Dancomech Holdings

Company Background

RHB Investment Bank Bhd's “Top Malaysia Small Cap Companies 20 Jewels 2019” book.

https://www.thestar.com.my/business/business-news/2019/05/02/rhb-small-cap-jewels-awc-ccm-dancomech-guan-chong-revenue-group/

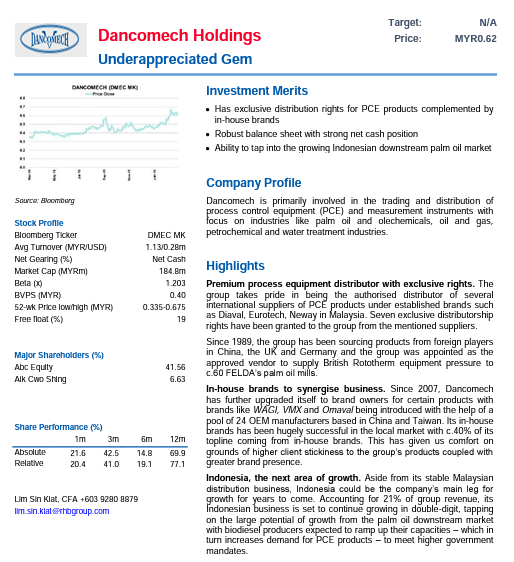

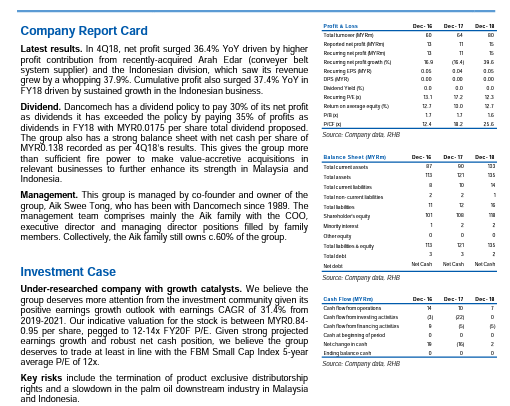

RHB Research Report on Dancomech Holdings

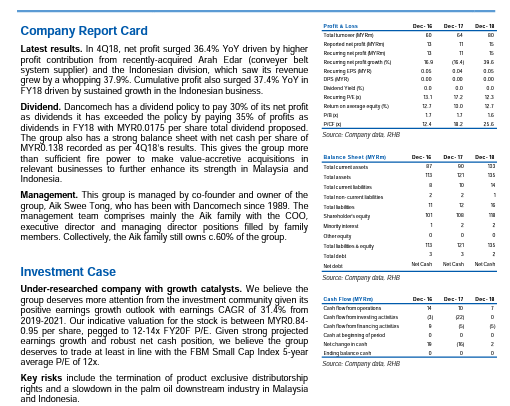

Fundamental Analysis

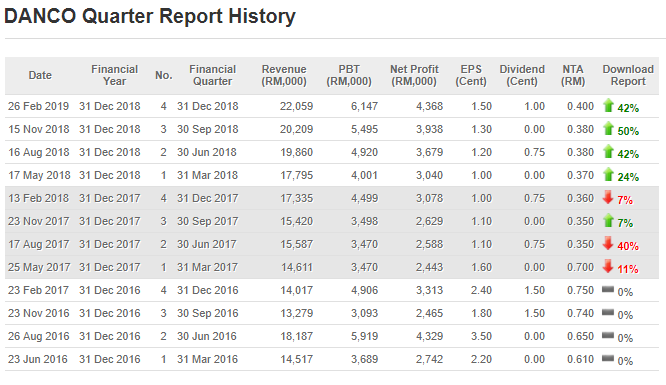

Profit Growth of Danco

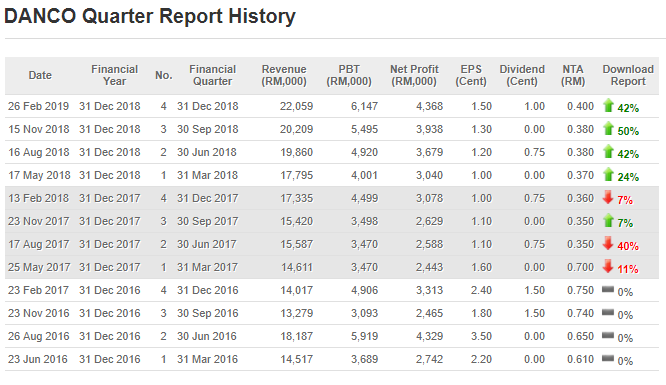

You can see from the above table that its EPS for the last 4 quarters were 1.00, 1.20, 1.30 and 1.50 cents. Based on the following facts:

Based on P/E 10, the share price should be 8.00 X 10 = Rm 0.80

Based on P/E 12, the share price should be 8.00 X 12 = Rm 0.96

Based on the Danco's past fundamental results, you can observe that the company having steady growth since it's listed in Bursa Malaysia on year 2016. It is one of the best performing IPO stock in year 2016. On the 4th quarter of FY18, the group achieved new high REVENUE, PBT & Net Profit. It is expected that a huge GROWTH coming for FY19 with their latest acquisition of ARAB EDAR and Indonesian business. With the strong recovery of Oil and Gas activities, It is expected to be seen that it will contribute some growth on this coming quarter result. To be honest, how many company in Bursa Malaysia can have such steady growth in earning and revenues. Their growth can be compared like KGB, Penta & Frontkn.

