EDARAN - ANOTHER BULLET TRAIN LEAVING THE STATION !!!!! (PERSONAL TP 0.65 Short Term, 0.81 Mid to Long Term),

At the time of writing, markets had closed strong overnight led by US markets:

Dow Jones Industrial Average closed at 26,504.95, up 197.16 points (+0.75%)

S&P 500 closed at 2,945.64, up 28.12 points (+0.96%)

Nasdaq closed at 8,164, up 127.22 points (+1.58%)

FTSE 100 closed at 7,380.64, up 29.33 points (+0.40%)

DAX closed at 12,412.75, up 67.33 points (+0.55%)

China A50 Futures closed at 13,746.5, up 79 points (+0.58%)

Hang Seng Futures closed at 30,018, up 360 points (+1.21%)

FBKLCI closed at 1,637.3, up 5.06 points (+0.31%)

The sentiment of investors on BSKL had improved towards the end of the week with momentum led by IWCITY and EKOVEST as market movers/leaders, and with the above strong closings by US/Europe/Asia Futures markets, we would see heightened sentiments next week which should fuel more rallies in counters that have retraced to their supports.

Recently I had spotted this small cap company; an investment grade, which have been underlooked and undercovered - EDARAN BERHAD or EDARAN (Stock Code 5036, listed on MAIN BOARD, TECHNOLOGY)

In summary, EDARAN is an integrated IT solutions provider. Some of the service provided are Solutions Integration, Project Management Consultancy and Infrastructure Service.

I noticed considerable interest starts to build in on Friday where the volume registered a sizeable increase to 1.93 million units.

This positive momentum & enthusiasm, coupled with strong movement in NASDAQ (Technology Counters), I believe, should carry forward next week ( forbearing instances of the adversity/ negativity of the regional markets sentiment affecting Bursa Malaysia) since it was able to close Friday conclusively at 0.55. I foresee it trending to the next resistance of 0.61 before heading to my personal TP between 0.65 (short term) to 0.81 on the intermediate to long term.

WHY I THINK THIS STOCK IS UNDERLOOKED AND COULD HAVE GREAT POTENTIAL TO RISE FURTHER?

1. Low Shares Float & Market Cap - Less Resistances In Uptrend

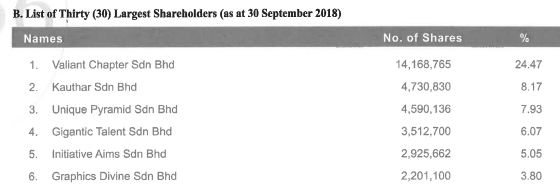

Refer to below link for list of top 30 shareholders as of latest Annual Report 2018. The top 30 shareholders hold 40.53 million units (67.56%) of the total float.

Refer image below. We see that the top 6 shareholders are companies and they hold 33.29 million units (55.49%). There had been no shareholding changes in the major shareholders since last August 2018. This reflects the firm and major confidence of shareholders with the future of this company.

Since the total effective float of the company and current market cap of RM 33 million is relatively small, I see that path for uptrend will see less resistances compared to companies having market cap above RM 150 million.

https://www.malaysiastock.biz/GetReport.aspx?file=AR/2018/10/30/5036%20-%200957165612342.pdf&name=PART%203%20EDARAN%20AR2018.pdf

2. Technical Analysis - Bullish Momentum on Breakout of Downtrend

Refer below chart of EDARAN captured from early February 2019 until to-date. As we can see it had hit the resistance lines for 4 times but failed to maintain the momentum and closed back lower within the bullish flag pattern.

I foresee the current breakout to be genuine and to sustain based on the below:

a. A significant bullish engulfing candle appeared with good volume, and closing at near DAY'S HIGH or 0.55, indicating that bulls are taking control over bears

b. MACD has been on sideways movement for a while, and the next bull candle might cause MACD to cross the signal line on daily chart, signalling further bullish momentum & investors / traders enthusiasm.

c. Stochastics indicated that the counter is oversold, but has turned direction with K crossing the D

Continuation of trend should see it testing the next resistance of 0.65 which is the recent January 2019 and November 2018 high, before further testing August 2018 high of 0.81.

3. Financial Analysis - Trading at PE Ratio of 4.55 and Bright Prospect Ahead

Refer below link for EDARAN QR summary. Latest 4 Quarters EPS stands at 12.08 cents. This means that at current price of 0.55, EDARAN is only trading at mere 4.55 PE Ratio!!! Taking about 7-10 PE Ratio for similar IT companies, EDARAN should be trading at range of 0.84 - 1.20 in longer term valuation.

https://www.malaysiastock.biz/Corporate-Infomation.aspx?securityCode=5036

Based on commentary by management for prospects in FY 2019 as below:

i. Secured new contract extensions including from Jabatan Kastam Diraja Malaysia, Jabatan Perdana Menteri, Majlis Perbandaran Kuantan, and Ministry of Health, to name a few

ii. Penetrating new markets, established names such as POS Malaysia, Fusionex Solutions, Jabatan Pendaftaran Negara, National Hydraulic Research Institute of Malaysia, and Northport (M) Berhad

iii. 'Rental and Warranty' support services has proven to be a popular product and contributed significantly to the Group's performance. Example of client for this is University Teknologi Mara (UiTM), Ministry of International Trade and Industry (MITI), Jabatan Perkhidmatan Awam and Majlis Perbandaran Kuantan

iv. Enhance customers' IT hardware and software with new technologies, and potential to work on long term basis with clients like POS Malaysia Bhd and Etiqa Insurance Bhd

v. ELITEMAC (a wholly owned subsidiary of EDARAN) has vast experience in setting up the in frastructure for mobile operators in the country/ Therefore it stands to gain from the 5G network rollout by government starting from 2019 onwards.

CONCLUSION

Considering all the above, my personal TP for EDARAN is set at RM 0.65 (Short Term), and RM 0.81 (Mid to Long Term)

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is not a BUY CALL but only sharing my observations.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/205011.jsp