I bought some IQ recently at about RM1.00.

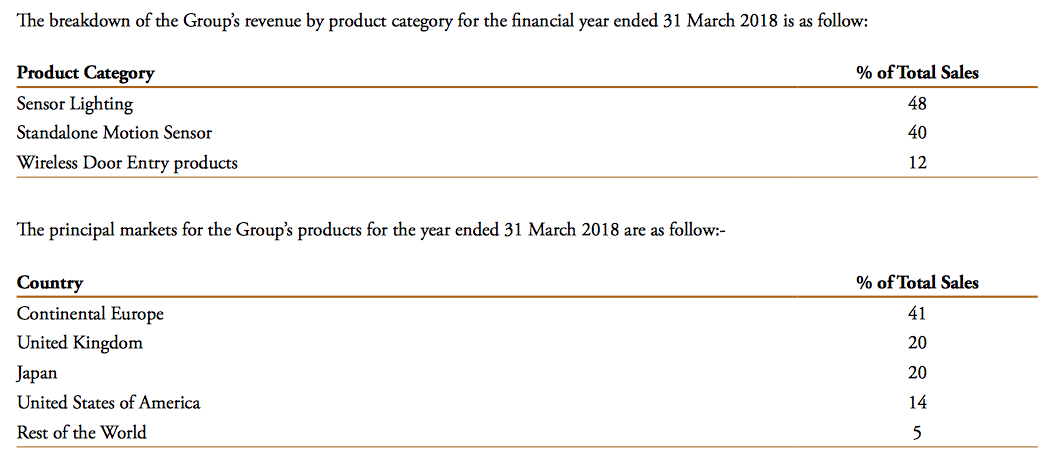

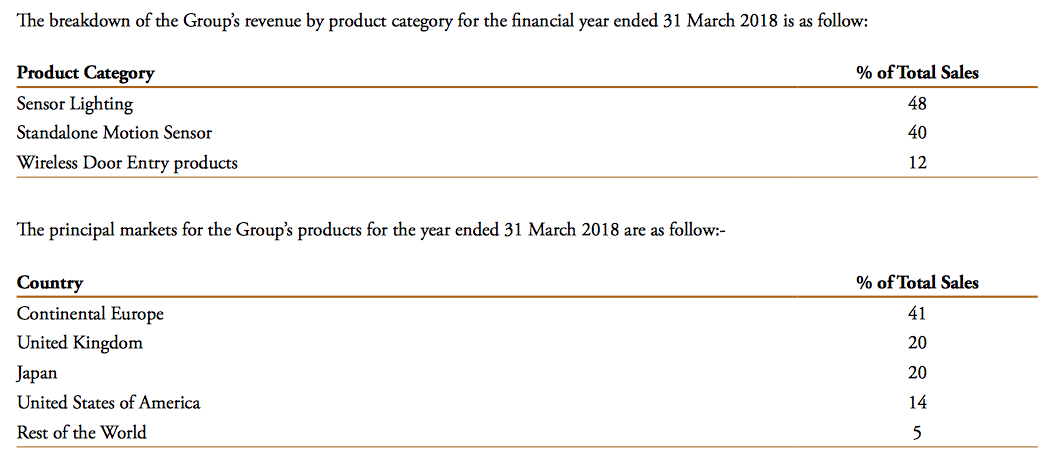

It is a manufacturer of lighting products and sensors (infrared as well as motion). It sells its lighting products together with the sensors, or sensors on stand alone basis to customers.

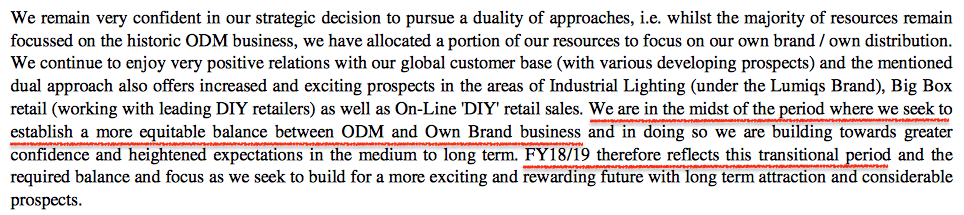

In the past, IQ manufactures for customers as Original Equipement Manufacturer or Original Design Manufacturer. (OEM means IQ manufactures according to customers' design. ODM means IQ designs and then manufactures for its customers. In both cases, the customers will sell the products under its own brands)

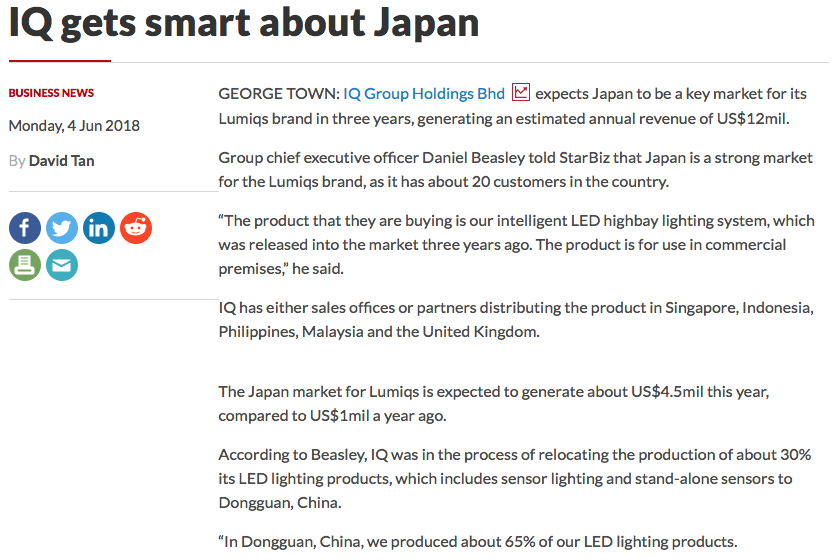

However, recently, IQ starts selling under its own brand - LUMIQS.

LUMIQS has been quite well received in Japan.

The stock has come down by a lot. It is now near 5 year all time low.

But buying at all time low doesn't necessarily mean it is ok. If fundamental is not good, it can potentially slide further.

So, is it a good buy or not a good buy at RM1.00 ?

First of all, market cap is RM88 mil at current level. Meaning the stock is ok as long as it can make RM8.8 mil profit per annum.

Can it ?

