There is few points that i am looking into WASEONG. Hereby i am listing down the reason

1. WASEONG JV with Salto Separator to produce all type of equipment for crude palm oil. Diversification of nature of business to create different source of income.

Source obtain from

http://www.sinchew.com.my/node/1788485/%E5%8D%8E%E5%95%86%E4%B8%8E%E6%97%A5%E4%BC%81%E8%81%94%E8%90%A5%E6%A3%95%E6%B2%B9%E8%AE%BE%E5%A4%

WHY is it going up lately?

I think it is relately to recent Minister Teressa Kok to promote of B10. When government policy is to reduce palm oil storage and encourage more people to use B10. This is the future direction of the Palm Oil Policy.

" Malaysia will increase the minimum bio-content local producers must add to its biodiesel fuel to 10% from 7% starting on Dec 1.

In a statement Wednesday, CPP said it acknowledged the government’s decision to cancel the Multi-Product Pipeline (MPP), Trans-Sabah Gas Pipeline (TSGP) projects and another pipeline project, linking Malacca to a Petronas refinery and petrochemical plant in Johor.

Read more at https://www.thestar.com.my/business/business-news/2018/09/12/cpp-seeking-compensation-for-cancelled-pipeline-projects/#sKUT3rUMJWFTb50d.99

But did you see the picture, not a single coverage mentioned about WASEONG? So, if a person who never keep on reading news and remember what happened in the past. Even The Edge also never mention about WASEONG.You may refer to the linkage at below.

http://www.theedgemarkets.com/article/china-petroleum-pipeline-discuss-compensation-putrajaya-over-cancelled-projects

I worry you dont believe what i said, therefore i print screen it as a proof.

So, what you are trying to tell now? I am tellng the history and what is happening. The catalyst of the palm oil equipment could be continue running as Dr. M said implementation B20 by 2020. Such a nice number for 4D or 6D 202020.

Just a joke. But if came out and you did bought this number then do some charity.

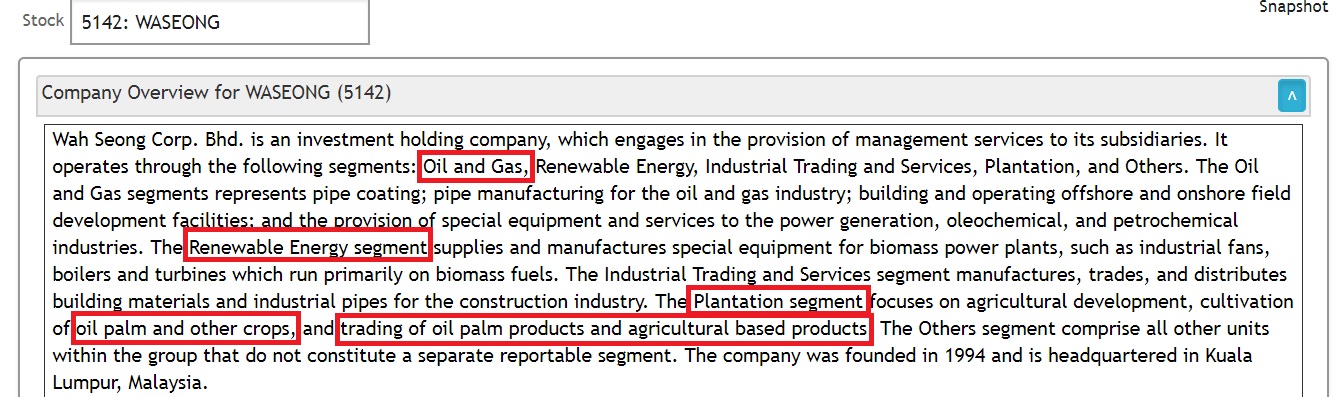

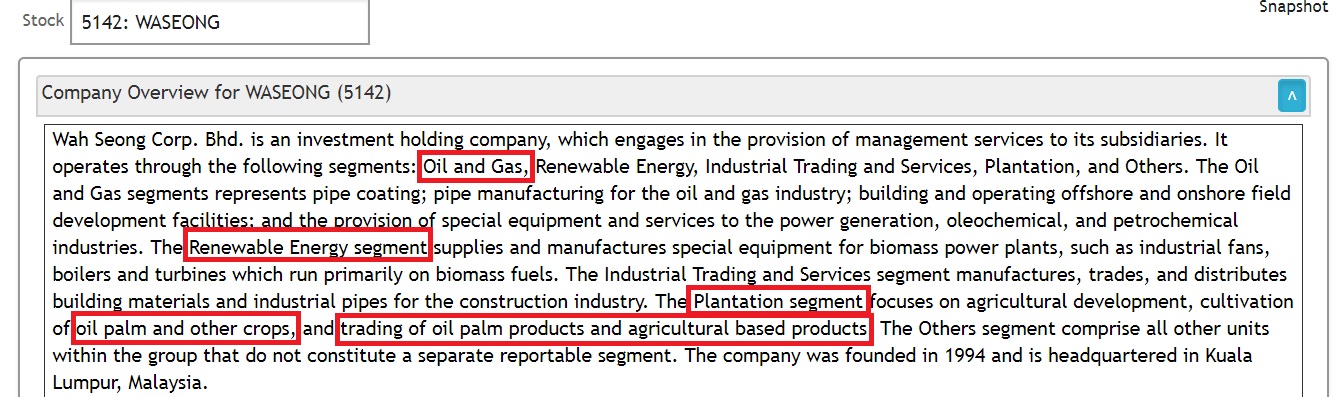

Let us have a overview what is WASEONG doing. So, let me printscreen for my software CHARTVIEWPLUS.

Oil & Gas price currently on the rebound phase. Same go for the palm oil. Both the worst time is over. Now is going to AUTUMN.

Crude oil rebound is not the immediate beneficiary for WASEONG, but then when oil & gas price rebound, relevant oil & gas exploration activity will start to active. That is the time WASEONG step in to provide services for the upstream countery in oil & gas sector.

Let take a look at the financial earning side.

WASEONG showing a good financial result which i highlighted in red.

WASEONG cummulative profit nearly increase 75% for the financial year end 2018 compare to first 3 quarter financial year end 2017. Therefore, coming quarter if WASEONG able to maintain approximately 20 million profit that mean is 100% growth in their profit margin.