Technical Analysis

It is observed that the stock have broken 0.60 support level due to past few days weak sentiment. However, Danco is strong enough to rebound back and formed hammer on 14 May 2019. Today have a slight rebound until 0.595 and closed at 0.585. Anything below 0.60 is an opportunity for everyone. Do not forget strong stock need time to prove them. The next stage is Danco need to breakout from 0.68 level. Based on TA, i'm expecting a TP of 0.80 in short term.

Conclusion

With the cover from RHB Research Report, given Dancomech Target Price 0.84 - 0.95. I'm happy to see that finally Investment Bank start to cover this stock. Do not forget what happen to Frontkn & KGB. All of these start from penny stock where no any Investment Bank cover them during low pricing. They will cover them when only the company proven themselve in the quarter results. Please comment below if you feel that this company is not good enough. It is very rare to see such undervalued stock in Bursa Malaysia. As a result, please study hard on this company if you are interested with it.

Disclaimer

I am just an author who shares my opinion, views and general information. The comments above do not represent any recommendation of buy or sell call. Investments carry risk that you will have to bear at your own cost. I will not be held liable for any investment decisions made. Please seek for professional advice before you made any decisions.

Company Background

Dancomech Holdings Bhd (DANCO) is engaged

in trading and distribution of PCE and Measurement Instruments. The

Company offer its products to palm oil and oleochemicals, oil & gas

and petrochemical, and water treatment & sewerage industries. The

majority of its customers are from industries such as palm oil and

oleochemicals, oil and gas and petrochemical, water treatment and

sewerage. For now, it has a diverse customer base of 1,459 customers

from various industries.

The company hasn’t recorded any losses over the last 30 years, not even in 1997.

Dancomech Holdings is one of the Top 20 Jewels 2019 in RHB PicksRHB Investment Bank Bhd's “Top Malaysia Small Cap Companies 20 Jewels 2019” book.

https://www.thestar.com.my/business/business-news/2019/05/02/rhb-small-cap-jewels-awc-ccm-dancomech-guan-chong-revenue-group/

RHB Research Report on Dancomech Holdings

Fundamental Analysis

Profit Growth of Danco

You can see from the above table that its EPS for the last 4 quarters were 1.00, 1.20, 1.30 and 1.50 cents. Based on the following facts:

1. Strong contribution from Indonesia and latest acquisition (Arab Edar)

2. Accelerated rate of increase in profit.

It

is safe and conservative to assume that the company can make the same

profit of 2.00 cents per share per quarter, in the next 4 quarters for

financial year 2019. That means its annual EPS will be 8.00 cents.Based on P/E 10, the share price should be 8.00 X 10 = Rm 0.80

Based on P/E 12, the share price should be 8.00 X 12 = Rm 0.96

Based on the Danco's past fundamental results, you can observe that the company having steady growth since it's listed in Bursa Malaysia on year 2016. It is one of the best performing IPO stock in year 2016. On the 4th quarter of FY18, the group achieved new high REVENUE, PBT & Net Profit. It is expected that a huge GROWTH coming for FY19 with their latest acquisition of ARAB EDAR and Indonesian business. With the strong recovery of Oil and Gas activities, It is expected to be seen that it will contribute some growth on this coming quarter result. To be honest, how many company in Bursa Malaysia can have such steady growth in earning and revenues. Their growth can be compared like KGB, Penta & Frontkn.

Technical Analysis

It is observed that the stock have broken 0.60 support level due to past few days weak sentiment. However, Danco is strong enough to rebound back and formed hammer on 14 May 2019. Today have a slight rebound until 0.595 and closed at 0.585. Anything below 0.60 is an opportunity for everyone. Do not forget strong stock need time to prove them. The next stage is Danco need to breakout from 0.68 level. Based on TA, i'm expecting a TP of 0.80 in short term.

Conclusion

With the cover from RHB Research Report, given Dancomech Target Price 0.84 - 0.95. I'm happy to see that finally Investment Bank start to cover this stock. Do not forget what happen to Frontkn & KGB. All of these start from penny stock where no any Investment Bank cover them during low pricing. They will cover them when only the company proven themselve in the quarter results. Please comment below if you feel that this company is not good enough. It is very rare to see such undervalued stock in Bursa Malaysia. As a result, please study hard on this company if you are interested with it.

Disclaimer

I am just an author who shares my opinion, views and general information. The comments above do not represent any recommendation of buy or sell call. Investments carry risk that you will have to bear at your own cost. I will not be held liable for any investment decisions made. Please seek for professional advice before you made any decisions.

https://klse.i3investor.com/blogs/Roger1001/206675.jsp