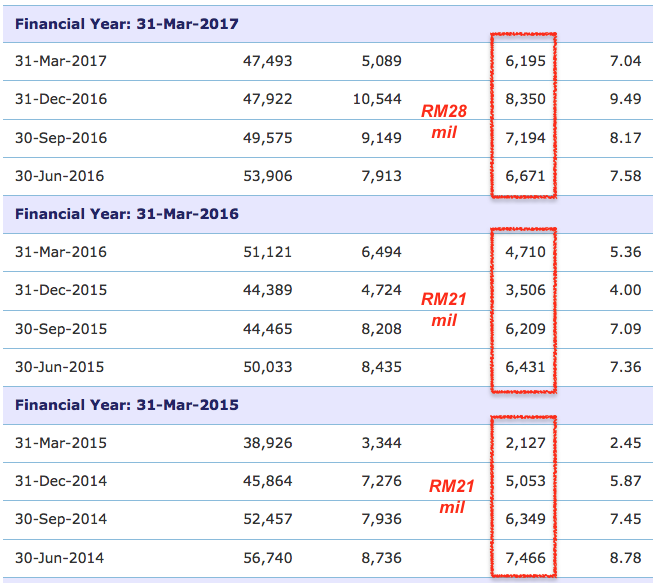

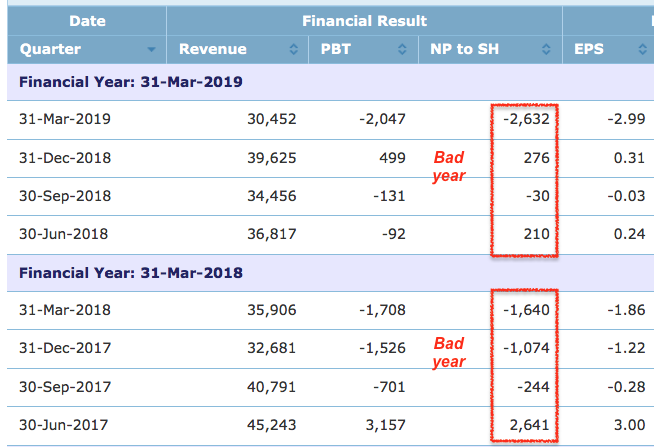

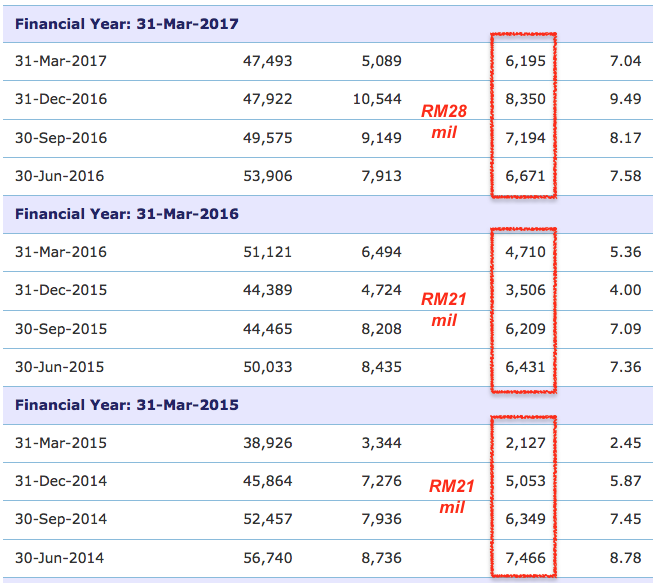

A quick check shows that in the past, it could make as much as RM28 mil per annum during good time.

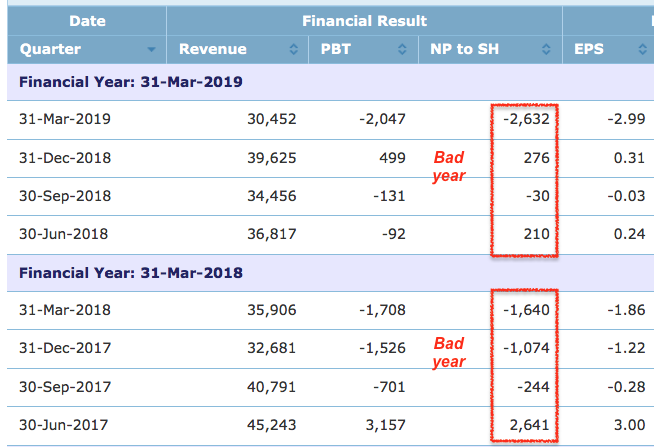

In FYE March 2018, the group's profitability was adversely affected by a combination of the followings :-

(a) slow down in sales (reason unknown);

(b) delay in product launches;

(c) forex loss; and

(d) one off expenses to reward employees.

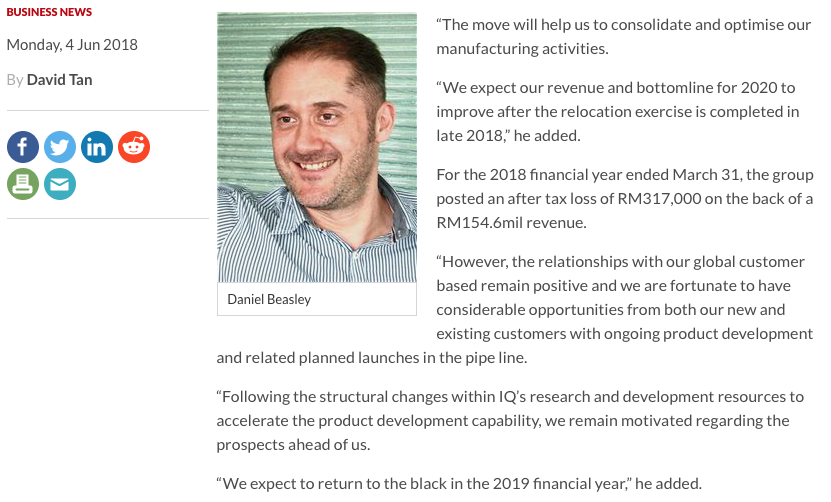

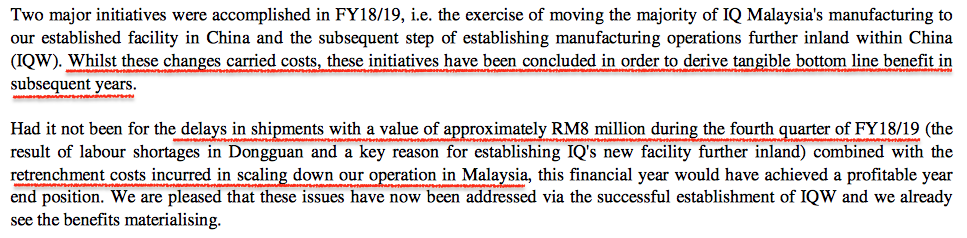

In FYE March 2019, the group was busy streamlining its operations. It has always had two manufacturing plants : one in Penang (35% of sales), and another in Dongguan, China (65% of sales). During FYE March 2019, it moved all its operation to Dongguan, China.