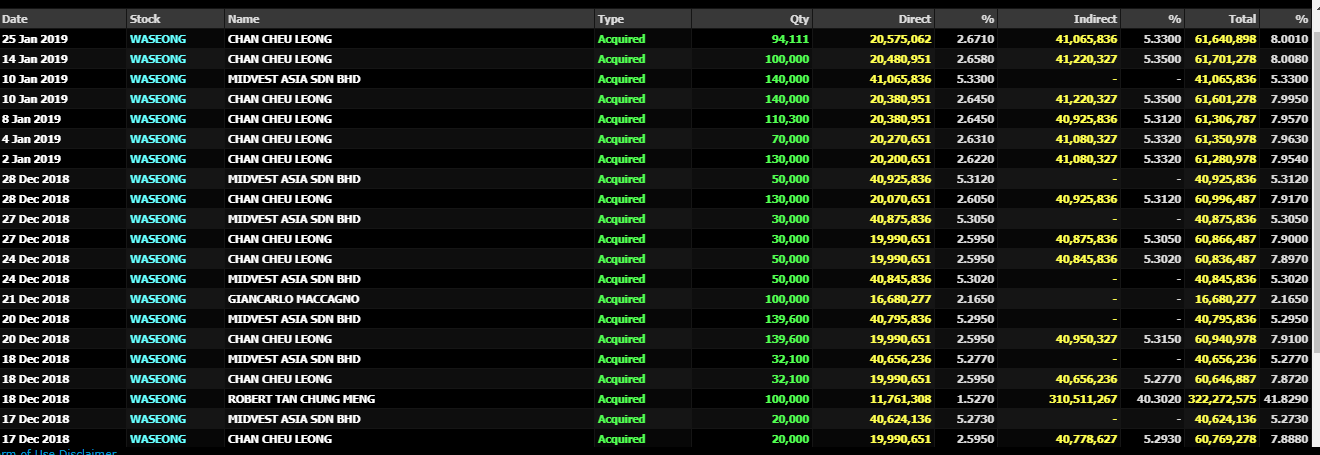

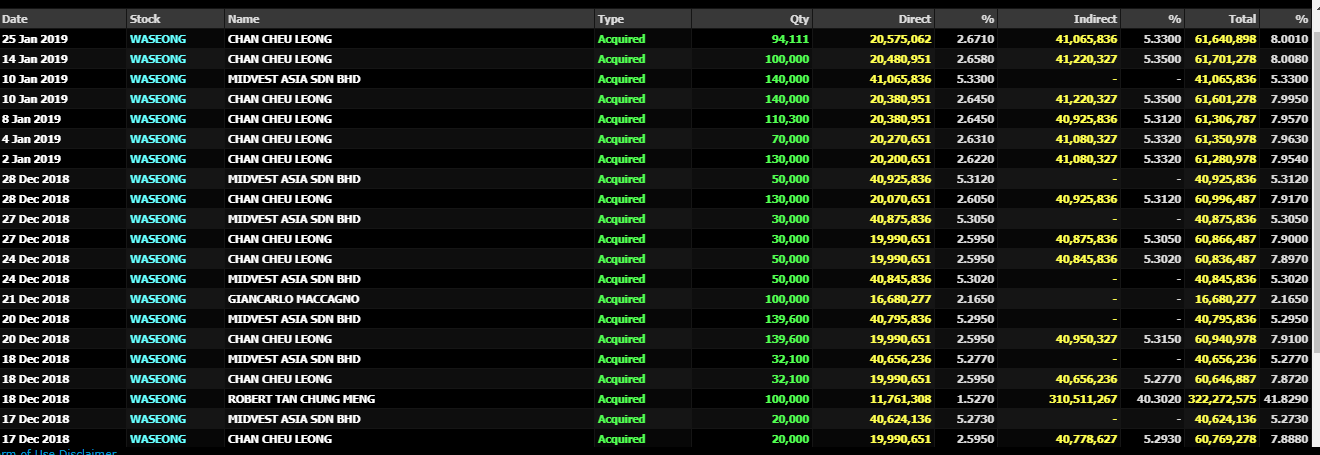

On top of that, I do notice that the major shareholder are actively buying back their shares at the low price.

I guess my sharing is up till here. Continue to stay on as i will update more stock info in the future.

1. WASEONG JV with Salto Separator to produce all type of equipment for crude palm oil. Diversification of nature of business to create different source of income.

Source obtain from

http://www.sinchew.com.my/node/1788485/%E5%8D%8E%E5%95%86%E4%B8%8E%E6%97%A5%E4%BC%81%E8%81%94%E8%90%A5%E6%A3%95%E6%B2%B9%E8%AE%BE%E5%A4%

WHY is it going up lately?

I think it is relately to recent Minister Teressa Kok to promote of B10. When government policy is to reduce palm oil storage and encourage more people to use B10. This is the future direction of the Palm Oil Policy.

" Malaysia will increase the minimum bio-content local producers must add to its biodiesel fuel to 10% from 7% starting on Dec 1.

Primary Industries Minister Teresa Kok said in a radio interview with national news agency Bernama on Wednesday that the government has given the approval to implement the B10 biodiesel mandate.

"The cabinet has approved the use of B10 and it will be implemented

from Dec 1. We also have the agreement from the Federation of Malaysian

Manufacturers that the industrial sector will use B7," she said in the

interview which was posted to Bernama Radio's Facebook page. "

Source obtain from https://www.theedgemarkets.com/article/malaysia-implement-b10-biodiesel-programme-dec-1

Stevent, this is last year story and this is too late for us to getting

in. We are entering at the higher price level right now. It is too

risky. So, is there any new catalyst ongoing?

"Our Prime Minister Dr. Mahathir said by 2020, Malaysia Biodiesel must

achieve B20. meaning there should be more demand for the palm oil

related equipment.

Mahathir added that the biodiesel programme was important for the

country as palm oil was the “golden crop” of Malaysia and had been

supporting the country’s economy for a long time.

“The use of biodiesel will have a positive impact on the palm oil

industry by reducing palm oil stocks and further stabilising palm oil

prices,” he said.

It would also allow 650,000 palm oil smallholders to enjoy more stable prices and an increase in revenue, he added.

“The biodiesel programme will also help the country achieve its

objectives in maintaining low carbon mobility as outlined in the

mid-term review of the 11th Malaysia Plan.”

Above information can be obtain

from https://www.freemalaysiatoday.com/category/nation/2018/12/11/malaysia-must-achieve-use-of-b20-biodiesel-by-2020-says-dr-m/

So, this explain why is it WASEONG went up? What about earlier chart that it came down?

I guess this is pretty much got to do with local gas pipine line project.

I able to find out the news that release in the past which not many people cover this stock.

