GUNUNG - LETS CLIMB THE MOUNTAIN TOGETHER !!!

(PERSONAL TP 0.40 mid to long term - No Contra)

Recently I had spotted this small cap company; which I believe has a bright future ahead -GUNUNG CAPITAL BERHAD or GUNUNG (Stock Code 7676, listed on MAIN BOARD, TRANSPORTATION & LOGISTICS, market cap RM 64.89M as at writing)

In

summary, GUNUNG is an investment holding company whose core business is

in chartering out land-based transportation assets. Its subsidiaries

also involved in the development of mini hydroelectric power plants as

well as property development and construction.

I

noticed collection mode and considerable interest starts to build up

today, 19/6/2019 where the volume registered a sizeable increase to 256.5 thousand units. This counter has been exceptionally quiet over some time.

With

this positive momentum & enthusiasm ahead, I believe, should carry

forward tomorrow. I foresee it trending to the next resistance of 0.35 before heading to my personal TP of 0.40 mid to long term.

MARKET

TALK SAYS THAT A REVERSE TAKE-OVER (RTO) MIGHT BE TARGETING THIS

COMPANY AND BELOW ARE THE REASONS I BELIEVE TO CONTRIBUTE TOWARDS IT :

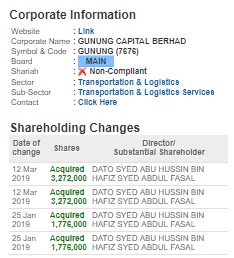

1. DBT at 45 cts (13 cts premium) Acquired by Director Dato Syed Abu Hussin Bin Hafiz Syed Abdul Fasal

Refer

below images of DBT under this counter. We see that on 25 January 2019

and 12 March 2019, there was 2 DBT totalling up to 5.048 million units

was performed at 45 cts (13 cts premium to closing price at the time).

And

if we further check, this acquisition was made by the largest

shareholder / director of GUNUNG which is Dato Syed Abu Hussin Bin Hafiz

Syed Abdul Fasal.

This brings his total shareholdings up to 27.98% of the company as at latest annual report.

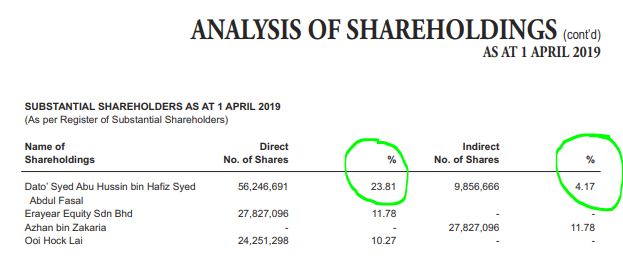

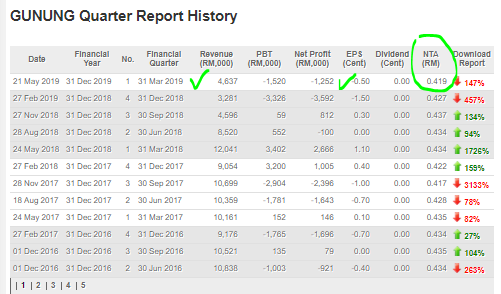

2. Financials - NTA of 41.9 cts and Low Debt Make it a Delicious Target for Takeover or Backdoor Listing

Refer below latest QR for GUNUNG. As we can, revenue had climbed while loss had been reduced compared to last quarter.

NTA is at 41.9 cts which is a 12.4 cts premium to current closing price.

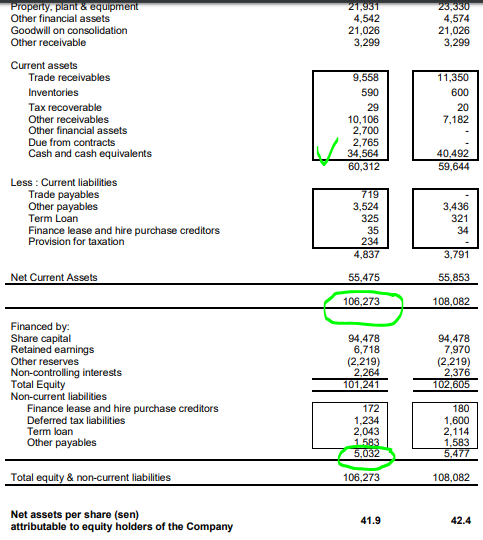

If we further dive into the financial statements, we can see that the

company has a strong cash balance of RM 34.5 million, and total net

assets of RM 106.3 million.

On the liabilities section, we note that the company only has about RM

9.8 million in liabilities (RM 4.8 million in current liabilities and RM

5 million in non current liabilities). Hence, the company has a high

net asset value of 41.9 cts, whilst having very low debt.

Market talk, is that there is a potential Reverse Talk Over (RTO) in

motion for this company. I would not be surprised if this characteristic

of company is being targeted for takeover.

3. Bright Prospect Ahead - Transport & Hydro Electric Businesses

Refer to below prospects comment in latest QR. Group has following bright prospects ahead:

i. Shuttle bus service for IIUM

ii. Contract to ferry school children for Ministry of Defense

iii. Other ad-hoc charters

iv. Commissioning of hydro projects in Perak in FY2019

v, 5 sites of hydro power with installed capacity 34.25 MW (at various stages of construction)

vi. 4 sites of hydro power with installed capacity of 97.8 MW to start construction in FY 2019

vii. Kerian site with capacity 14 MW and Sungai Slim site with capacity

6 MW is generating power based on its TNB energy purchase agreement

4. Technical Analysis - Accumulation in Progress Towards Breakout of Downtrend

Refer below weekly chart of GUNUNG.

If we look at its history, GUNUNG has been on a downtrend since May

2017 (about 2 years now). The current trading price is nearly at the

year low price, hence implying very minimal downside risk.

Once the stocks breaks the downtrend channel, the first resistance seen at 35 cts, then higher towards 40 cts.

We can see that volume is building up reasonably, and MACD has recently

crossed signal line upwards implying a bullish momentum ahead.

CONCLUSION

Considering all the above, my personal TP for GUNUNG is set at RM 0.40 (mid to long term).

I have

started collecting this counter slowly as i see the downside risk very

minimal as it is trading near its year low. Market talk of a possible

RTO which needs to be affirmed through reliable sorces.

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is not a BUY CALL but only sharing my observations.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/211524.jsp