(In the latest development, it further moved its China operation from Dongguan to Wuning city at neighbouring Jiangxi province due to labour shortage)

FYE March 2019 was adversely affected by a combination of the followings :

(a) relocation cost;

(b) Penang retrenchment cost; and

(c) RM8 mil delay in shipment in final quarter caused by labour shortage at Dongguan.

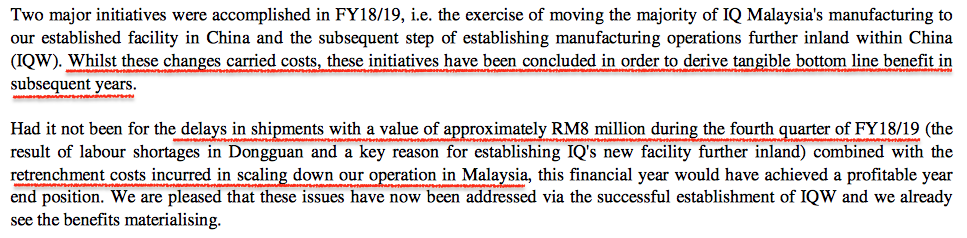

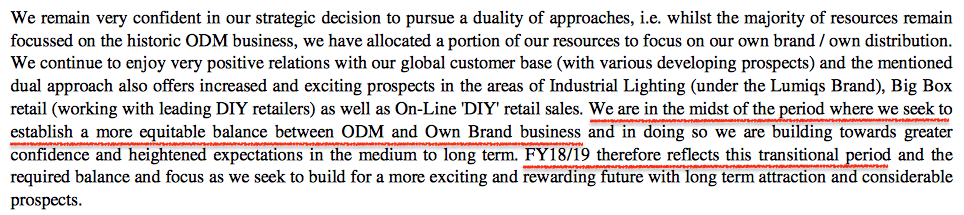

The following is company's comments about its prospects :

(Source : March 2019 quarterly report)

It is a manufacturer of lighting products and sensors (infrared as well as motion). It sells its lighting products together with the sensors, or sensors on stand alone basis to customers.

In the past, IQ manufactures for customers as Original Equipement Manufacturer or Original Design Manufacturer. (OEM means IQ manufactures according to customers' design. ODM means IQ designs and then manufactures for its customers. In both cases, the customers will sell the products under its own brands)

However, recently, IQ starts selling under its own brand - LUMIQS.

LUMIQS has been quite well received in Japan.

The stock has come down by a lot. It is now near 5 year all time low.

But buying at all time low doesn't necessarily mean it is ok. If fundamental is not good, it can potentially slide further.

So, is it a good buy or not a good buy at RM1.00 ?

First of all, market cap is RM88 mil at current level. Meaning the stock is ok as long as it can make RM8.8 mil profit per annum.

Can it ?

A quick check shows that in the past, it could make as much as RM28 mil per annum during good time.

In FYE March 2018, the group's profitability was adversely affected by a combination of the followings :-

(a) slow down in sales (reason unknown);

(b) delay in product launches;

(c) forex loss; and

(d) one off expenses to reward employees.

In FYE March 2019, the group was busy streamlining its operations. It has always had two manufacturing plants : one in Penang (35% of sales), and another in Dongguan, China (65% of sales). During FYE March 2019, it moved all its operation to Dongguan, China.

(In the latest development, it further moved its China operation from Dongguan to Wuning city at neighbouring Jiangxi province due to labour shortage)

FYE March 2019 was adversely affected by a combination of the followings :

(a) relocation cost;

(b) Penang retrenchment cost; and

(c) RM8 mil delay in shipment in final quarter caused by labour shortage at Dongguan.

The following is company's comments about its prospects :

(Source : March 2019 quarterly report)

https://klse.i3investor.com/blogs/icon8888/211175.jsp