Malaysia is going to deploy 5G network commercially nationwide. They need to have access to lots of locations. So, if we build 5G in the traditional way - big towers and all, I think it’s just going to be very expensive because we need far too many of them.

Few companies will be beneficiary from National Fiberisation and Connectivity Plan (NFCP) when 5G going to deploy. I noticed one of the laggards which were Rohas Tecnic Bhd, especially in price action. OCK, Redtone already moved up due to recent positive sentiments on the 5G related stock theme.

One of the solutions is Chinese telecoms infrastructure firm China Tower plans to speed up the construction of 5G networks and keep costs down by making use of electric power companies’ transmission towers. Rohas currently owns experience of constructing more than 4,700km of power transmission grids and over 500km of fittings and accessories supplied domestically and regionally. They are the only Malaysian company who had 3,000km experience in installing OPGW and ADSS under live-line conditions. Can Rohas benefit from this core competence?

Rohas is a Malaysia-based utility infrastructure investment holding company. On March 8, 2017, Rohas Tecnic Berhad acquired REI Group, consisting of Rohas-Euco Industries, its subsidiaries and associated companies. REI Group’s core business is in steel tower fabrication for transmission grids and telecommunications; comprising full in-house engineering design, manufacturing assets and construction capabilities.

Sarawak state is dishing out awards to construct 300 telco towers this year with a total cost (including EPCC and tower costs) of RM1 billion. It is expected to be divided into four work packages and Rohas is confident to secure telco tower orders from three work package contractors. At the same time, Rohas is also trying to bid for EPCC contracts for those packages.

The recent acquisition of Global Tower Corp in Cambodia opens up opportunities for them to undertake EPCC contract to construct telco towers and to own telco tower assets. Data traffic growth for 4G is expected to increase steadily at a compound annual growth rate of 13.8% for the next 10 years and hence, this acquisition enables Rohas to ride on the positive trend.

Adopted from:

https://www.theedgemarkets.com/article/rohas-tecnic-seen-benefit-sarawak-projects

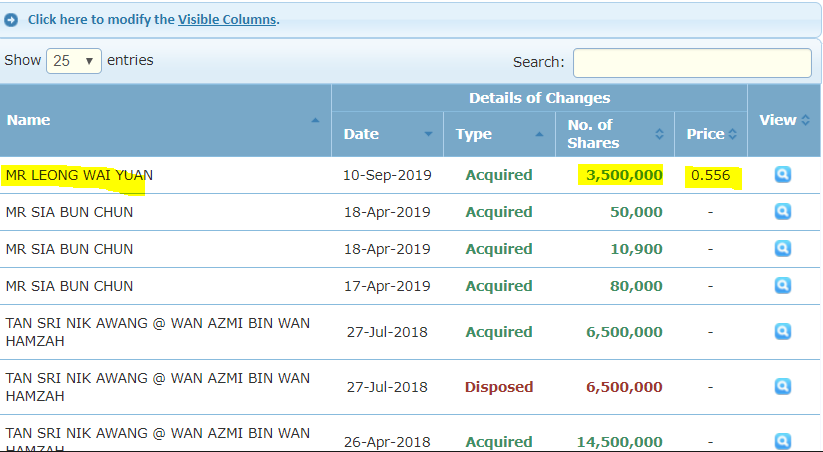

Director is acquiring Rohas aggressively as below. Something good going to happen?

Invest on your own risk where this is not a buy call or sell call. This articles merely for sharing and discussion only.