SERI KEMBANGAN: Alam Maritim Resources Bhd expects 30 per cent of its RM990 million order book to be recognised in the group's current financial year ending Dec 31, 2019, group managing director Datuk Azmi Ahmad said.

30 percent of 990million is equal to 297million

what is 297 million stands for?

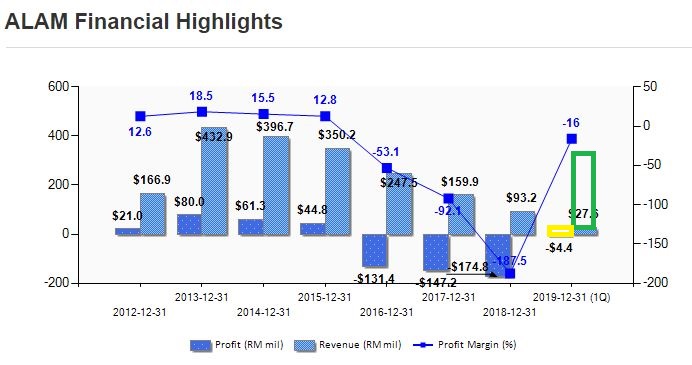

based on Alam quarter result:

With revenue 297million , Alam's revenue will be 3 years high,

How about profit margin?

based on Alam qr's history, Higher revenue will offset the operating cost which will make the company turn into positive profit margin, we believe in 2019 FY, the company will come back to positive.

Speaking to reporters after the company's annual general meeting today, he said these contracts would keep the company busy for between two and five years.

The nature of the contracts it secured he said, was a clear indication of the company’s shift in business focus from being a pure-play OSV provider to an integrated marine serviced provider by tapping on its expertise in OIC and subsea services.

"The group's strategy is consistent with oil majors mid-term activity outlook, which indicates a huge opportunity for OIC and subsea expertise given that Malaysia has a large number of legacy offshore assets, some even exceeding 35 years of operations of which, many have reached their end of life phase.

"This means, decommissioning activities are set to increase in momentum and this presents opportunities for AMRB," he said.

Meanwhile, the group continues to optimise its fleet of vessels, which currently stood at 39 and is planning to reduce nine vessels.

"To-date four vessels have been sold and we hope another five vessels to be disposed within this year.

"We are reducing the number of vessels and are focusing on certain vessels like platform support vessels and anchor handling tug supply vessels," he Azmi.

Read more at https://www.thestar.com.my/business/business-news/2019/06/19/alam-maritim-expects-30pct-from-order-book-to-be-recognised-this-year/#Wj5IX3S3K9T2WxSO.99

From Technical Analysis, Alam now pricing at very low with strong support, after AGM today and now we know the revenue will boost in this year, the chances of company turn into profit is very high.

we are targeting ALAM for RM0.15 in short term which is 50% potential gainF

Disclaimer : all information provided here, including recommendations should be treated for education purposes only

https://klse.i3investor.com/blogs/Rampage/211539.jsp