Malaysia Stock Analysis – Perdana (7108)

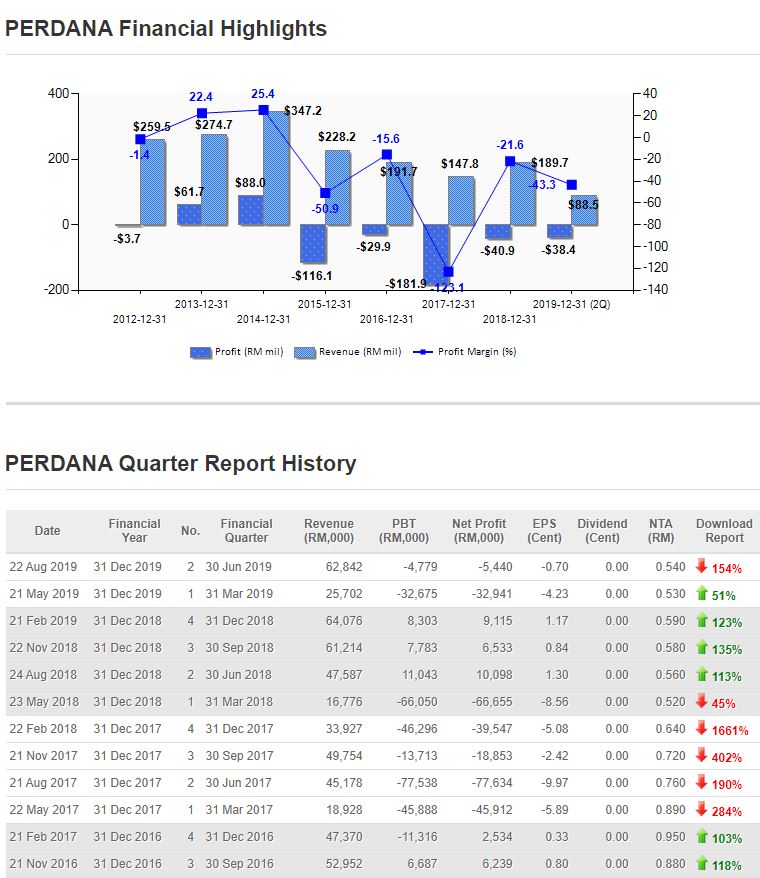

Is Perdana's performance progressing or regressing?

Perdana's latest quarterly (Q2) results record the company's performance from April 1 to June 30.

Turnover for the quarter:

RM 62.8 mil, up 32.1% year-on-year; quarterly growth of 144.5%

RM 62.8 mil, up 32.1% year-on-year; quarterly growth of 144.5%

Net profit for the quarter:

RM 5.4 mil, down 153.9% year-on-year; 83.5% quarter-on-quarter

RM 5.4 mil, down 153.9% year-on-year; 83.5% quarter-on-quarter

The company's original operating profit was RM 12.2 mil, but because of

the interest on the debt was too high (RM 13.2 mil), the company's

“pre-tax profit” after the repayment became a loss of RM 4.8 mil.

Hence, the debt is the biggest problem for Perdana. In addition, the

company's earnings seem to be regressing year after year mainly because

the company's FY18Q2 has a very high one-time off profit compared to

this quarter.

Year-by-year comparison:

The company's turnover increased by 32.1% year-on-year mainly due to the improvement in the use of oil tankers, from 70% in FY18Q2 to 79% in the current quarter.

The company's turnover increased by 32.1% year-on-year mainly due to the improvement in the use of oil tankers, from 70% in FY18Q2 to 79% in the current quarter.

Although the turnover increased, the company had a pre-tax loss of RM

4.8 mil, down 56.7% year-on-year. This figure has been calculated by

reversal of impairment loss RM 2.8 mil, legal expenses RM 2.6 mil and

foreign exchange loss of RM 1.4 mil.

However, the pre-tax profit of the company FY18Q2 is RM 11 mil. And this figure includes 25.8 mil of foreign exchange earnings.

Assuming a one-time off loss, the company's pre-tax loss for the

quarter was RM 3.6 mil; and FY18Q2 was a pre-tax loss of RM 14.8 mil. In

other words, the company's “pre-tax profit”, which deducted one-time

gains in the quarter, was 75.7% year-on-year!

Quarterly comparison:

The company's turnover increased by 144.5% quarter-to-quarter mainly because the tanker utilization rate and the previous quarter's comparison have greatly improved, from 36% in FY19Q1 to 79% in this quarter.

The company's turnover increased by 144.5% quarter-to-quarter mainly because the tanker utilization rate and the previous quarter's comparison have greatly improved, from 36% in FY19Q1 to 79% in this quarter.

The quarterly increase in tanker usage was due to the improvement in work orders and contracts received during the quarter.

The company's pre-tax loss of RM 4.8 mil was improved by 85.4%

quarter-to-quarter. We know that this RM 4.8 mil has included reversal

of impairment loss RM 2.8 mil, legal expenses RM 2.6 mil and foreign

exchange loss of RM 1.4 mil. Assuming that these one-time gains are

deducted, the company's pre-tax loss is only RM 3.6 mil.

However, the pre-tax loss of RM 32.7 mil in the previous quarter

included a foreign exchange gain of RM 1.1 mil. If deducted, the

company's pre-tax loss was RM 33.8 mil.

In other words, the company's “pre-tax profit”, which deducted one-time gains in the quarter, was 89.3% quarter-on-quarter!

Future Prospect:

After the seasonal slowdown in this year (Q1 2019), the company's tanker leasing business has improved significantly during this quarter, which is why the company's turnover on this quarter can be significantly improved by 145%, which is the best performance since 2015. This has allowed management to determine that the market for tanker support services is continuing to recover.

After the seasonal slowdown in this year (Q1 2019), the company's tanker leasing business has improved significantly during this quarter, which is why the company's turnover on this quarter can be significantly improved by 145%, which is the best performance since 2015. This has allowed management to determine that the market for tanker support services is continuing to recover.

Management believes that the business will be better in the second half

of 2019, as most tankers have been designated by Dayang for offshore

repairs and contract-up contracts. These activities have been seen to

increase the number of agreements with other upstream companies.

In addition, management hopes that the tight supply of tankers will

contribute to a stronger charter rate, which will drive the company's

financial performance. Management believes that 2019 will be a huge

turning point in Perdana's torment and challenges in the past few years.

The management is very confident that the company's cooperation with

Dayang, coupled with Dayang's debt relief, will make Perdana a better

era and become a stronger company by 2020.

Louis Yap

Facebook:

Web Site: