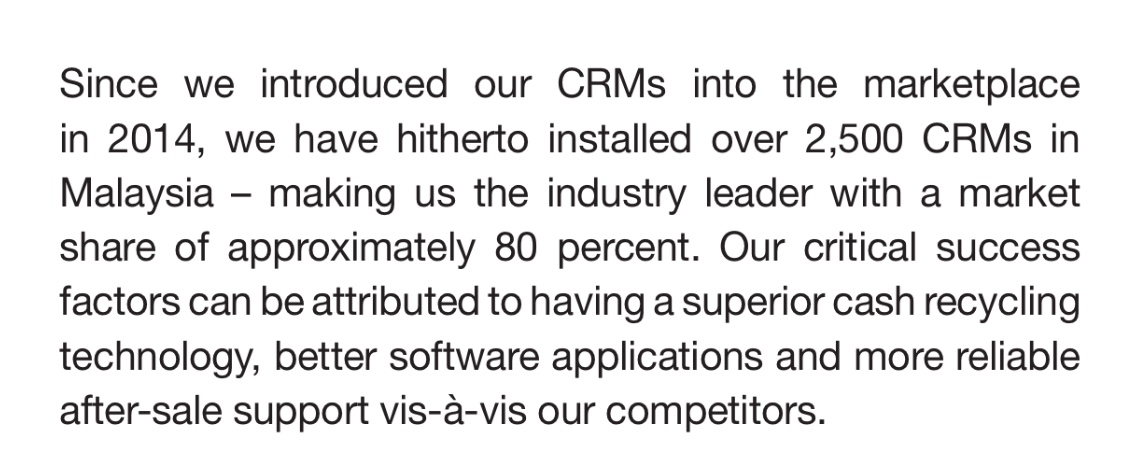

The

future looks exciting for Opensys. In 2017 annual report, Opensys

mentioned that it had installed over 2,500 CRMs in Malaysia since 2014

and became the industry leader with 80% market share.

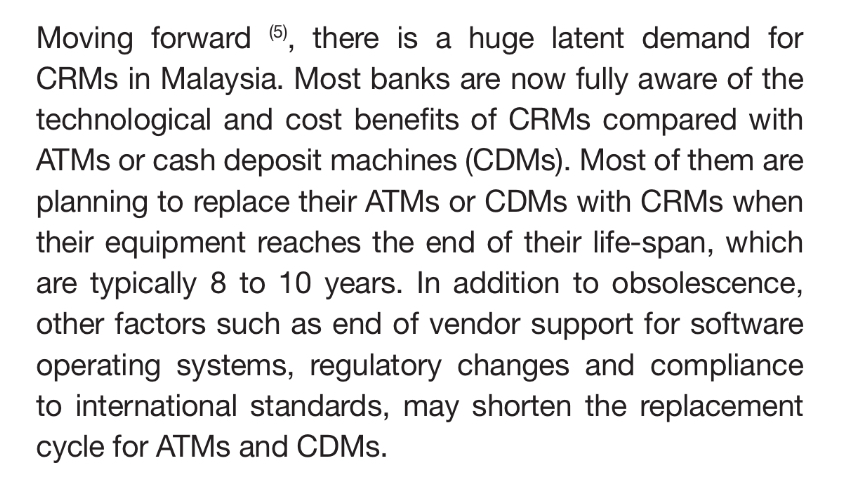

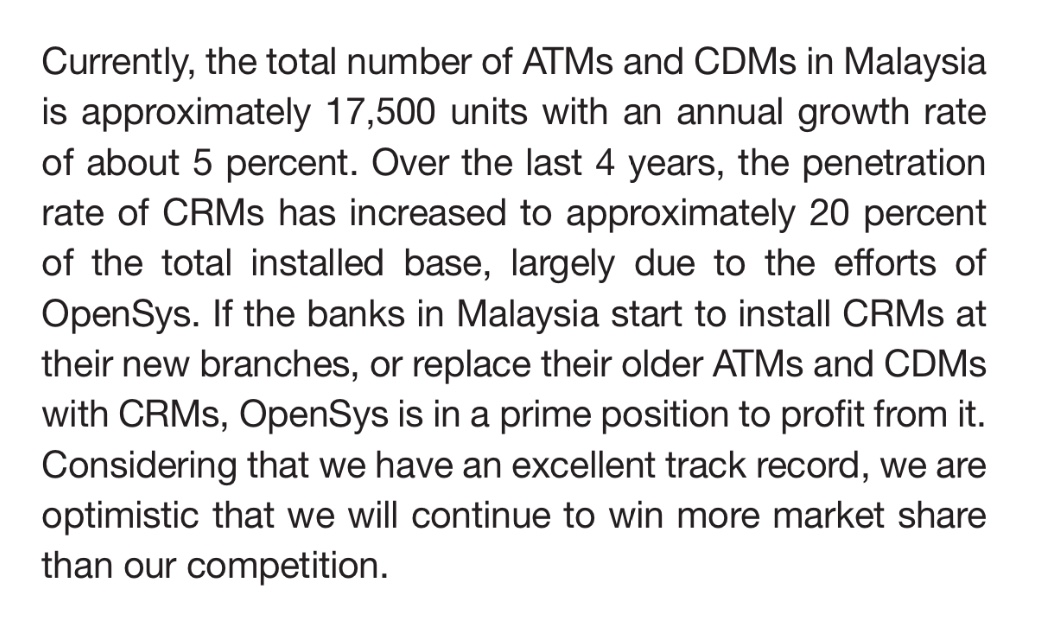

Moving

forward, there is a huge patent demand for CRMs in Malaysia. Only 20%

of bank machines are CRMs today. Opensys is optimistic of winning more

market share considering its excellent track record.

Source

Disclaimer: The article above does not represent a recommendation to buy or sell.

https://klse.i3investor.com/blogs/Amazinggrowth/193718.jsp

https://klse.i3investor.com/blogs/Amazinggrowth/193718.jsp