Wah

Seong’s pipe-coating prospects remain positive on the home turf. Some

of the jobs include the 800km pipe manufacturing and pipe-coating jobs

for the multi-product pipeline (MPP) project connecting Pengerang to

Perlis as well as the 600km pipe manufacturing and pipe-coating jobs for

the trans-Sabah gas pipeline (TSGP) project,

which could be awarded soonest by the first half of 2018 (1H18). Note

that both the projects are owned by Suria Strategic Energy Resources Sdn

Bhd, a special-purpose vehicle owned by the finance ministry with China

Petroleum Pipeline Engineering Co as the main contractor. We believe

Wah Seong stands a good chance to win the projects, being the only

American Petroleum Institute-certified local pipe manufacturer to

compete with Chinese contractors.

Source obtain from http://www.theedgemarkets.com/article/wah-seongs-pipecoating-prospects-positive-home-turf

This is the old news now TSGP being cancel.

China

Petroleum Pipeline Engineering Co. Ltd (CPP) has acknowledged the

government’s decision to cancel the pipeline projects and will discuss

fair and equitable compensation with the Malaysian government.

In a statement Wednesday, CPP said it acknowledged the government’s decision to cancel the Multi-Product Pipeline (MPP), Trans-Sabah Gas Pipeline (TSGP) projects and another pipeline project, linking Malacca to a Petronas refinery and petrochemical plant in Johor.

“CPP understands and respects that the decision is due to economic and financial reasons,” it said.

“CPP will proceed to discuss with the asset owner/Malaysian government for a fair and equitable compensation for the cancellation of the projects,” it said in the statement.

As a result of the cancellation, CPP said it would re-assign staff, local and foreign, previously designated to the pipeline projects to other ongoing ventures in Malaysia and other parts of the world.

“CPP hopes to work with the Malaysian government in the future pipeline project and contribute towards the economic prosperity of Malaysia,” it added.

“CPP will proceed to discuss with the asset owner/Malaysian government for a fair and equitable compensation for the cancellation of the projects,” it said in the statement.

As a result of the cancellation, CPP said it would re-assign staff, local and foreign, previously designated to the pipeline projects to other ongoing ventures in Malaysia and other parts of the world.

“CPP hopes to work with the Malaysian government in the future pipeline project and contribute towards the economic prosperity of Malaysia,” it added.

Read more at https://www.thestar.com.my/business/business-news/2018/09/12/cpp-seeking-compensation-for-cancelled-pipeline-projects/#sKUT3rUMJWFTb50d.99

But did you see the picture, not a single coverage mentioned about WASEONG? So, if a person who never keep on reading news and remember what happened in the past. Even The Edge also never mention about WASEONG.You may refer to the linkage at below.

http://www.theedgemarkets.com/article/china-petroleum-pipeline-discuss-compensation-putrajaya-over-cancelled-projects

I worry you dont believe what i said, therefore i print screen it as a proof.

So, what you are trying to tell now? I am tellng the history and what is happening. The catalyst of the palm oil equipment could be continue running as Dr. M said implementation B20 by 2020. Such a nice number for 4D or 6D 202020.

Just a joke. But if came out and you did bought this number then do some charity.

Let us have a overview what is WASEONG doing. So, let me printscreen for my software CHARTVIEWPLUS.

Oil & Gas price currently on the rebound phase. Same go for the palm oil. Both the worst time is over. Now is going to AUTUMN.

Crude oil rebound is not the immediate beneficiary for WASEONG, but then when oil & gas price rebound, relevant oil & gas exploration activity will start to active. That is the time WASEONG step in to provide services for the upstream countery in oil & gas sector.

Let take a look at the financial earning side.

WASEONG showing a good financial result which i highlighted in red.

WASEONG cummulative profit nearly increase 75% for the financial year end 2018 compare to first 3 quarter financial year end 2017. Therefore, coming quarter if WASEONG able to maintain approximately 20 million profit that mean is 100% growth in their profit margin.

On top of that, I do notice that the major shareholder are actively buying back their shares at the low price.

I guess my sharing is up till here. Continue to stay on as i will update more stock info in the future.

Disclaimer

: Above is for educational sharing purpose. Kindly consult your

dealer/remisier for any investment decision. Trade at your own risk.

Telegram Link : https://t.me/steventhee628

FB Link : https://www.facebook.com/Steventheeinvestment/

Website : https://steventhee.wixsite.com/website

https://klse.i3investor.com/blogs/SICStockPick/193725.jsp

https://klse.i3investor.com/blogs/SICStockPick/193725.jsp