Discovering ARB Bhd, it reminds me of Koon Yew Yin (KYY)'s Liihen and Latitude Tree which shot up more than 800% within 2.5 years and VS Industry shot up more than 200% within 2 years. You can read all about these from his previous article namely "My Track Record".

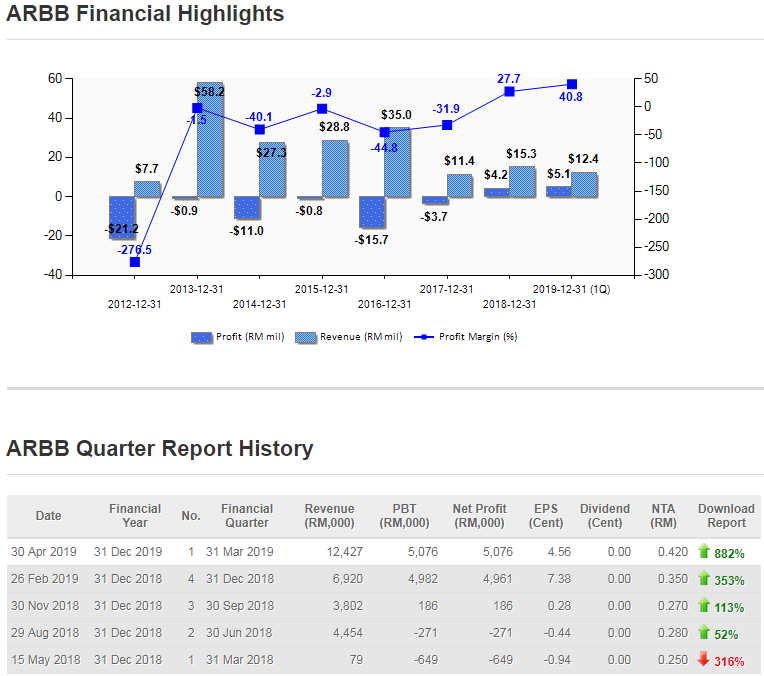

Looking at 1Q19 results, its 1Q19 EPS alone is 4.56sen. If we annualise it, we would get 18.24sen.

And at the current price of 44sen, the share price is trading at 2.4x PER only!

Are you kidding me!

The company has grown from strength to strength and never looked back since turned around in 3Q18. It is a new lease of life!

The resumption of its timber segment in April 2019 on top of its recurring business from ERP software may potentially give much higher EPS from 2Q19 onwards!

Not to forget, last week news that ARB Bhd signed two separate agreements with Chinese companies for the provision of water supply-related technology for a combined project value of RM800 million.

ARB executive director and chief executive officer (investment & technology) Datuk Larry Liew Kok Leong said ARB's wholly-owned subsidiary Arbiot Sdn Bhd inked memoranda of understanding (MoA) with Hangzhou Mayam IoT Tech Co Ltd and Shuifa IoT Tech Co Ltd.

He added that Hangzhou Mayam will provide the necessary funding to Arbiot to implement a smart water metering project in Malaysia to measure, collect and analyse real-time water usage information and data, including water leakages, water pressure, date and time of water consumed by households, in digital form.

The project is valued at RM200 million.

"We target to have about 300,000 residential units to be installed with the smart water metering system within 24 months for phase one.

"Currently we are still finalising our discussions with state authorities including Pengurusan Air Selangor Sdn Bhd (Air Selangor), Lembaga Air Perak and Perbadanan Bekalan Air Pulau Pinang (PBAPP)."

Should we look at 6-7x PER for a small-cap stock and conservative EPS of 18.24x (not include timber segment), it implies RM1.09-RM1.28. It means the potential upside is 147% to 190% in 2H2019!

So, think about it.

https://klse.i3investor.com/blogs/investsmartway/217187.jsp